Gold, Copper Only at the Beginning of a Much Longer Bull Market

2024.05.06 15:21

Two commodities have emerged as pivotal players as geopolitical tensions have escalated, influencing global financial markets: and . These metals are not merely survivors of market volatility but are thriving, charting a course that I believe savvy investors would be wise to monitor.

As I’ve said countless times before, gold has long been considered a store of value in turbulent times, and now is no exception. Prices are near all-time highs, reflecting its enduring appeal during periods of uncertainty.

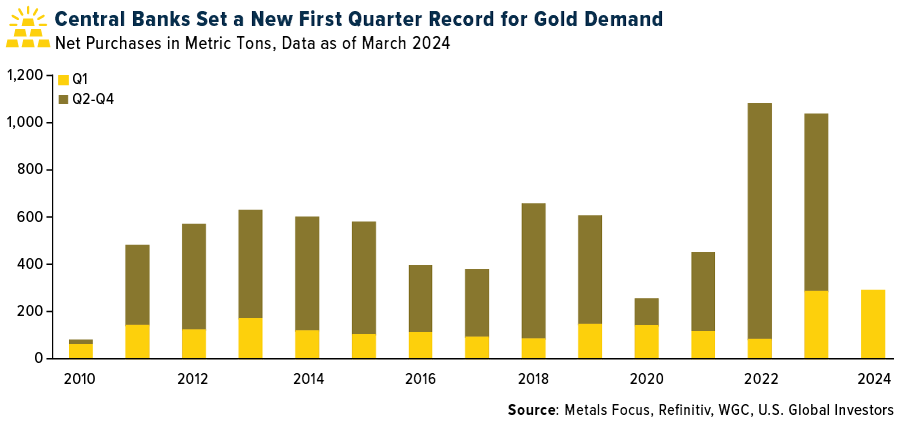

Central banks, particularly in emerging markets, are increasing their gold reserves. The first quarter of 2024 saw institutions purchase a record 290 tons of gold, according to the World Gold Council (WGC). This unprecedented amount highlights a strategic shift toward the metal as a reserve currency and away from the U.S. dollar.

High Demands Meets Tightening Supply

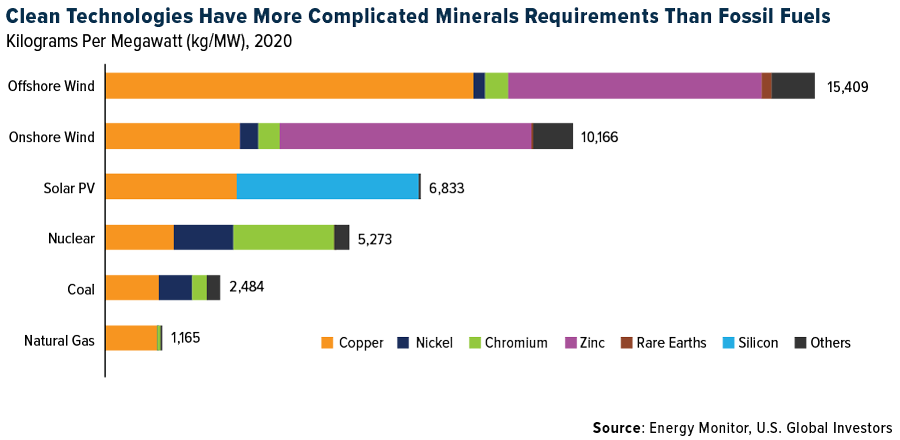

While gold secures its position as a safe haven, copper is making headlines for different reasons. Often referred to as “Dr. Copper” for its ability to predict economic trends due to its widespread industrial applications, copper has also seen a significant price increase in recent days. The industrial metal climbed to a two-year high, supported by strong global economic activity, particularly surging demand driven by energy transition technologies like electric vehicles (EVs), wind and solar.

The global copper market is tightening. Production challenges, such as stoppages and declining ore grades in major South American producers, are anticipated to limit supply growth this year, though rebound is expected in 2025.

Despite these challenges, the demand for copper continues to grow, fueled by its critical role in green energy solutions. The International Copper Association (ICA) forecasts that copper demand will increase from 28.3 million metric tons in 2020 to 40.9 million metric tons by 2040, with a compound annual growth rate of 1.85%.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Manufacturing Costs and Commodity Impacts

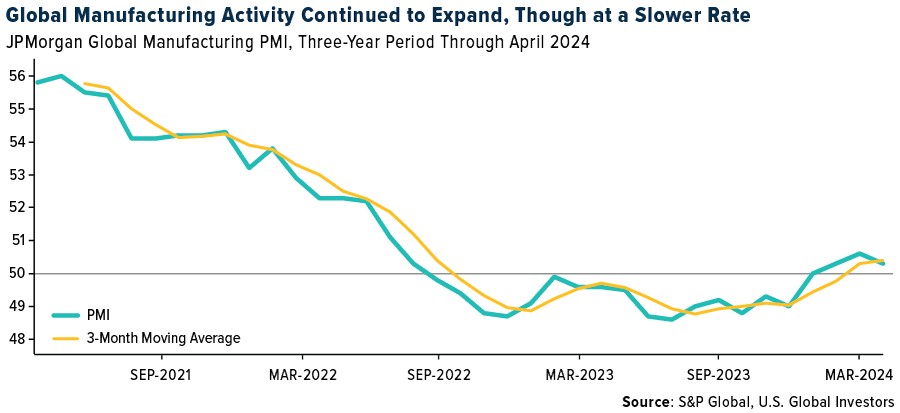

The global manufacturing sector provides further insights. The JPMorgan Global Manufacturing PMI saw a slight decline to 50.3 in April from a 20-month high of 50.6 in March, but it remains above the neutral mark, indicating expansion. This resilience in manufacturing suggests a sustained demand for industrial metals, reinforcing the bullish outlook for copper.

Rising input costs and selling prices within the manufacturing sector point to building price pressures, likely contributing to inflation concerns. Such economic indicators are critical for investors to consider as they assess the potential impacts on commodity prices and investment returns.

The $1.8 Trillion Drive Toward a Low-Carbon Economy

The shift toward a low-carbon economy is not just a policy preference but a potential investment theme. BloombergNEF reports that global investment in the energy transition reached a staggering $1.8 trillion in 2023, nearly doubling from 2020 levels. Such investments, particularly in regions like Europe, the Middle East and Africa (EMEA), are expected to drive further demand for copper, given its essential role in electrification and renewable energy infrastructures.

Balancing Portfolios with Gold and Copper

For investors, the implications of these trends are clear. Gold remains a critical asset in any diversified portfolio, especially for those seeking to hedge against geopolitical risk and potential inflation. Persistently strong demand from central banks further supports the investment case for the yellow metal. I always recommend a 10% weighting, with 5% in physical gold (bars, coins, jewelry), the other 5% in high-quality gold mining stocks, mutual funds and ETFs.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Not to be outdone, copper presents a compelling growth story tied to the global economic recovery and the transition to green energy. With the expected increase in demand and current supply constraints, prices may continue to rise, presenting a valuable opportunity for investors.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The JPMorgan Global Manufacturing PMI is compiled by S&P Global from responses to monthly questionnaires sent to purchasing managers in survey panels in over 40 countries, totaling around 13,500 companies.