Gold Inches Below Key Resistance

2022.11.14 08:06

[ad_1]

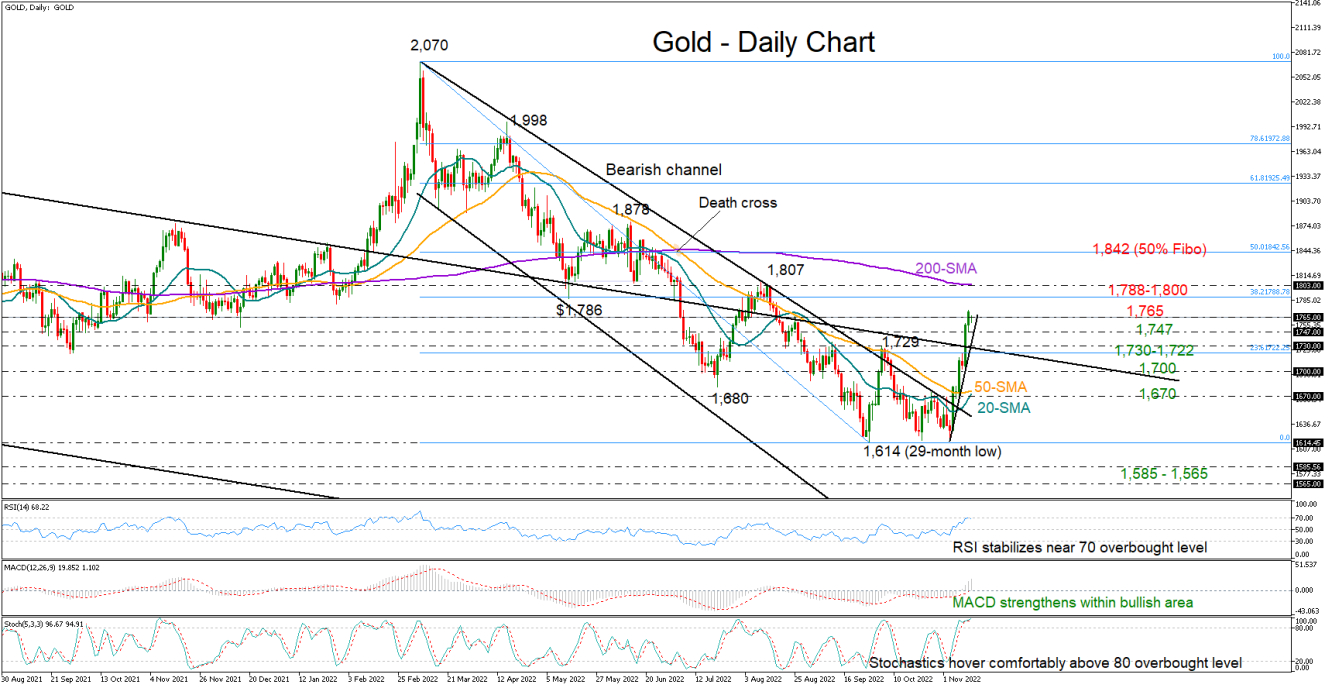

Gold opened with a small negative gap on Monday, pulling back below the August 25 high of 1,765 after stretching its extraordinary rally to a two-and-a-half month high of 1,772 last Friday.

The latest impressive ascent confirmed a triple bottom structure around the 29-month low of 1,614, flagging a bullish trend reversal. Yet, some easing cannot be ruled out in the near term as the RSI and the stochastics seem to be losing momentum near overbought levels.

Should the price reverse lower, Friday’s base of 1,747 could immediately provide some footing. A step below that floor would shift the spotlight to the key 1,730-1,722 area once again, where the 23.6% Fibonacci retracement of the 2,070-1,614 downleg is positioned. Additional declines from here could re-challenge the 1,700 psychological mark ahead of the 20- and 50-day simple moving averages (SMAs) and the important barrier of 1,670.

If the rally resumes above 1,765, the next target could be the 1,788-1,800 zone, formed by the 38.2% Fibonacci level and the 200-day SMA. This is also where the price peaked in August. Therefore, a violation at this point could further power the bullish wave, bringing the 50% Fibonacci of 1,842 next into view.

In summary, gold has the potential for more upside, though the bulls may take a breather after last week’s swift upturn before they continue higher. A break below 1,730-1,722 could raise negative risks.

[ad_2]

Source link