Gold Bottoming Despite Fed

2023.06.16 16:58

recent pullback looks to be bottoming, despite ongoing aggressive Fed hawkishness. In recent weeks the yellow metal has consolidated high, defying aggressive Fedspeak, another big US-jobs upside surprise, and hawkish rate forecasts from top Fed officials. This resilience leading right into gold’s major summer-doldrums seasonal low coincides with speculators maintaining really bullish gold-futures positioning.

Gold was enjoying a strong upleg into early May, powering an impressive 26.3% higher in 7.2 months. But after rapidly surging to $2,050 and challenging all-time-record nominal highs, gold was really getting stretched. Trading way up at 1.132x its 200-day moving average, gold was very overbought. While still under the upleg-slaying danger zone over 1.160x, a healthy pullback was in order to rebalance sentiment.

That’s exactly what happened over the next several weeks. Gold fell 5.4% to $1,941, with very-hawkish comments from top Fed officials playing a big role. While the sharpness and magnitude of that mid-upleg pullback were normal, it succeeded in quickly sapping excessive greed. Herd psychology decayed back to bearish, as traders soon forgot about gold’s powerful run leading into that. Gold increasingly fell out of favor.

Over the several weeks since that initial selloff low, gold has ground sideways on balance. And that has been a high consolidation, in the upper middle of gold’s upleg trading range. So this pullback’s technical damage has been pretty minor, certainly not justifying such pessimistic sentiment. But bearishness and apathy are par for the course in this seasonally weakest time of the year for gold, the dreaded summer doldrums.

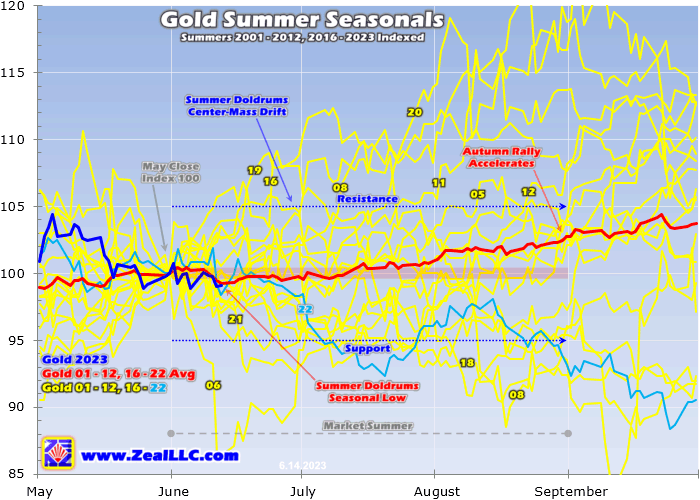

I a whole essay last week advancing this seasonality-research thread. This chart is updated from that, normalizing gold’s summer seasonal performances across all modern bull-market years. Gold’s price action during those market summers is indexed to 100 as of May’s final closes, recasting it in perfectly-comparable percentage terms. Gold’s recent early-summer behavior is tracking seasonal norms.

Gold’s current indexed summer-to-date performance is rendered in dark blue, drifting sideways to slightly lower. This year gold exited May at $1,963, and as of mid-week it has averaged $1,956 summer-to-date. Despite all the gold bearishness out there, that is running only a little under gold’s indexed average from 2001 to 2012 and 2016 to 2022 shown in red. So there’s been nothing unusual about gold’s recent drift.

After dropping to late May’s initial pullback low of $1,941, gold revisited $1,942 in early June and $1,944 the day before this week’s latest Federal Open Market Committee decision from the Fed. So if $1,940 holds, gold is carving a bullish triple-bottom. That’s actually impressively resilient considering the recent Fed-hawkish news flow. Gold has weathered several major selling-sparking catalysts since early June.

The first was the latest monthly US jobs report released on Friday the 2nd. That is the granddaddy of all economic reports, really moving markets when it surprises. Better-than-expected monthly jobs growth often really slams gold, unleashing heavy gold-futures selling. Because the Fed has a dual mandate from Congress of price stability and maximum employment, the US jobs situation greatly influences monetary policy.

