Gold Holding Up Nicely Against Strong U.S. Dollar, Surging Bond Yields

2022.06.21 19:56

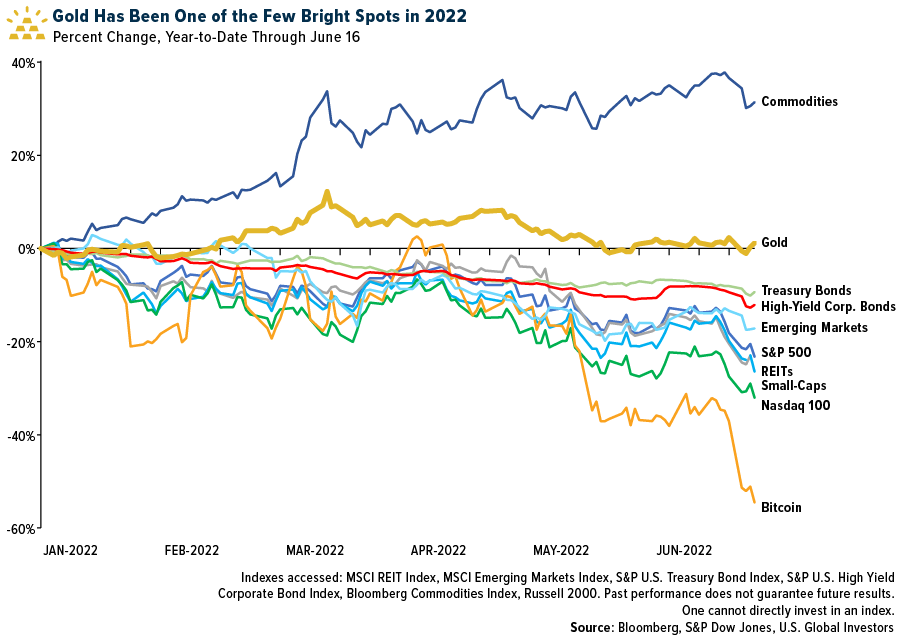

We’re almost halfway through 2022, and so far, gold has been the big winner after oil, coal, and other commodities. The yellow metal has managed to stay positive since the start of the year, skirting pressure from surging yields and a strong U.S. dollar. Meanwhile, nearly every other asset class—from large-cap and small-cap equities to bonds, from real estate investment trusts (REITs) to cryptocurrencies—has fallen into either correction or bear market territory. Indexes, Commodities, Bonds YTD

Indexes, Commodities, Bonds YTD

I believe this shows that gold has retained its perceived role as a store of value during times of decades-high inflation and economic and geopolitical uncertainty. As I often say, investing in gold won’t make you a billionaire, but it could help stabilize your portfolio when everything else is crashing.

