Gold: Exhaustion Likely to Continue Amid Recessionary Fears

2023.12.05 11:50

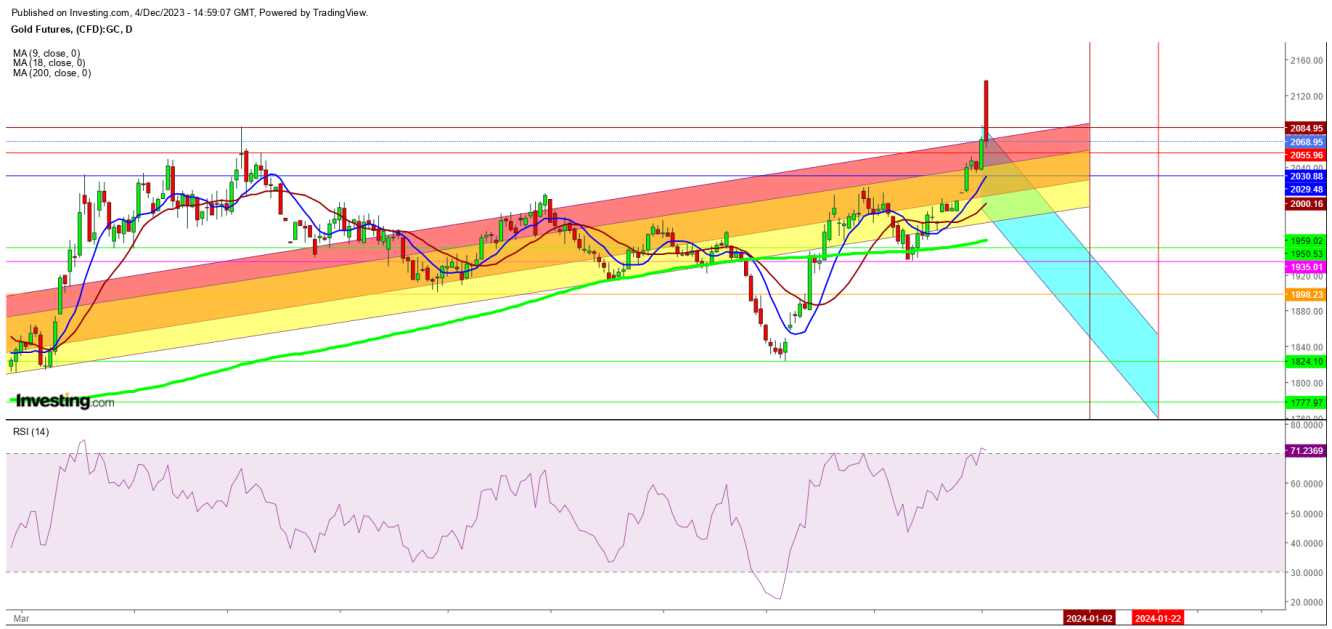

Despite a rollover-gap-up opening on the first trading session of this week, Gold futures could remain in the grip of the big bears, wait above the level of $2089 as the macro economic data likely to strengthen their grip for a long.

Gold Futures Weekly Chart

Gold Futures Weekly Chart

Undoubtedly, the geo-political tension generated reasons for the bulls to remain in command since last few months amid favorable conditions, developed with constant attempts made by the Federal Reserve to do every possible thing to keep the inflation in check, but whole scenario gets a sudden tilt with favorable macro-economic data.

Fed Policy looks evident enough to slow the economy. U.S. monetary Policy against Consumer Inflation and unemployment suggest it Is close to the Tightest Due to Recent Hiking Cycles. There are the following three questions:-

1. Is the economy slowing after the blow-out gain in the GDP in Q3?

2. Is inflation still easing at a pace which gives the Central Bank some comfort in ignoring more rate hikes and then cutting early next year?

3. Are we heading for increasing deflation amid recessionary fear?

I find that the movements by the define a lot now as the rollover-gap-up opening followed by the February Futures confirms a steep slide is likely to continue till the Fed meets in March 2024 and could continue even after that.

Technically, the gold futures tried to breach the long-term resistance at $2084 on the first trading session of this week. But all attempt proved futile due to the thick presence of big bears above this level. Undoubtedly, the day’s trading range wider than expected, with an opening at $2091.80, day’s high at $2151.20, low at $2061.65, while currently trading at 2066 at the time of writing of this analysis confirms the continuity of the exhaustion during the upcoming days and weeks ahead.

Disclaimer: The author of this analysis may or may not have any position in the Gold futures. Readers can take any long or short trading position at their own risk. Involved risk in trading needs to be taken care of before creating any trading call.