Gold Hits Record High as Canada and Mexico Brace for Trump’s Tariffs

2025.01.31 09:43

- Gold flirts with $2,800 amid fears of trade war escalation

- Trump vows tariffs on Mexico and Canada are coming

- Safety flows, policy divergence drive dollar and yen to weekly gains

- Apple (NASDAQ:) beats earnings, could help Wall Street erase weekly losses

Gold Enters Unchartered Territory as Tariffs Loom

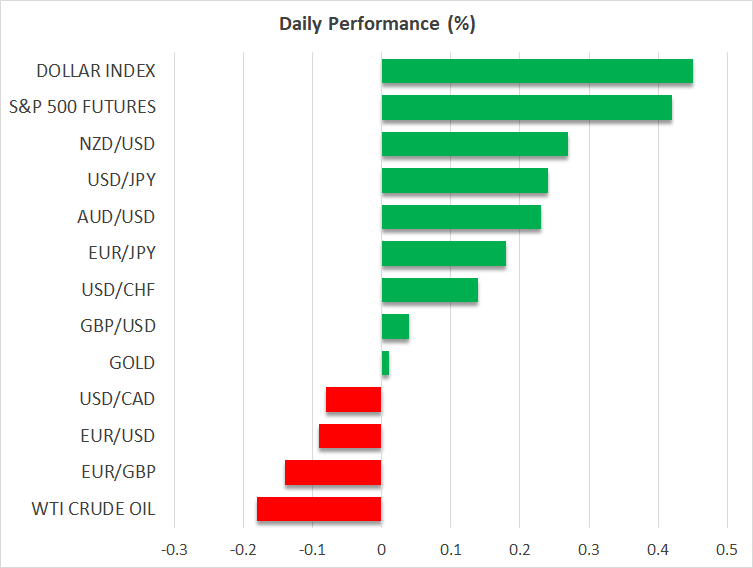

Markets are surprisingly calm on Friday, taking the and decisions in their stride and showing little panic ahead of possible US tariffs on Mexico and Canada at midnight. In fact, the biggest upset this week was from a totally unexpected source – the selloff in AI-linked stocks on concerns of cheaper AI competition from China.

However, the signs of stress have been more prominent in precious metals, particularly in gold, which has now completed the retracement of the October-November down leg and is back in record territory.

hit an intra-day all-time high of $2,800.99 in spot trading earlier today, as investors adjusted their positions ahead of US President Trump’s decision on whether to slap 25% levies on Canadian and Mexican imports.

Trump doubled down on his threat on Thursday, but left the door open to excluding imports from any tariff hike as this would only push up the price of gasoline in the US.

However, Trump hinted that any announcement could also include tariffs against China, which he accused of being involved in the illegal trade of fentanyl.

Loonie and Peso Under Pressure as Decision Awaited

The is trading close to five-year lows against its US counterpart, while the is near two-and-a-half-year lows. Further losses are likely if Trump follows through with his threat, but overall, market jitters appear to be contained.

Investors may be hoping that the three countries will reach a last-minute deal to avert a tariff war, or that any action will be temporary. Trump’s newly appointed border czar is meeting with Canadian officials today to review Canada’s efforts to better control its borders.

Any decision about tariffs on Chinese imports will also be crucial as the potential market fallout could be much bigger in such a scenario.

Dollar and Yen Shine

The and have also been benefiting from safe-haven flows this week, but monetary policy divergence has been a factor too. The Fed kept rates on hold on Wednesday and strongly signaled a pause in March, while both the European Central Bank and Bank of Canada cut rates by 25 basis points.

Officials from the Bank of Japan on the other hand have been busy flagging the likelihood of further rate hikes over the course of the year, although the yen pared back some of its weekly gains on Friday after Governor Ueda told lawmakers that underlying inflation remains slightly below the Bank’s 2% target.

