Gold Continues to Trade Near 2,000; Yen Tumbles on Dovish BOJ

2023.10.31 07:08

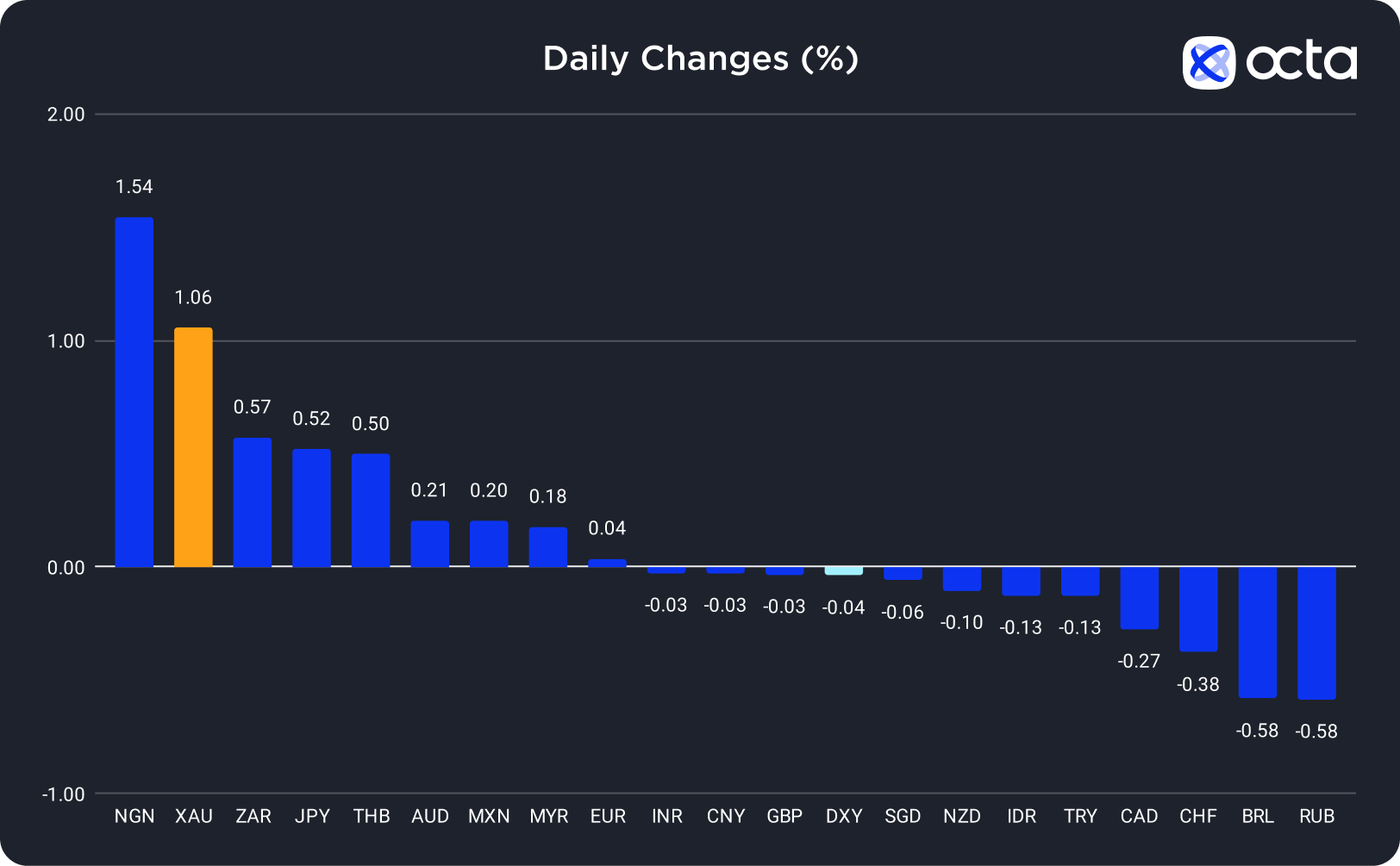

On Friday, the Nigerian naira (NGN) was the best-performing currency among the 20 global currencies we track, while the Russian rouble (RUB) showed the weakest results. The (JPY) was the leader among the majors, while the (CHF) underperformed.

Changes in Exchange Rates on 30 October

Changes in Exchange Rates on 30 October

Gold Continues to Trade Near 2,000 as Mideast Risks Persist

(XAU) price dropped by 0.49% on Monday but continued trading near the $2,000 mark amid still strong safe-haven demand.

Israel’s ground incursion into Gaza was more restrained than initially anticipated, which, for the time being, has contained the spread of risks and led to a minor decline in XAU/USD. Fundamentally, however, the bullish trend of the metal remains strong. According to a recent report from the World Gold Council, central banks are purchasing gold at unprecedented levels due to volatile markets and geopolitical tensions boosting the demand for the precious metal. Additionally, gold’s appeal as a safe-haven asset drove its price up from 1,809.50 USD per ounce on 6 October to just over 1,990 USD per ounce on 31 October. This 8% increase marked the most significant monthly rise in XAU/USD since November 2022. On the macroeconomic front, however, not all is rosy for the bullion. Investors look ahead to this week’s U.S. Federal Reserve (Fed) policy meeting for any clues on the future path of interest rates. Currently, the market is still pricing in a hefty 34% probability of an interest rate hike in January, which, in theory, should exert downward pressure on the yellow metal.

XAU/USD was relatively flat during the Asian and early European sessions. Today, traders should focus on the release of the latest U.S. Consumer Confidence report at 2:00 p.m. UTC. Weaker-than-expected results may push XAU/USD back above the pivotal 2,000 level. However, strong figures may trigger a correction towards 1,980.

“Spot gold may fall into a range of 1,964–1,977 per ounce, following its failure to break a resistance at 2,010,” said Reuters analyst Wang Tao.

Yen Tumbles as BOJ Remains Dovish

The Japanese yen (JPY) gained 0.34% on Monday as traders repositioned ahead of the critical Bank of Japan (BOJ) interest rate decision.

Later today, however, JPY dropped as BOJ announced that it would stick to its ultra-loose monetary policy and maintain its target of around 0% for its government bond. USD/JPY surged as much as 0.72% on the news as traders were anticipating a change in policy. However, the Japanese regulator revised its inflation forecast well above the 2% target, highlighting a growing conviction that conditions for tighter monetary policy are still coming.

USD/JPY continued to rise during the early European session. Today, traders should focus on the publication of the latest U.S. Consumer Confidence report at 2:00 p.m. UTC. Weaker-than-expected results may trigger a correction in USD/JPY towards 149.500. However, strong figures may push the pair towards 150.500.

“As long as the U.S. economy displays more robustness in its official data than the rest of the world does, the , , yen and will have a tough go at appreciating vs the ,” said Thierry Wizman, Macquarie’s global Forex and interest rates strategist.