Gold Caught Between Support and Resistance: What’s the Next Move?

2024.11.11 10:58

- Gold prices retreat as US Dollar strengthens as hopes of aggressive rate cuts fade.

- China’s economic slowdown concerns and potential sanctions impact iron ore and gold prices.

- Technical analysis indicates gold’s vulnerability to further downside, with key levels identified.

Gold prices () have started the week on the back foot as the continues to advance. Growing hopes of a ceasefire under a Trump Presidency have also diminished the safe haven’s appeal coupled with expectations of fewer rate cuts in 2025.

The biggest loser from the US election last week appears to be commodity markets which are feeling the strain of a rampant US Dollar. Gold prices retreated last week followed by , with facing fresh challenges from concern around China growth as well.

China, who had been a major buyer of this year, has remained on the sidelines for the past few months as Gold prices continued to soar to fresh highs. Concerns around the growth picture in China have also impacted Ore prices as markets anticipate a slowdown in the Chinese economy which could dent demand for raw materials. The threat of sanctions has seen UBS downgrade China growth for 2025 to 4% while warning that 2026 could prove even more challenging. Will we see more downgrades in the coming weeks?

US Dollar Strength Expected to Continue

The problem for Gold prices moving forward is that President Trump will only take office in January. This means that any of the optimism around a Middle East peace deal and the potential for higher rates may not change until then. This could leave Gold in a spot of bother with the recent selloff likely to continue.

There are a few things that could reignite the bullish rally in the precious metal with one of them being a retaliatory attack on Israel by Iran. This could put hopes of a Middle East ceasefire in jeopardy and thus lead to an increase in demand for safe havens once more.

Many had touted a Trump victory as a positive for the Gold rally, however given that markets have some experience from Trump’s first term it appears they are a lot calmer this time around.

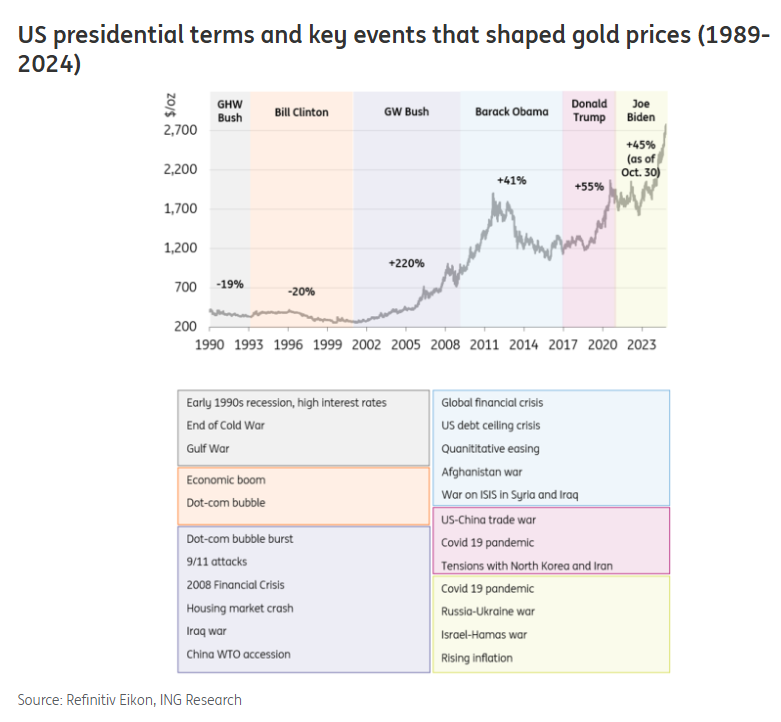

Looking back at the performance of Gold under various Presidents, during Trump’s first term in office the precious metal rose 55%.

The picture however may be distorted by the fact that the last year of the Trump Presidency occurred during the pandemic as Gold demand was ramped up due to the uncertainty.

Source: Refinitiv, ING Think

Even then given the recent rally in Gold and the expectation that Trump policies could lead to higher inflation and a stronger USD, another 55% gain seems unlikely.

A look ahead to the rest of the day, the Veterans day holiday in the US should see a low liquidity US session which could lead to a lot of choppy price action as the European session comes to a close.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold on a daily timeframe is looking ominous and vulnerable toward further downside.

A break of the long-term ascending trendline last week was followed by a brief foray higher before a rejection and selloff which has brought Gold to within touching distance of last week’s low. At the moment though, price appears to be caught between support at 2650 and resistance 2700.

Immediate support rests at 2650 before 2639 and 2624 comes into focus.

Now a recovery from her will need acceptance above the 2700 handle if we are to see a further push to the upside. At this stage the 2800 handle appears far away but could still come into play moving forward.

Gold (XAU/USD) Daily Chart, November 11, 2024

Source: TradingView

Support

Resistance

Most Read:

Original Post