Gold Hits Record High as US Dollar Slips Ahead of Fed Rate Cut Decision

2024.09.13 10:41

prices surged to 2,570 USD per troy ounce on Friday. New record highs became possible amid the weakening position of the and declining yields on US government bonds.

Gold prices began to rise after the release of another package of US macroeconomic statistics. The weekly increased compared to the previous week and remained above average values. This signals a weakening employment market, which is confirmed by weak wage figures for August. Meanwhile, increased slightly more than expected in August due to high maintenance costs. The overall trend still confirms easing inflationary pressures, which will allow the to lower interest rates next week.

According to the CME FedWatch tool, the odds of a 25-basis-point interest rate cut is 59% now, while the likelihood of a 50-basis-point rate cut is estimated at 41%. Yesterday, the lowered its interest rate by 60 basis points to 3.65% per annum, which is a good signal for gold prices.

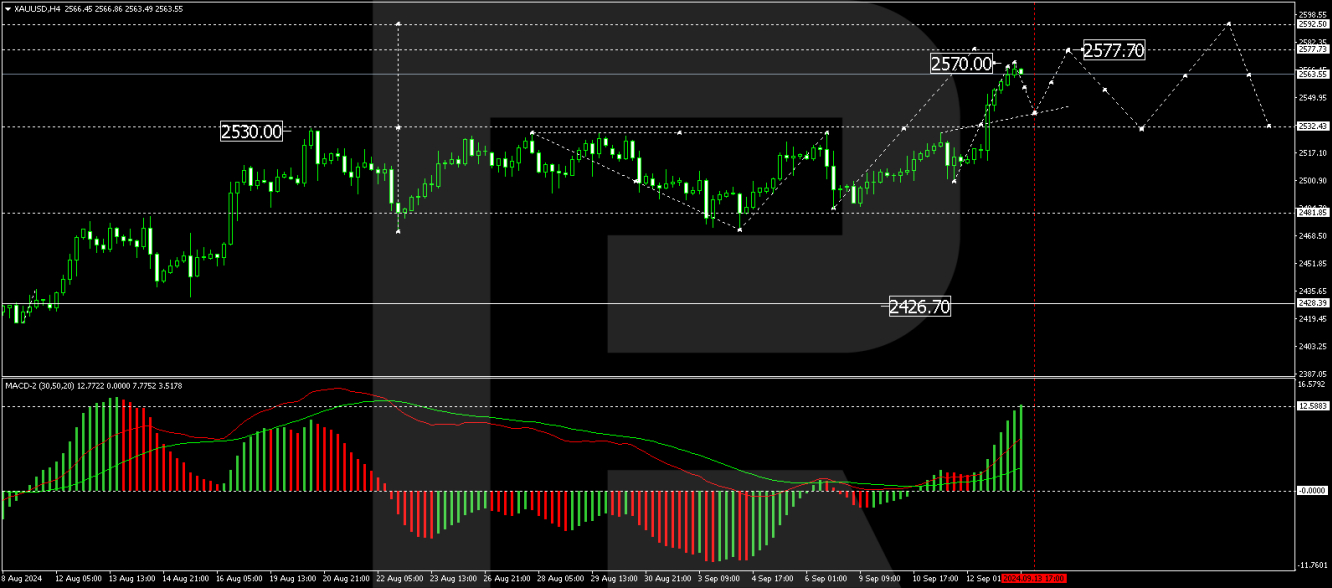

XAU/USD technical analysis

On the XAU/USD H4 chart, the market has broken above the consolidation range. A breakout of the 2,535.35 level can be considered as a market proposal to extend the growth wave to 2,570.00 and potentially further to 2,585.85. Today, the market has completed a wave, reaching 2,570.00. Subsequently, a technical decline to at least 2,541.55 (testing from above) could follow. Once the price hits this level, a growth structure might develop, aiming for the local target of 2,585.85.

It is worth noting that breaking through the 2,535.35 level may result in a continuous growth structure to the 2,595.95 level, without a significant correction. This is the main target. This scenario is technically supported by the MACD indicator, whose signal line is above zero and pointing strictly upwards.

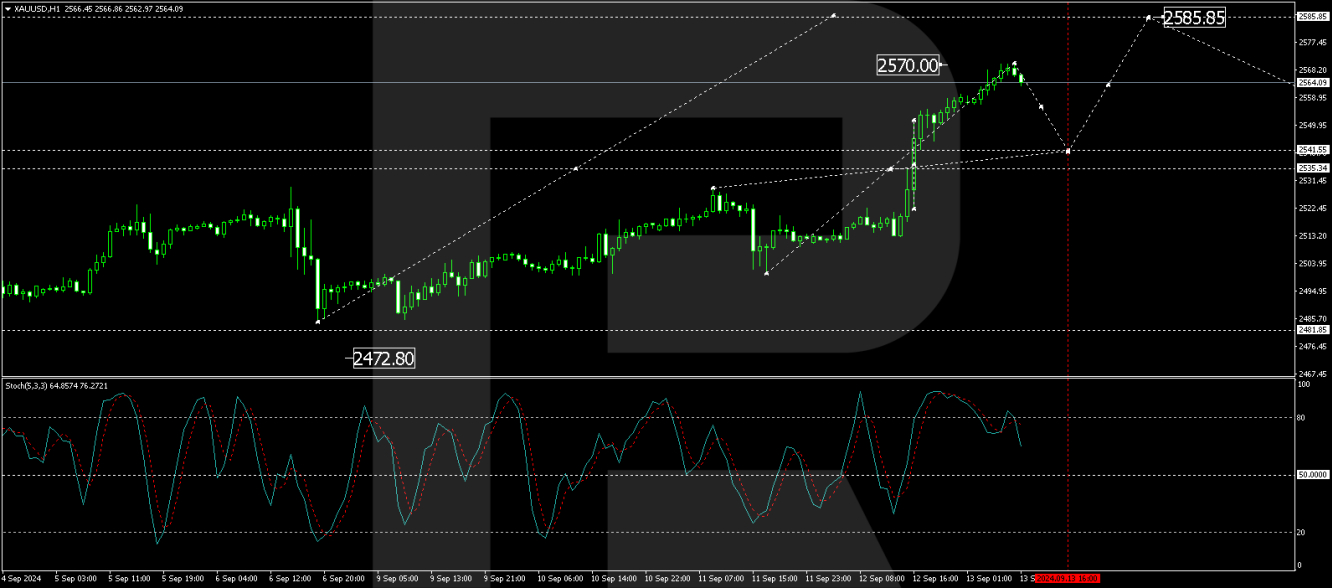

On the XAU/USD H1 chart, the market has completed a growth wave, reaching 2,570.00. A consolidation range is currently forming below this level. With a downward breakout, the price could decline to 2,541.55. An upward breakout will open the potential for a continuation of the trend to 2,585.85. This scenario is also technically supported by the Stochastic oscillator, whose signal line is around 80 and poised for a decline to 20.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.