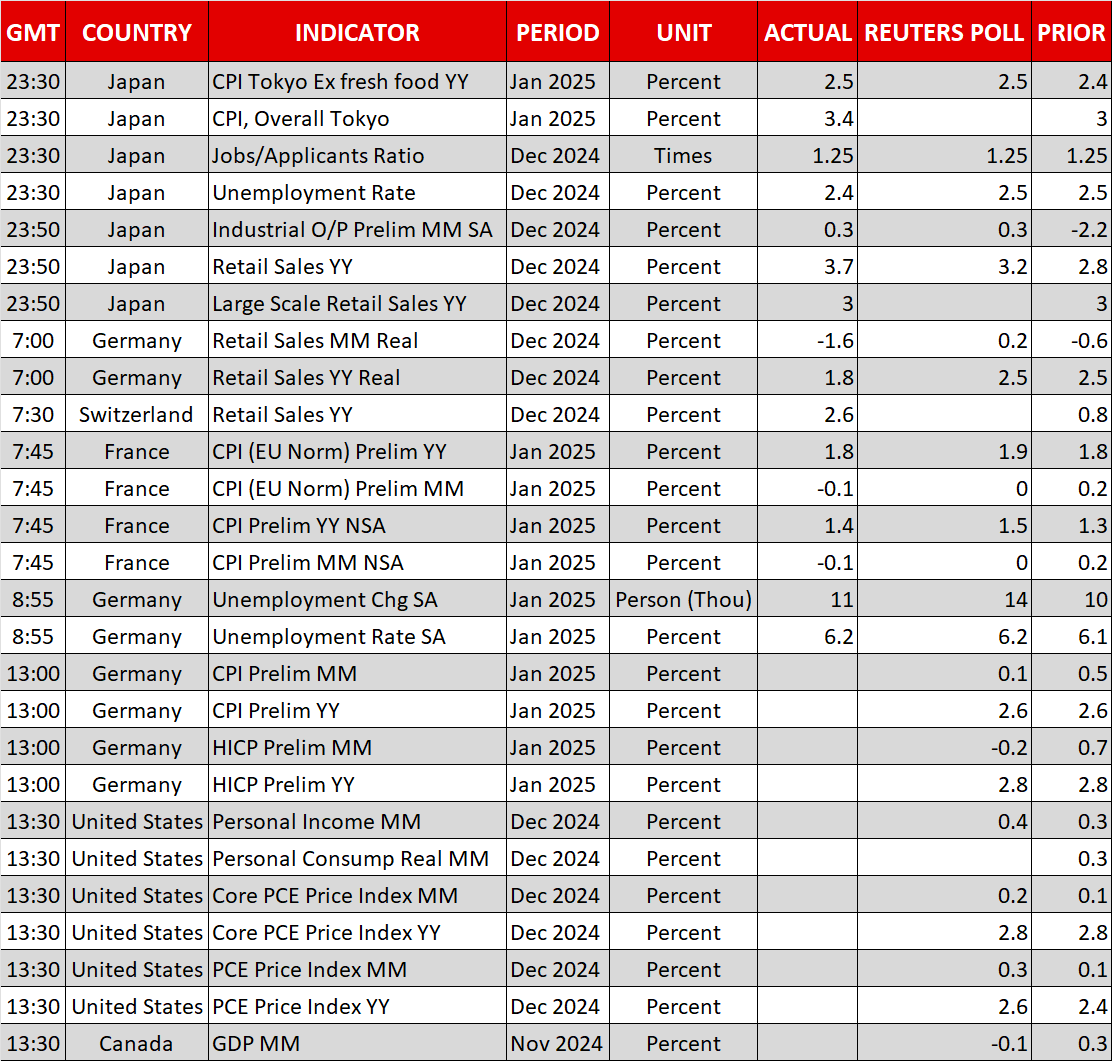

The immediate focus now is on the latest PCE inflation data due out of the US at 13:30 GMT. A soft reading could see the dollar pull back.

AI Jitters And Tech Earnings Rattle US Stocks

In equity markets, Asian and European indices are headed for weekly gains despite the wobble on Wall Street. That could all change by Monday, though, if Trump includes China in his tariffs announcement expected later today or tomorrow.

But on Wall Street, it’s all about AI and tech earnings. Nvidia’s (NASDAQ:) stock is still reeling from Monday’s selloff when investors took fright from the sudden popularity in Chinese AI chatbot, DeepSeek. Microsoft (NASDAQ:) is another casualty and its woes worsened when its earnings failed to impress. Meta (NASDAQ:) managed to come out unscathed despite its earnings raising some doubts about future revenue growth.

However, there’s still a chance that both the and can turn things around today as Apple’s stock is soaring in pre-market trading following upbeat earnings yesterday.

Although Apple announced weaker-than-expected iPhone sales, it forecast positive growth for the current quarter.