Gold: It All Comes Down to This for the Yellow Metal

2024.12.09 02:35

I have been writing about this since 2015.

must outperform the stock market to be in a secular bull market.

A few years ago, I modified the concept to include Bonds. Gold must outperform the conventional 60/40 investment portfolio (60% Stocks, 40% Bonds) to be in a secular bull market.

The 1960s is the only outlier to this concept, as gold mining stocks, the proxy for Gold, broke out of a 28-year base in 1964 and advanced 300% to a peak in 1968.

Gold’s breakout of a 13-year cup and handle pattern in March 2024 is the best historical comparison.

The difference is that Gold has yet to outperform the stock market as gold stocks did in the mid to late 1960s.

It is baffling that Gold broke out of a 13-year cup-and-handle pattern and advanced from $2100 to $2800 yet did not outperform the stock market.

This further highlights the need for a bear market in stocks and for Gold to break out against the 60/40 Portfolio.

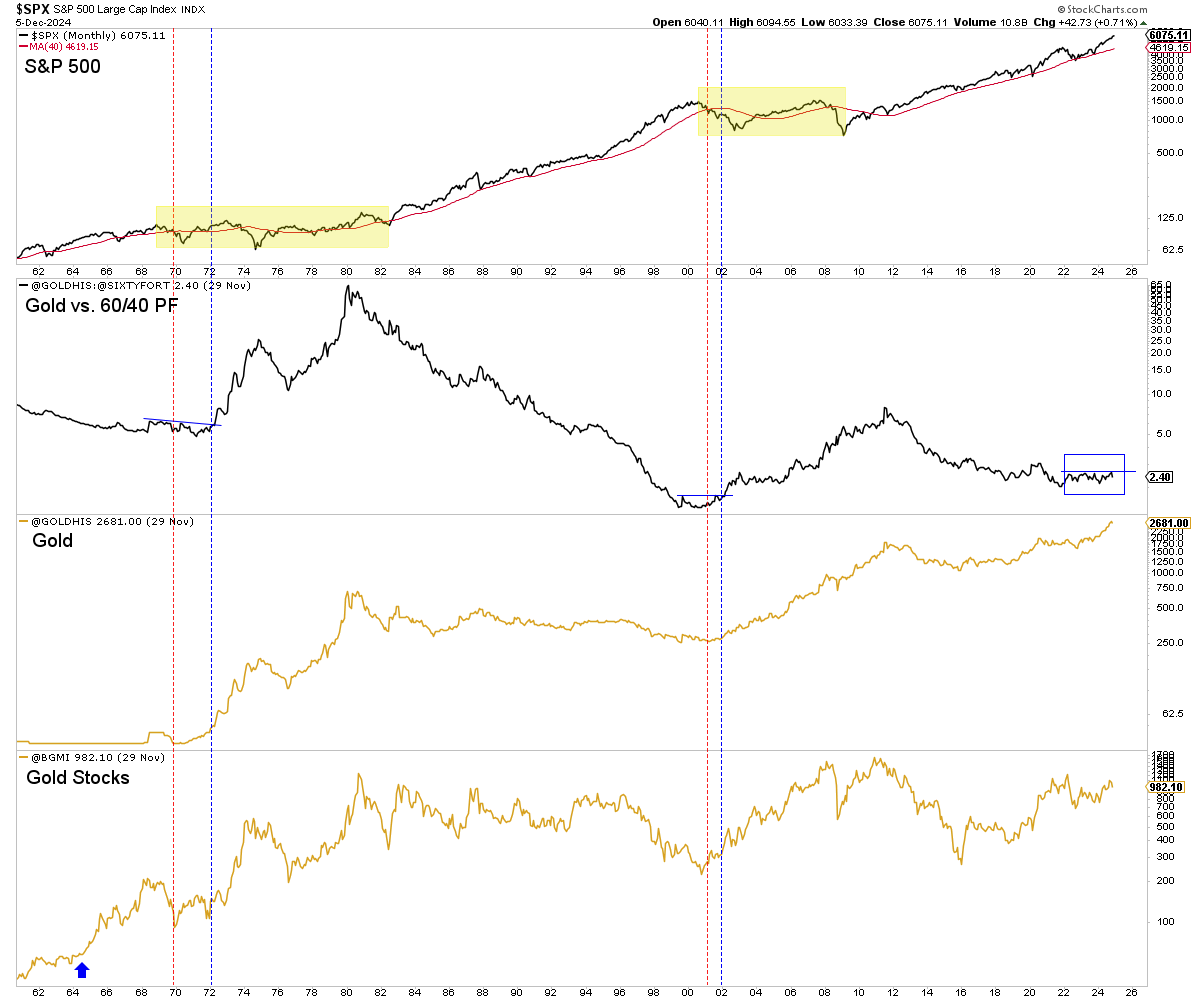

In the chart below, we highlight the secular bear market in stocks (yellow), note the losing its 40-month moving average (red line), and the confirmation signal from Gold against the 60/40 portfolio (blue line).

Also, note how Gold’s breakouts against the 60/40 portfolio occurred when or around the time precious metals diverged from bear markets in equities. Thus, the coming signal will likely happen when precious metals diverge from a bear market in equities.

Until then, Gold and remain in uptrends but it does not feel like a bull market.

New capital is not coming into the sector. This keeps valuations low and hurts, in relative terms, leveraged plays.

Gold stocks and juniors are a leveraged play. Silver is a leveraged play.

When Gold begins to outperform the 60/40 portfolio and stock market in earnest, Gold, Silver, and other leveraged plays will soar as fresh capital moves into the sector.

Until then, one can position in quality junior companies that will lead that move higher.