Gold Has Altitude Sickness, but the Climb Is Not Over

2023.01.20 06:44

[ad_1]

Gold has made an impressive rally in the last 11 weeks, adding 19.9% to its lows at the start of November and hitting highs since last April at $1937 this morning. While maintaining a bullish outlook on gold, we focus on short-term overbought and a high chance of correction before a new leg up.

Gold has made an impressive rally in the last 11 weeks

Gold has made an impressive rally in the last 11 weeks

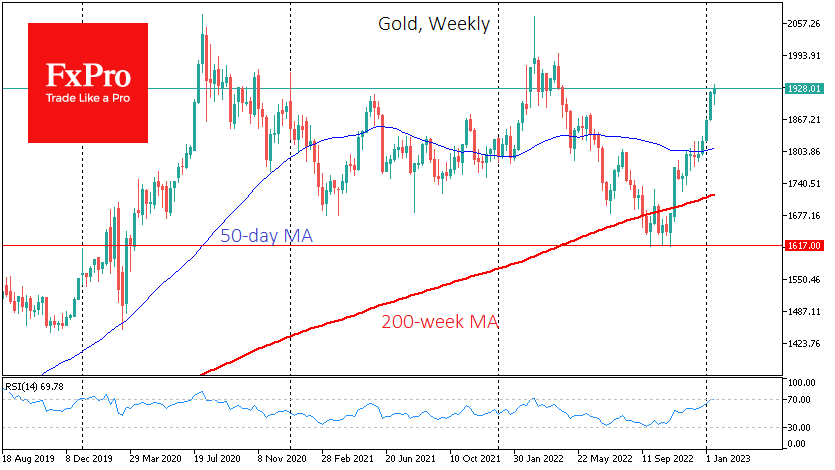

Late last year, gold turned upwards after getting methodical support on declines under the 200-week moving average, correcting half of the gains from the lows of 2018 to the 2020 and 2022 peaks.

Fundamentally, gold was pulled down by an appreciating dollar and a tightening of US monetary policy, which made US bond purchases more attractive than holding non-coupon-earning gold. A slowdown in rate hikes halted the rise in medium-term bond yields, allowing gold to shine again.

A 20% rally from the lows will allow us to name it a new bull market for gold, suggesting further gains. We saw similar situations in late 2002 and 2008 and the second half of 2018. This historical proximity sets up a further multi-year rally in gold with a renewal of historical highs above 2630 – 161.8% of initial climbing from 2018 to 2020.

But often, the market needs short-term corrections to get fuel for gains, allowing it to lock in profits and join the movement on a pullback. And such a pullback seems to be imminent.

Gold’s correction to 61.8% of the latest rally may end at $1860

Gold’s correction to 61.8% of the latest rally may end at $1860

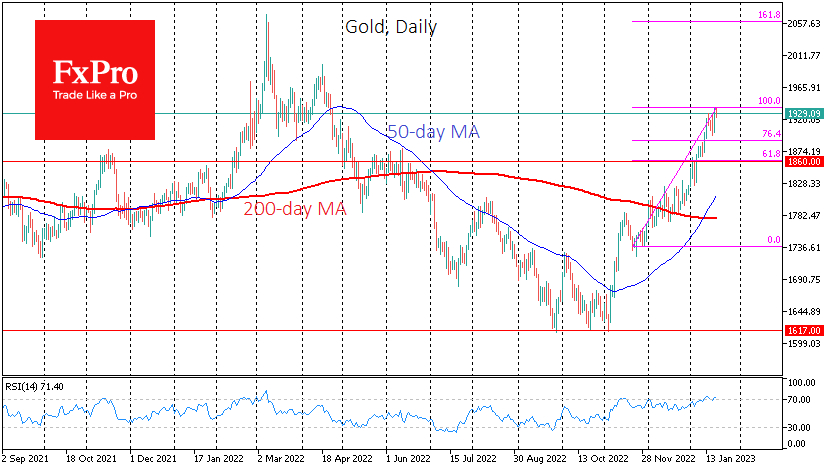

During the four weeks since Dec. 19, the amplitude of the move-up was also increasing. But this movement lost momentum this week. Despite the new price high, the RSI on the daily chart has stalled just on the verge of an overbought area. We had seen something similar at the beginning of the rally, when the powerful momentum of early November wore off by the middle of the month, taking the gold back from $1785 to $1735 – perfectly within the Fibonacci retracement pattern.

A repeat of this pattern from the highs set earlier this morning ($1937) would suggest a return to the $1860 area. This is also where the local tops of June are concentrated, which adds to the importance of support. The gold could be there by the end of the month and return to the upside as early as February.

[ad_2]