Gold Investors Vanish

2023.08.04 16:38

investors have vanished at least American stock-market ones. Despite gold’s strong upleg since late September, identifiable investment demand through major gold ETFs has been all but nonexistent. That lack of investment-capital inflows has certainly retarded gold’s secular bull. But with unsustainable unusual factors driving this anomalous disconnect, gold investment demand should start normalizing soon.

The best-available global gold investment data is only published quarterly by the World Gold Council in its fantastic Gold Demand Trends reports. The latest covering Q2’23 was just released this week, revealing anaemic gold investment demand last quarter. The WGC’s crack analysts reported that ran 256.1 metric tons, surging 19.8% year-over-year. But that is split into two subcategories, physical bars and coins and ETFs.

Worldwide bar-and-coin demand in Q2 only climbed 6.2% YoY to 277.5t. That looked pretty weak during a quarter where gold prices surged 5.6% YoY to a new all-time-record average high of $1,978. Investors love chasing upside momentum, but oddly they’ve largely ignored golds. From late September to early May gold’s latest upleg powered a strong 26.3% higher to $2,050, challenging an old record nominal high.

That was early August 2020’s $2,062, yet investors still yawned. Global gold-ETF investment demand was even poorer last quarter, with those vehicles seeing 21.3t of draws. Declining bullion holdings mean investors are pulling capital out of gold ETFs on balance, differentially selling their shares compared to gold. The comparable Q2’22 was worse, suffering 47.4t of gold-ETF draws. Investors are apathetic about gold.

During the first half of 2022, gold slipped 1.3% yet total global investment demand per the WGC weighed in at 772.2t. Gold fared far better in H1’23, surging 5.2% which should’ve attracted momentum-chasing investors. Yet worldwide investment demand still plunged 31.1% YoY to 532.0t. The WGC guys blamed this on “an absence of positive catalysts, particularly in light of a resilient US economy and strong equity markets.”

That makes sense, as the benchmark US stock index has blasted 28.3% higher from its bear-market low in mid-October to late July. It has recovered to within just 4.3% of early January 2022’s all-time-record peak. That powerful stock bull was fueled by March’s bank failures not spreading, then the artificial intelligence mania, and lately the looming end of the Fed’s monster 525-basis-point rate-hike cycle.

When stock markets are surging and greed running rampant, investors grow increasingly complacent. They forget the wisdom of prudently diversifying their stock-heavy portfolios with some counter-moving gold. For centuries if not millennia, there was a universal standard of allocating 5% to 10% of investment capital to gold. But that has dwindled to effectively zero for American stock investors according to one proxy.

The giant American GLD SPDR Gold Shares (NYSE:) and iShares Gold Trust (NYSE:) are the world’s largest and dominant gold ETFs. Together at the end of June, they commanded a massive 1,370.6t of gold-bullion holdings. That accounted for fully 40.0% of all the gold held by all the world’s physically-backed gold ETFs. Third place is a UK gold ETF merely weighing in at 7.0%, GLD and IAU are in a league of their own.

Those GLD and IAU holdings exiting Q2 were worth $84.2b. That’s a big number, but utterly minuscule compared to the collective market capitalization of all elite S&P 500 stocks running $39,032.8b. That implies American stock investors are running trivial gold allocations around just 0.2%. They don’t want it in their portfolios, gold has been left for dead. But abandoning this ultimate portfolio diversifier is really irrational.

While the US stock markets have enjoyed a strong bull run, that has left them in a really-risky place here. Stocks are dangerously overvalued, with those S&P 500 companies exiting July averaging trailing twelve-month price-to-earnings ratios of 30.5x. That is well into formal stock-bubble territory starting at 28x, or twice the last century-and-a-half’s fair value at 14x. Stocks are super-expensive, especially market darlings.

The poster child for this artificial intelligence mania is graphics-chip designer NVIDIA (NASDAQ:), certainly a great company. I’ve bought many NVIDIA GPUs over the decades in work and gaming computers, they are awesome products. Since those beefy processors are ideal for AI, NVDA stock skyrocketed 323.0% from mid-October to mid-July. Yet that incredible run dragged its TTM P/E up to an unsustainable and absurd 248.7x.

While extreme herd sentiment can temporarily disconnect stock prices from underlying corporate profits, eventually valuations have to reasonably reflect those actual fundamentals. At NVIDIA’s current earnings levels, it would take investors about 250 years for it to merely earn back the stock price they are paying. That’s crazy, and all the most-popular mega-cap stocks are also now trading at unsustainable bubble valuations.

Apple Inc’s (NASDAQ:) TTM P/E at the end of July ran 33.6x, Microsoft Corporation’s (NASDAQ:) 37.1x, Alphabet’s (NASDAQ:) 30.5x, Amazon’s (NASDAQ:) 318.6x, Tesla Inc’s (NASDAQ:) 87.5x, and Meta Platforms’ (NASDAQ:) 42.7x. These massive companies are now known as the Magnificent Seven stocks, and account for 28.2% of the S&P 500’s entire market cap. Together their weighted-average P/E is running a ludicrously extreme 93.8x earnings. Their lofty stock prices are only supported by herd euphoria.

