Gold: Bulls Need to Clear Key Resistance Zone Above $2,708 Before Next Leg Up

2024.12.09 07:02

- Gold’s short-term outlook is clouded by mixed signals, with resistance holding firm around key levels.

- Upcoming CPI and ECB decisions could be the catalyst gold needs to break out of its range-bound phase.

- Strong dollar and geopolitical uncertainties continue to weigh on gold, while technical signals suggest caution.

- Discover the top stocks poised to benefit amid stock market’s surge using InvestingPro’s powerful tools – now up to 55% off amid the Extended Cyber Monday offer!

and rose in the first half of Monday’s session. A shift in China’s monetary stance provided a welcome boost for Chinese stocks and this helped to provide a positive backdrop for all China-related assets, from miners to key commodity prices.

Meanwhile, geopolitical upheaval from the Middle East to South Korea and France also helped to fuel a bit of a rebound in gold and prices. Looking ahead, interest-rate decisions from major central banks, including the European Central Bank and key US data will dominate the agenda this week.

China’s shift in monetary stance and central bank bonanza

China’s top leaders announced they will embrace a “moderately loose” strategy next year, in a sign of greater easing ahead that will likely be hailed by investors hungry for more stimulus. On top of this, policymakers will set interest rates this week for the first time since governments in Paris and Berlin both collapsed over budget talks.

In addition to the ECB, the and the are expected to ease policy. If we hear more dovish signals than expected from these central banks, then that could help assets with low or zero yields such as gold – especially if geopolitical uncertainties remain elevated.

Gold’s consolidation phase ahead of CPI

Despite rising around 0.9% by mid-morning European trade, gold was still contained within its existing two-week-old ranges. The range-bound conditions follow a retreat from record highs in late October. This pullback ended a nine-month winning streak, leaving November in the red.

Many investors are probably waiting for a deeper correction before jumping back into the market, resulting in modestly bearish sentiment in the near-term gold forecast. As the focus shifts to the upcoming US Consumer Price Index () report and the Federal Reserve’s final meeting of the year, gold’s price action will likely hinge on these pivotal events.

A stronger dollar may hold gold back

While the procyclical currencies rebounded amid China stimulus optimism, the was still holding near its recent highs. The greenback’s sharp rally since September has significantly impacted gold prices, making the metal costlier in major gold-consuming regions like India and China.

These two countries alone account for over half of the global jewelry market, according to the World Gold Council. The dollar’s strength, paired with a rotation toward riskier assets like tech stocks and cryptocurrencies, has also diminished gold’s appeal. But today’s recovery may be a sign that perhaps the consolidation phase might be nearing an end. Still, a confirmed breakout is needed.

Mixed economic data adds to uncertainty

Last week’s US (NFP) report added another layer of ambiguity. While headline job growth exceeded expectations, a 355K drop in household survey employment and a rise in the to 4.2% dampened optimism.

Stronger-than-expected (up 0.4% month-over-month) failed to offset concerns about broader economic weakness. As the Fed pivots its focus towards employment and away from inflation data, the upcoming CPI report may not prove so pivotal for the next moves in gold after all – unless we see a rather hot print.

