Gold Heading for Correction

2023.01.31 13:38

[ad_1]

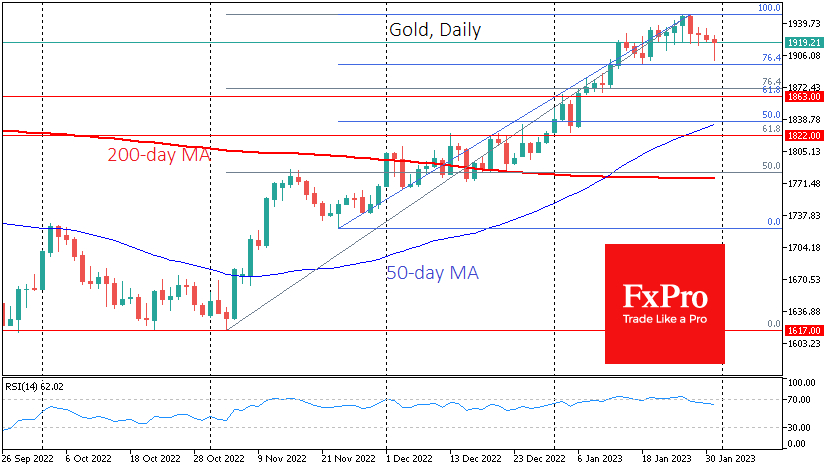

Gold is declining for the fourth consecutive session, flirting with the $1900 level and $49 below last Thursday’s peak. Gold’s 2.5% retreat is much more pronounced than the dollar index’s 1% growth over the same period.

The current reversal to the downside is linked to several factors and could be relatively long and deep, although it is unlikely to break the long-term uptrend.

The formal trigger for a wave of buying has now been a pull into defensive assets ahead of a hectic second half of the week, which includes interest rate decisions from the , , and , as well as releases on eurozone and .

After a rally of more than 20% from the September and November double lows of $1617, a technical correction above $1900 is needed. Accumulated bull fatigue was evident in last week’s relatively deep intraday drawdowns.

In addition, the RSI has been in overbought territory for two weeks on the daily timeframe and returned to neutral territory below 70 last Wednesday, which often signals the start of a correction. At the end of November, gold lost 3.3% on a similar signal before rebounding.

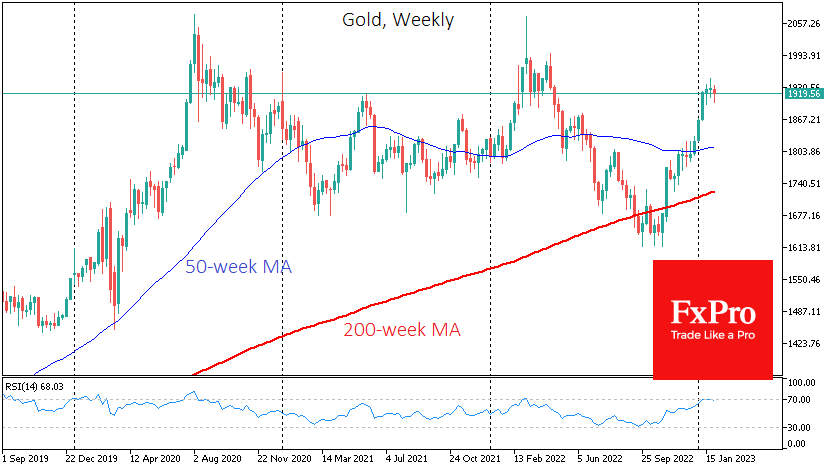

Gold is also overbought on the weekly timeframe, which has almost always led to a sudden reversal or a prolonged stall in this area.

Now it is worth preparing for a deeper correction as the gains of the past two months have been more significant. The Fibonacci patterns suggest a potential retreat to $1862 if we look at the November-January momentum and to $1822 if we look at a full correction of the entire velocity from the November lows.

The 50-week moving average is also targeting the $1820 area. This is a crucial trend indicator where buyers and sellers will battle it out for the long-term trend. However, it is too early to speculate on the outcome of this battle.

The FxPro Analyst Team

[ad_2]