Gold Holds Steady, GBP Rises Against Weakening Dollar

2023.09.12 06:06

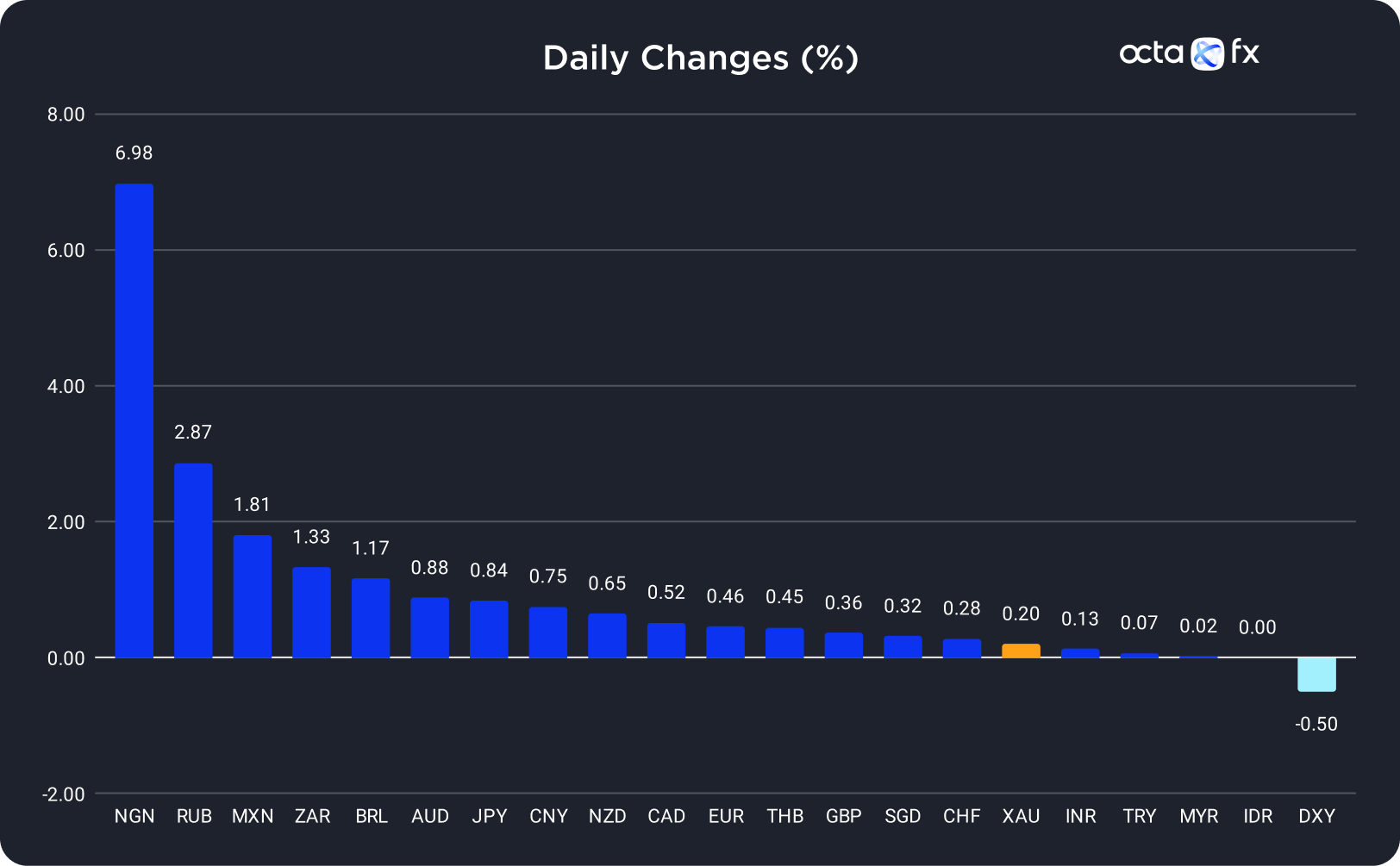

On Monday, the Nigerian naira (NGN) was the best-performing currency among the 20 global currencies we track, while the showed the weakest results. The (AUD) was the leader among majors, while the Indonesian rupiah (IDR) underperformed among emerging markets.

Changes In Exchange Rates On 11 September

Changes In Exchange Rates On 11 September

Gold Moves Sideways Ahead of the US CPI Report Tomorrow

The price rose by only 0.20% on Monday and failed to hold above the important 1,930 level despite the US dollar’s sharp drop.

Most XAU/USD investors now refrain from placing big orders. They are waiting for the important U.S. Consumer Price Index (CPI) data tomorrow at 12:30 p.m. UTC to clarify the gold trend. Indeed, the CPI report is crucial for metals traders as it will greatly influence the upcoming Federal Reserve’s (Fed) interest rate decision. Currently, the market is pricing a 7% chance of a rate hike in September and a 42% probability of a rate increase in November. In their latest speeches, Fed officials stressed that inflation is not defeated yet, but they aren’t planning to continue raising the base rate. ‘For futures to climb above 2,000 USD per ounce, the Fed needs to be less hawkish, and the and Treasury yields need to back off,’ said Phillip Streible, the chief market strategist at Blue Line Futures.

XAU/USD was declining slightly during the Asian session. The macroeconomic calendar is rather uneventful today, so gold will probably continue to move in a tight range of 1,915–1,925. ‘Spot gold may retest a support at 1,914 USD per ounce, as its bounce triggered by this support could have ended around a resistance of 1,930,’ said Reuters analyst Wang Tao.

GBP Rose on Monday, Benefitting From the Weakening US Dollar

On Monday, the (GBP) gained 0.35% as a sharp drop in dragged down the US Dollar Index (DXY) and pushed up the other currencies.

However, GBP/USD lost most of yesterday’s gains this morning after the U.K. Office for National Statistics published its regular Labour Force Survey (LFS). The LFS data showed a strong rise in average earnings and a small increase in claimant count, but the market focused on the worse-than-expected headline employment figures.

‘The further rise in wage growth will only add to the Bank of England’s (BOE) unease and supports our view that the Bank will raise interest rates once more, from 5.25% currently to a peak of 5.50%, next week,’ said Ashley Webb, the U.K. economist at consultancy Capital Economics.

Indeed, Catherine Mann, the BOE policymaker, said it’s too soon for the regulator to stop raising interest rates.

Despite the BOE’s hawkish stance on the rate-hike path, GBP/USD continued to fall during the early European session. Tomorrow, another important report—Gross Domestic Production for July— will trigger volatility, especially in GBP/USD. If the figures are better than expected, GBP may reverse and test 1.25500 again.