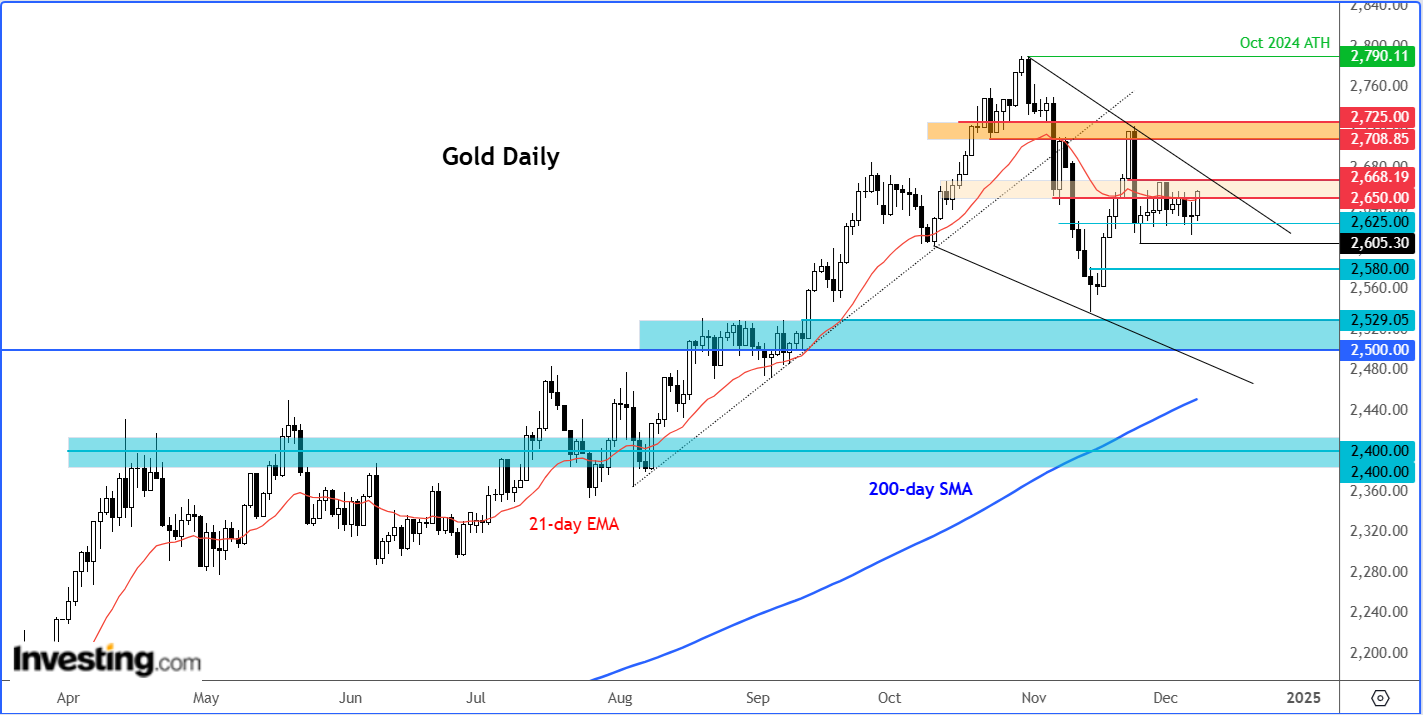

Gold technical analysis: Key levels and trends to watch

From a technical perspective, gold exhibits mixed signals in the short term. A recent sell-off, exactly two Mondays ago now, formed a bearish engulfing candle, reinforcing resistance at $2708-$2725. Yet, the lack of bearish follow-through is concerning for the bears.

Anyway, this range, a former support zone, now acts as a potential barrier to upward momentum. Complicating the technical picture further, gold is also forming a falling wedge pattern, typically a bullish signal over the long term. However, near-term resistance within this pattern may limit immediate upside potential.

Key resistance levels to monitor include:

- $2668: A daily close above this level may signal a bullish reversal, ending a two-week consolidation

- $2708-$2725 next major resistance area in the event we see a bullish breakout from a falling wedge

Key support levels to watch:

- $2580: Falling below this base could open the door to further declines toward $2500-$2530, a critical support zone.

- Long-term support at $2440-$2400: This range aligns with the 200-day moving average and remains a backstop if selling pressure intensifies.

In summary

The gold forecast for the short term remains mixed as traders weigh competing influences, including the dollar’s strength, geopolitical uncertainties, and upcoming US inflation data. While long-term trends remain supportive, short-term technical resistance and loss of momentum suggest caution. The US CPI data release or ECB’s rate decision this week could provide the catalyst gold needs to define its next trajectory, although in all likelihood traders instead may wait until the Fed’s rate decision in the following week.

***

Subscribe now to InvestingPro to take advantage of the market’s top AI-powered stock-picker at a fraction of the cost. For a limited time only!

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.