Gold Drops Below 1,920 Amid Fed Speeches and Data Release

2023.09.07 06:45

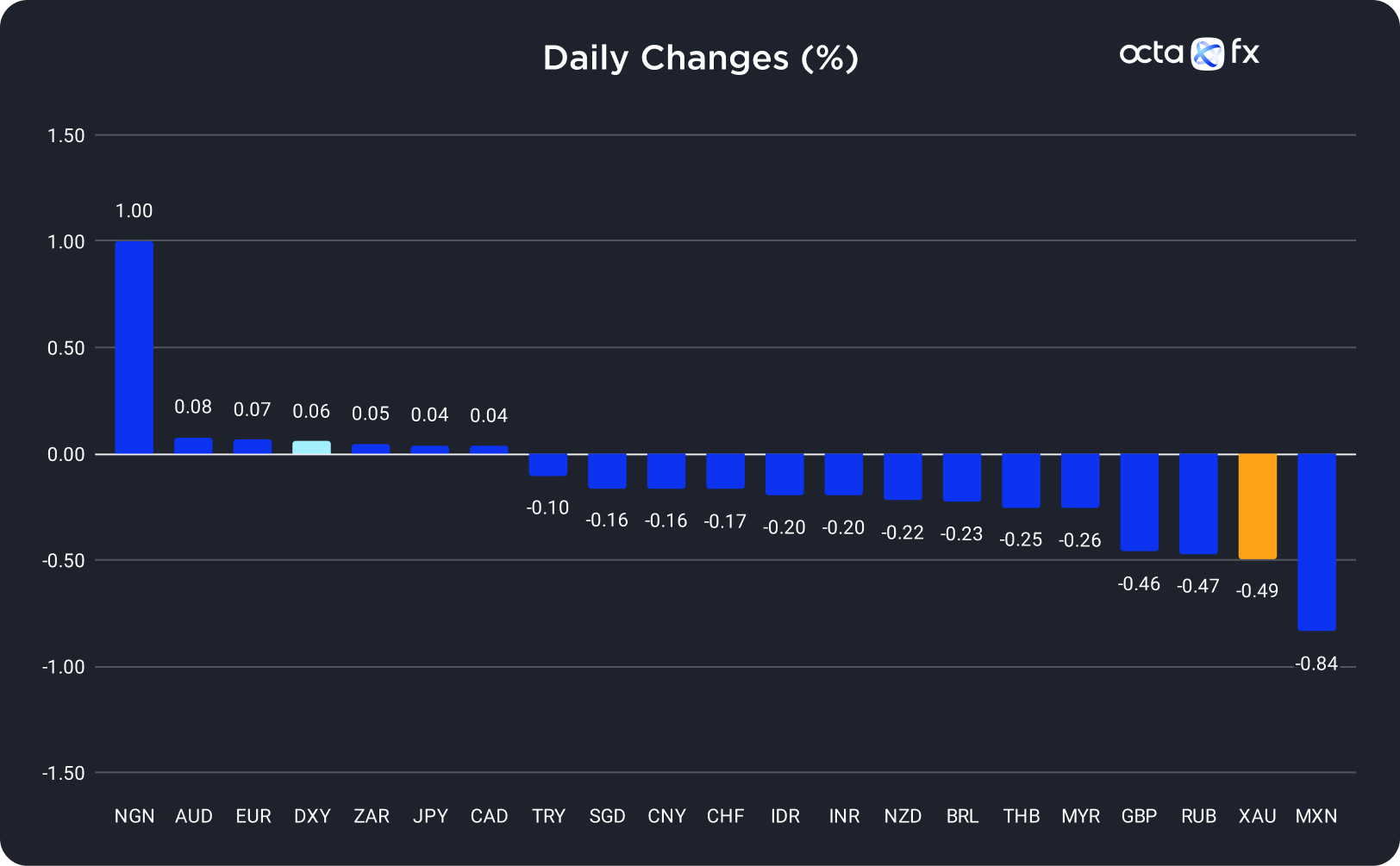

On Wednesday, the Nigerian naira (NGN) was the best-performing currency among the 20 global currencies we track, while the Mexican peso (MXN) showed the weakest results. The was the leader among majors, while the underperformed.

Changes In Exchange Rates On 6 September

Changes In Exchange Rates On 6 September

Upbeat US Economic Data Brought Down Gold

price dropped by almost 0.5%, settling below the important 1,920 level after better-than-expected U.S. macroeconomic data increased the chances for more rate hikes from the Federal Reserve (Fed) this year.

The U.S. Services Purchasing Managers Index (PMI) figures exceeded the market forecast. The data reveals the resilience of the U.S. economy, meaning the underlying price pressure might keep inflation high. Thus, increased inflation might prompt the Fed to continue tightening its monetary policy. The probability of another 25-basis-point (bps) rate hike in November has increased to 44%. The moves higher when the market expects more rate increases, putting downward pressure on non-yielding assets like .

“‘Gold’s move is not dramatic, it’s a wait-and-watch to see what the FOMC is going to do and also if the global economy is going to slip into recession or not,” said Chris Gaffney, the president at EverBank World Markets.

XAU/USD was relatively flat during the Asian session, staying below the important 1,920 level. Today, traders should focus on two speeches by the Fed officials: Patrick Harker’s speech at 2:00 p.m. and Austan Goolsbee’s speech at 3:45 p.m. UTC. They might communicate important details about the path of the U.S. base rate. In addition, the U.S. Initial Jobless Claims release at 12:30 p.m. UTC will likely cause short-term volatility in all USD pairs.

“Spot gold may bounce moderately into a range of 1,923–1,928 per ounce before falling again,” said Reuters analyst Wang Tao.

Today’s Crude Oil Report May Prolong the Bullish Trend in XTI/USD

On Wednesday, the price of the —XTI/USD—reached a 10-month high after Saudi Arabia and Russia agreed to extend their output cuts until the end of the year.

Saudi Arabia will continue its voluntary production cut of 1 million barrels per day (bpd), while Russia will lower supplies by only 300,000 bpd. These cuts will keep the overall OPEC production share relatively low and likely boost oil prices in the short term. However, high crude oil prices in the long term might slow the pace of the demand recovery. Expensive crude oil may increase global inflation and trigger an economic recession. Thus, the recent rally in crude oil looks rather shaky.

XTI/USD was falling slightly during the Asian session. Today, the U.S. Energy Information Agency (EIA) will publish its regular Crude Oil Inventories report at 3:00 p.m. UTC. The report will show the number of barrels of crude oil held in inventory by commercial firms during the past week. Most investors will focus on the change in inventories compared to the previous week. Analysts expect inventories to decrease by about 2.1 million barrels in the week to 1 September. The report will be bullish if EIA shows a larger-than-expected stock decline, pushing XTI/USD towards 87.60–88.00. If EIA declares a smaller decline or an increase in stock, XTI/USD will probably fall towards 85.40.