Commodities Analysis and Opinion

Gold Finally Beats Resistance at 2335/40 – More Upside Ahead?

2024.07.08 03:52

Gold

- Gold () finally beat resistance at 2335/40 mid-last week for our buy signal and then a downward revision to the May NFP number, higher than expected unemployment and lower average earnings sent Gold higher on expectations of a rate cut, as predicted.

- The break above 2371 was our buy signal on Friday targeting 2377/79 and 2384/86 for profit-taking before the weekend.

- Prices reached as far as 2392 by the close. A great trade if you were quick enough to catch it.

- Although overbought in the short term, I think further gains are likely at the start of this week. A break above 2395 is the next buy signal targeting 2405/07 and perhaps as far as 2422/25.

- I would be a buyer if we see any weakness on Monday but the only support I can identify is quite a long way down at 2371/68. Longs need stops below 2364.

Targets: 2377, 2384, 2390

Silver

- Silver () I said was forming a bull flag, meaning eventually we will break higher for a buy signal. That has happened last week and beating 3015 helped that buy signal and we shot higher to 3080/85 on Friday, then beating 3090 for another buy signal.

- My targets were 3105/10 and 3130/35, even 3150/55 I said was possible.

- Silver rocketed to 3148, so we only missed my 3rd target by 2 ticks.

- A great trade if you were quick enough to jump in on the buy signal.

- Now that we have broken higher and completed the bull flag pattern, I expect the downside to be limited and I expect to see further gains this week.

- First support at 3085/75 and longs need stops below 3065.

- A break above 3155 is the buy signal for this week targeting 3175 and 3200/10, perhaps as far as 3230.

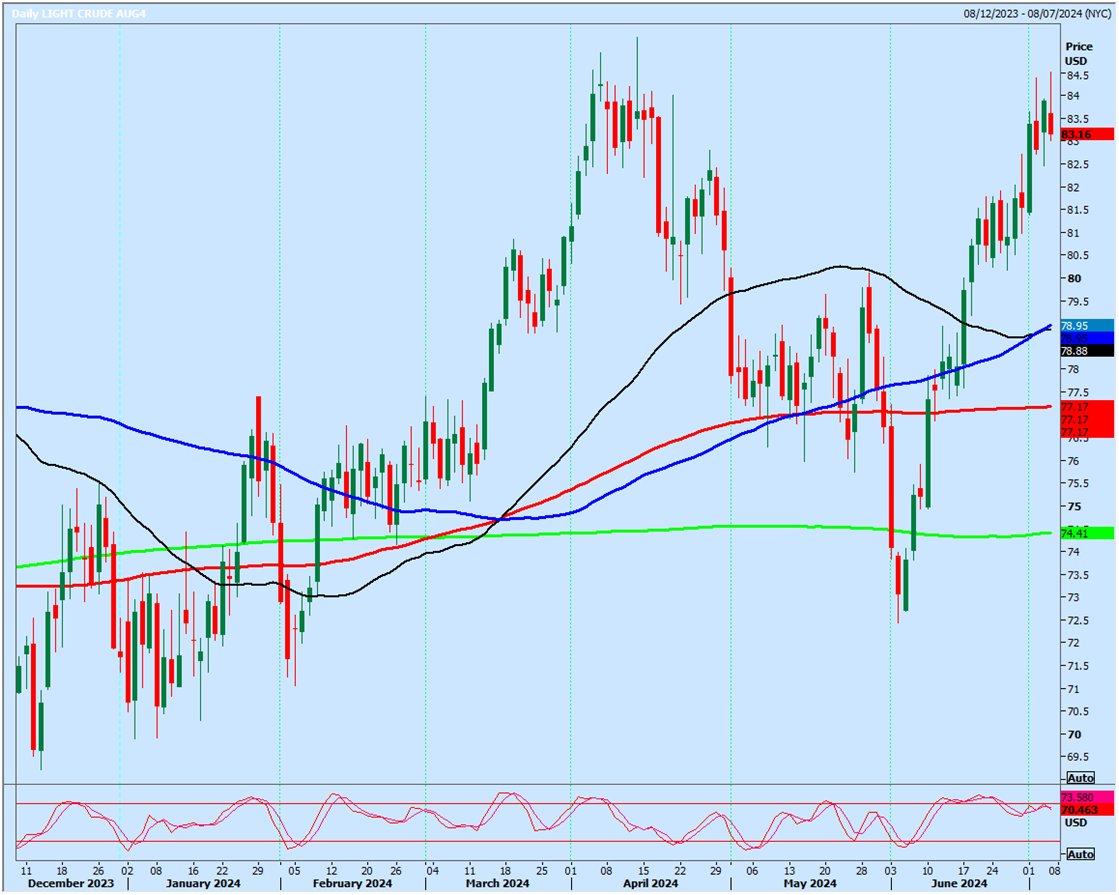

WTI Crude August Future

Last session low and high for the AUGUST contract: 8302 – 8452.

(To compare the spread with the contract that your trade).

- August has traded sideways for 3 days and we have 2 candles with long upper wicks, suggesting there is profit taking around 8430/50.

Again we meet minor support at 8270/40 which could hold the downside again today. Longs need stops below 8225. - A break below 8225 is a sell signal targeting 8160.

- A break above 8450 is the next buy signal targeting 8490 and 8520.