Dollar at 20-Year Highs

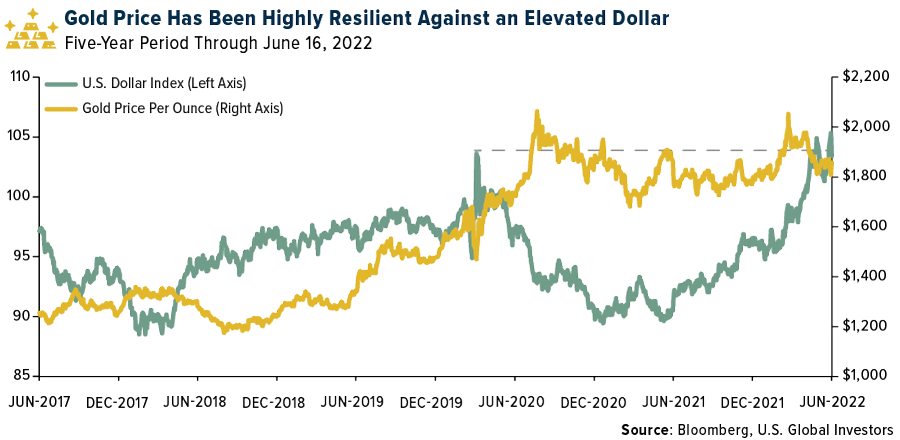

I’m most impressed that gold has stayed afloat even as the U.S. dollar has strengthened to 20-year highs against a basket of other major currencies. Since gold is priced in dollars, the two assets have historically shared an inverse relationship, with one falling when the other rises and vice versa. At the beginning of the pandemic, the dollar spiked as investors sought a safe haven, which put pressure on gold. The value of the dollar is now highly elevated on the back of interest rate hikes, and yet the yellow metal has continued to trade above $1,800 an ounce.

It’s for this reason, among others, that I agree with Newmont CEO Tom Palmer, who said last week that gold’s floor price has likely increased from previous support of around $1,200 to between $1,500 and $1,600 currently.

Gold/USD Long-Term Performance

Gold/USD Long-Term Performance

While I’m on this topic, a stronger dollar is mixed news. On the one hand, it can help limit the effects of inflation by offsetting the price of imports. On the other hand, it makes U.S. exports more expensive to overseas buyers. We’ll likely see lower fourth-quarter earnings for companies with international exposure as a result. Earlier this month, Microsoft (NASDAQ:MSFT) joined Coca-Cola (NYSE:KO), Procter & Gamble (NYSE:PG) and a host of other multinational U.S. companies in cutting forecasts for the remainder of the year due to a stronger greenback.

Will S&P 500 Companies Raise Their Dividends to Compete with Treasury Yields?

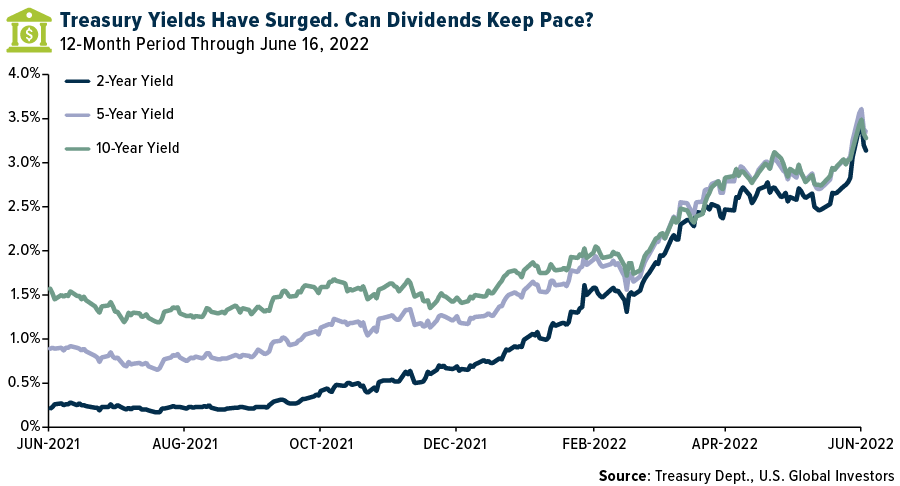

As I mentioned earlier, government bonds have steadily sold off this year, pushing yields to multiyear highs. (Bond yields rise when prices fall.) The 2-year yield was trading as high as 3.45% last week, a substantial increase from 0.78% at the start of the year.

U.S. Treasury Yields 1-Year Chart

U.S. Treasury Yields 1-Year Chart

This may attract yield-seeking investors, but I urge them to keep in mind that inflation is running at an annual rate of 8.6%. That means they’re effectively paying the government for the privilege of holding its debt.

At the same time, dividend investors may have a hard time selecting stocks that pay out at a competitive rate. As of this month, the S&P 500 has a dividend yield of only 1.68%, up slightly from the beginning of 2022 but down from June 2020, when it was closer to 2.0%.

It’s well known that gold doesn’t pay any income, but with stocks and bonds out of favor, the metal may be a better bet to potentially keep ahead of inflation right now.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

***