The S&P 500 is seriously overbought too, stretching as high as 12.9% above its baseline 200-day moving average in mid-July. That means a sizable-to-large selloff is overdue to rebalance both technicals and sentiment. It would have to total 11% just to return to that 200 DMA, and could snowball a heck of a lot larger given these insane valuations. These lofty stock markets are an accident waiting to happen way up here.

This inevitable mean-reverting stock-market selloff arriving and then intensifying will help rekindle investors’ interest in gold. As the S&P 500 drawdown passes 5% then 10% and almost certainly well beyond, they will remember the wisdom of diversifying their portfolios. Investors returning to gold will work wonders for this upleg, fueling stronger upside momentum which other investors will chase. It’s only a matter of time.

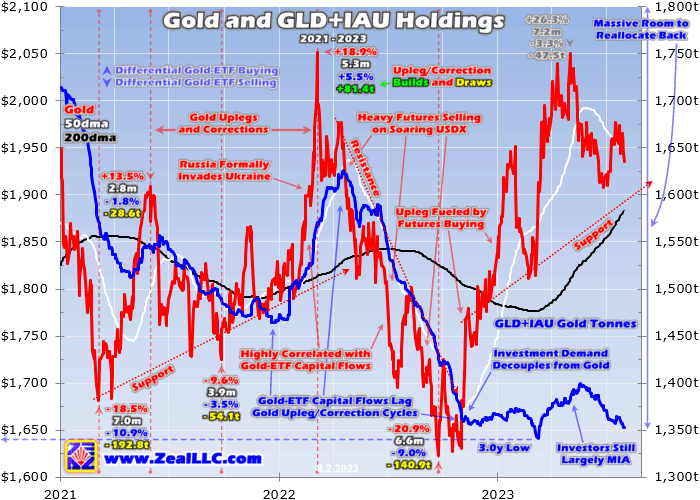

Interestingly GLD+IAU holdings have long proven the best daily high-resolution proxy for the quarterly global gold investment-demand data reported by the World Gold Council. This chart superimposes them over gold prices and technicals over the past several years or so. Note before late 2022, gold was highly correlated with these major ETFs’ gold bullion. Now American stock investors’ demand has completely decoupled.

Again gold powered 26.3% higher at best over 7.2 months into early May, its biggest upleg by far in the last several years. Yet incredibly GLD+IAU holdings actually fell 3.3% or 47.5 metric tons over this span. Gold investors have vanished at least the American stock-market ones. That left all the heavy lifting that fueled this strong gold upleg to speculators buying gold futures. I last analyzed that in a mid-June essay.

A major gold upleg where dominant-gold-ETF holdings don’t materially participate is unheard of. Gold’s previous much-smaller 18.9% upleg crested in early March 2022, soon after Russia invaded Ukraine and right before the Fed launched its monster rate-hike cycle. During that exact span, GLD+IAU holdings enjoyed a 5.5% or 81.4t build. Then gold plunged as the US dollar soared parabolic on those huge rate hikes.

From early March to late September last year, the benchmark skyrocketed up 16.7% to hit an extreme 20.4-year secular peak. That unleashed enormous gold-futures selling that clobbered the yellow metal 20.9% lower. But that serious gold selloff was exacerbated by American stock investors, who sold enough GLD and IAU shares to force their holdings a big 9.0% or 140.9t lower during that same span.

They haven’t recovered since, first slumping to a deep 3.0-year low last seen just emerging from March 2020’s brutal pandemic-lockdown stock panic. Then investors nibbled some as gold’s upleg surged again into early May, but that overall GLD+IAU build was small. Even that fizzled and reversed as gold rolled over into a healthy mid-upleg pullback later in May and June. Investors really want nothing to do with gold.

This is an exceedingly-anomalous situation likely mostly driven by these euphoric stock markets. Gold’s last comparable uplegs to today’s both peaked in 2020, at gigantic 42.7% and 40.0% gains. American stock investors flooding into GLD and IAU shares to chase gold’s upside momentum were the main drivers. GLD+IAU holdings soared a huge 30.4% or 314.2t in the former then 35.3% or 460.5t during the latter.

Surging investment demand is normal during major gold uplegs, fueling and accelerating them. Yet at best in gold’s current strong upleg, GLD+IAU holdings merely climbed a modest 4.3% or 58.2t between mid-March to late May. Gold investors have vanished, they are missing in action. They have been so darned distracted by this latest stock-market bubble that they’ve mostly ignored gold’s excellent recent gains.

Can this wildly-anomalous situation persist for long? Maybe these euphoric bubble-valued stock markets can keep on powering higher indefinitely. Maybe this AI mania hasn’t yet sucked in all-available capital susceptible to the hype. Maybe NVIDIA can shoot north of 300x earnings. Maybe the Magnificent Seven can see their weighted-average TTM P/Es forge higher over 100x. But markets truly abhor extremes.

Past stock-market bubbles peaked right as everyone was totally convinced valuations no longer mattered and those strong surges could continue indefinitely. Sooner or later even the most-loved universally-held market-darling stocks run out of new buyers because everyone is already all-in. That leaves only sellers, so euphoric stock markets roll over into serious selloffs including 10%+ corrections and 20%+ new bears.

