Gold Confirmed Its Breakdown By Not Returning Above $1,700

2022.09.22 10:45

[ad_1]

has just clearly confirmed the descent to the 2020 lows, and this means that it’s ready to fall further. Will it happen during the FOMC conference?

In short, yesterday’s session developed practically exactly in tune with my analysis. PMs declined, but not substantially so. The back-and-forth movement simply continued.

What didn’t happen in the gold market is most important. Namely, gold didn’t move back above $1,700. This breakdown is now more than verified for the first time since mid-2020.

This means that gold is now very likely to slide. It probably hasn’t declined yet because the markets are waiting for the Fed. Either way, after the rate hike is announced, after/during the press conference, or once the dust settles (so in a few days), gold is likely to plunge – similarly to how it declined in 2013.

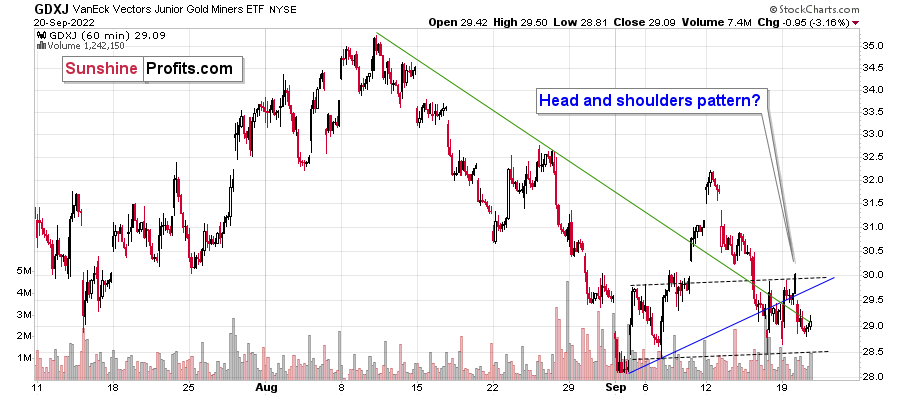

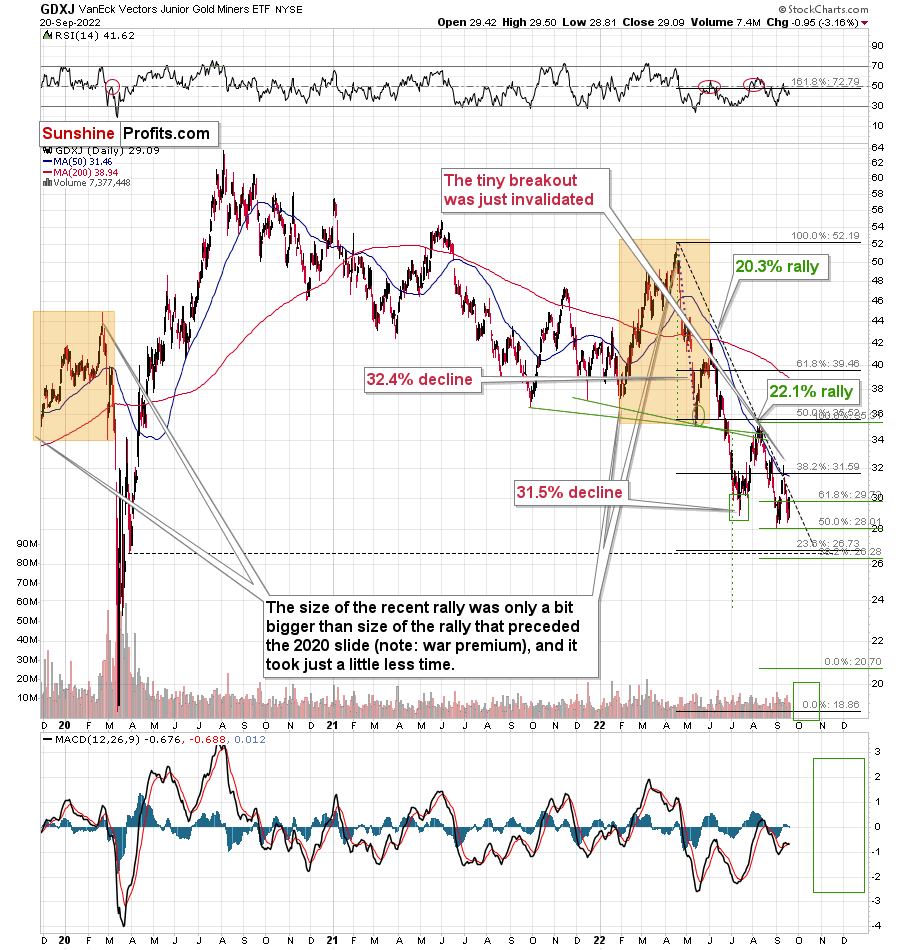

! wrote that juniors (the ETF) are now moving sideways and that they might create a head-and-shoulders pattern once they break below $28.5. Based on yesterday’s decline, they are now quite close.

The above will imply a decline to at least $25. The emphasis here is on “at least,” because there’s strong support at the 2020 lows. Such a move would likely correspond to a move to the 2020 low in gold.

If the self-similarity to 2013 continues, then it seems that we won’t have to wait much longer for this kind of sharp decline.

All in all, the profits on our short positions in the junior mining stocks are likely to increase profoundly in the coming weeks.

[ad_2]

Source link