Gold Bulls Eye ‘Golden Ratio’ for Breakout, but Dollar Gains Could Stall Rally

2024.12.24 03:17

- Gold prices start the week lower as the US Dollar strengthens due to averted government shutdown and expectations of a stronger dollar in 2025.

- Gold’s safe-haven appeal may be tested by geopolitical risks in Syria and the ongoing Russia-Ukraine conflict.

- Technical analysis suggests a bullish structure for Gold on a four-hour timeframe, with a potential for further upside if the “Golden Ratio” price level holds.

Global markets are surprisingly busy today as the Christmas holidays edge closer. I expected a bit more choppiness to start the week and lower levels of liquidity, however the fact that the Fed and BoE meetings only concluded on Thursday last week could be having an impact.

It would appear that markets are still digesting the Central Bank decisions last week. Profit-taking and repositioning ahead of the year-end could also be vital factors behind the moves we are seeing.

Gold prices () have started the week on the back foot as the has resumed its march higher following a brief lull on Friday. Given the lack of high-impact data releases this week Gold could remain rangebound between last week’s lows and today’s high around 2630 handle.

US Dollar Index Marches Higher

Markets are still adjusting to the Feds new policy outlook moving forward in 2025. US Treasury Yields and the enjoying strong starts to the week.

The Dollar was also boosted when a U.S. government shutdown was averted by Congress’ passage of spending legislation early on Saturday. A batch of poor US data today which saw the CB Consumer confidence number drop from 111.7 to 104.7 did little to halt the Greenbacks advance.

Thinner liquidity is definitely to factor in this week while repositioning may also play a role. Many analysts are expecting a stronger US Dollar in 2025 which could benefit the greenback as market participants eye portfolio allocations in the new year. Such a move could keep the US dollar supported and thus Gold prices under pressure.

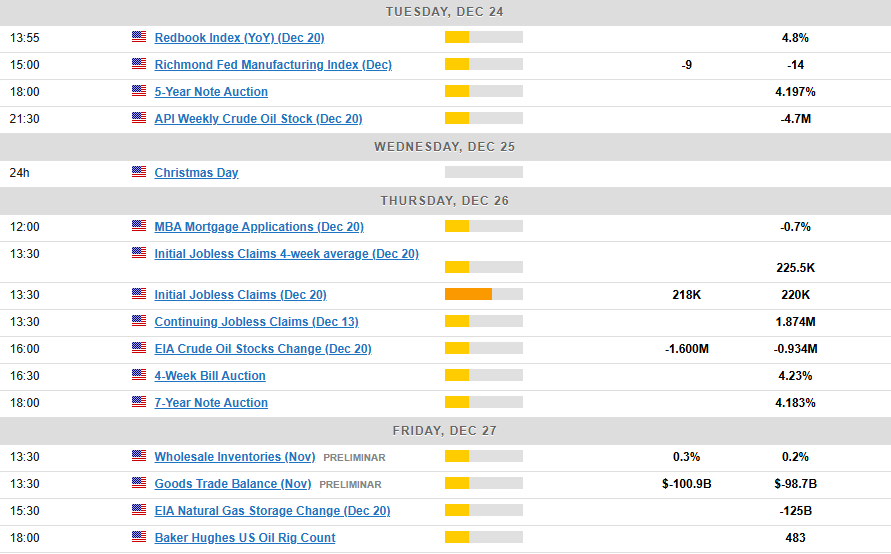

The Week Ahead

There are a whole lot of mid and low tier data releases moving forward this week. I expect choppiness however, I could be wrong given the start we are seeing today.

Risks continue to lie in the geopolitical realm with Syria not out of the woods yet while the Russia and Ukraine conflict continues to ramble on.

Developments here could impact the risk sentiment and thus have an impact on Gold’s safe-haven appeal.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold on a four-hour timeframe is bullish in structure following Friday’s rally.

Price has now made higher highs and higher lows since bottoming out at 2583 following the Fed decision. A four hour candle close below the 2600 handle is needed to invalidate the bullish structure which is developing otherwise a new leg to the upside looks more likely.

Gold (XAU/USD) Four-Hour (H4) Chart, December 23, 2024

Dropping down to a two-hour chart and drawing on the Fibonacci retracement tool we can see that price is now in a pivot area. This area is known as the “Golden Ratio” or “Golden Mean,” It is widely used by traders to identify potential reversal levels in the market.

If this area holds it will further strengthen the belief that a new leg to the upside may materialize and thus we could see bulls return with some gusto.

Immediate resistance rests 2624.86 with a break above opening up a test of the 2639 and 2650.

Immediate support rests at 2600 before the recent low at 2683 comes into focus once more.

Gold (XAU/USD) Two-Hour (H4) Chart, December 23, 2024

Source: TradingView

Support

Resistance

Most Read: l

Original Post