Often catalysts trigger these major trend reversals, and there are plenty of potential ones out there even with this monster Fed-rate-hike cycle ending. Its threat to corporate profits is probably the most-ominous one. The Fed hiked an astounding 525 basis points off zero in just 16.3 months, leaving it’s federal-funds rate way up at a 22.4-year high of 5.38%. That forced all interest rates across the economy proportionally higher.

The resulting far-higher debt-servicing costs are really cutting into Americans’ purchasing power. People are also way less likely to borrow more money to finance consumption, and that accounts for over two-thirds of all US economic activity. On top of that, this raging inflation unleashed by the Fed’s colossal post-pandemic-stock-panic money printing is further eroding Americans’ abilities to continue buying stuff.

Way more income is being gobbled up by much-higher prices for life’s necessities including food, shelter, energy, insurance, and medical expenses. That leaves way less for discretionary purchases, which are most of the products the big S&P 500 companies sell. When people have to decide between buying new NVIDIA graphics cards or Apple iPhones or keeping food on the table for their families, there’s no contest.

Lower corporate sales as people are forced to pull in their horns will disproportionally pinch corporate profits, leaving stocks even more overvalued. That will be further exacerbated by the US economy falling into a recession as these extreme Fed rate hikes’ impacts deepen. That was probably Fed officials’ goal all along, forcing a recession to slow consumer demand in an attempt to reduce inflationary price pressures.

Interestingly Fed staff economists recently predicted one starting in Q4’23 into Q1’24. The minutes from the FOMC’s mid-June meeting declared tightening “would lead to a mild recession starting later this year”. “Real GDP was projected to decelerate in the current quarter and the next one before declining modestly in both the fourth quarter of this year and the first quarter of next year.” Can a stock bubble survive a recession?

Probably not. And once these dangerously-overvalued seriously-overbought stock markets roll over long enough and far enough to spook euphoric investors, their shadow eclipsing gold will start passing. Gold stabilizes stock-heavy portfolios in major selloffs after euphoric surges. From late November 2021 to mid-October 2022, NVIDIA’s stock cratered 66.4%. The high-fliers leading stock bubbles inevitably get crushed.

It’s never easy being contrarian, betting against the thundering herd. But market extremes never last long historically. Stock bubbles inevitably pop, and anomalies like virtually-zero gold investment reverse then mean revert then overshoot in the opposite direction. These extreme stock markets are overdue to suffer a major selloff, and gold is overdue to see investment capital inflows return to chase its upside momentum.

The American stock investors alone who deploy in gold via GLD and IAU shares have massive room to buy. This week GLD+IAU holdings were running at just 1,352.3 metric tons, not far above those recent stock-panic-grade lows. In October 2020 soon after the last time gold regained favor among investors, it hit 1,800.5t. That leaves room for massive differential GLD-and-IAU-share buying to the tune of a 450t build.

And those capital inflows would still be quite conservative, as the Fed’s balance sheet underlying the US money supply was considerably smaller than last time GLD+IAU holdings hit 1,800t. And during the year leading into that, monthly headline CPI inflation merely averaged small 1.4% YoY increases. But in these last twelve months, that has exploded to a scary +6.3% YoY average. This is a far better environment for gold.

It has been the ultimate inflation hedge for centuries, as the global mined gold supply can only grow on the order of 1% annually due to natural mining constraints. Yet the Fed’s balance sheet remains a terrifying 98% above February 2020 levels prior to the extreme money-printing binge since. There are now vastly more US dollars, euros, yen, pounds, and other currencies available to chase relatively much less gold.

All investors need 5% to 10% portfolio allocations to gold, especially during stock-market bubbles where gold is overlooked and out of favour. Successful investing demands first buying low before later selling high, not the other way around. The biggest beneficiaries of the higher gold prices coming will be gold miners’ stocks. Their earnings and thus eventually stock prices really amplify underlying gold-price trends.

Despite this week’s irrational fear-driven gold-stock selloff, both the miners and their metal remain in their upleg uptrends. So this looks like a good opportunity to add beaten-down gold-stock positions at bargain prices. We refilled our newsletter trading books with 20 new trades in excellent smaller mid-tier and junior gold miners over several weeks into early July. They should leverage gold’s gains much more than majors.

The bottom line is gold investors have vanished, American stock investors in particular. Enamoured with this AI-mania stock bubble, they’ve forgotten the timeless wisdom of prudently diversifying their stock-heavy portfolios with gold. Thus gold’s latest strong upleg has powered higher with very-little identifiable investment buying. Without those essential capital inflows, it is nowhere near as big as it should’ve been.

But market extremes never last long, stock bubbles inevitably pop and roll over into serious selloffs. This one will prove no different given today’s crazy valuations. That mounting mean-reversion downside will dispel investors’ myopia in overlooking gold. Investment capital inflows will return as some investors start rebuilding gold allocations from virtually nothing. That will accelerate gold’s strong upleg to new record highs.