When job creation is running high implying an overheating US economy, the FOMC is more likely to hike its federal funds rate to temper that. So federal funds futures immediately price in higher rate-hike odds after jobs upside surprises, which fuels sizable US-dollar buying. Those dollar rallies are what motivate gold-futures speculators to flee and hammer gold, since it often moves in lockstep opposition to the dollar.

May’s latest US jobs print came in scorching hot, with 339k jobs created, almost doubling the +190k Wall Street economists expected. That was the 12th upside surprise out of the past 13 monthly jobs reports. There were plenty of inconsistencies in that headline number, which has grown increasingly suspect over the past 14 months or so. One is a gaping divergence between the two surveys feeding into that report.

Those are the establishment survey of employers and broader household survey of ordinary Americans. The former yielded that huge +339k surge, but the latter contradictorily revealed Americans actually lost 310k jobs in May. Normally these two surveys track and confirm each other, so big divergences point to likely manipulation. Starting in March last year, the rest of 2022 saw this same thing explode near 2.1m jobs.

But that big headline beat still crushed gold, which plunged from $1,979 leading into that key data to a -1.5% close at $1,948. The higher Fed-rate-hike odds resulting from that massive upside surprise also boosted the benchmark 0.5%. That sizable gold selling could’ve easily cascaded this time of year when sentiment waxes so bearish. Yet gold held, and bounced higher in subsequent trading days.

More gold-futures selling hit gold on June 7th, pounding it down 1.1% to $1,942 just above this pullback’s initial low a couple weeks earlier. The driver was again surging Fed-rate-hike odds, following a surprise rate hike by Canada’s central bank. After pausing its own violent hiking cycle in January, the Bank of Canada hiked 25 basis points to a 22-year high of 4.75% warning “underlying inflation remains stubbornly high”.

Federal-funds-futures-implied rate-hike odds for the FOMC’s next two meetings in mid-June and late July surged near 30% and 90% on that. With the BoC resuming rate hikes on inflation still raging, maybe the Fed would have to keep on hiking. Once again that gold-futures selling could’ve easily snowballed with such a Fed-hawkish outlook. But despite gold languishing in the summer doldrums, that didn’t happen.

The very next day gold bounced 1.2%, more than erasing that loss to potentially carve a double-bottom. The gold-futures guys dominating gold’s short-term price action apparently weren’t motivated to press its downside momentum. But gold resumed slumping over the next few trading days leading into the eve of this Wednesday’s FOMC decision, revisiting $1,944 for a potential triple-bottom for this latest normal pullback.

The Fed wasn’t expected to hike this week, and didn’t. After hiking its federal funds rate an extraordinary 500 basis points in just 13.6 months during its previous ten meetings, the FOMC . Top Fed officials decided to wait to better understand the lagging impact of their epic rate-hike cycle. But with that widely forecast, traders were way more interested in Fed officials’ latest FFR projections than the FOMC statement.

After every-other FOMC meeting or once a quarter, the Fed releases a Summary of Economic Projections revealing average forecasts of key economic data by individual top officials. The heart of that is the dot plot, showing where these guys setting monetary policy expect the FFR to be exiting coming years. In the previous late-March installment, that collective year-end-2023 projection ran 5.13% right at the current FFR.

The FOMC sets a 25-bp target range for this interest rate, which is now running between 5.00% to 5.25%. This week traders did expect to see Fed officials add on one more 25bp hike, but they surprised penciling in two more 25bp hikes by year-end 2023. That lifted their federal-funds-rate outlook by 50bp to 5.63%. Even though these projections are notoriously inaccurate for forecasting, that was still a Fed-hawkish surprise.

That was probably mostly signaling, Fed officials not wanting to appear dovish while pausing their violent hiking cycle. But traders still reacted, bidding the US dollar sharply higher from a pre-FOMC selloff and pounding gold down from $1,954 to $1,939. But again impressively gold recovered some to a +0.1% close at $1,945. That was despite the Fed chair himself waxing hawkish in his post-FOMC press conference.

Jerome Powell warned that:

“Inflation has not really moved down. It has not reacted much to our existing rate hikes. We’re going to have to keep at it.” He said “…not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate if you think about it.”

Higher for longer was the narrative.

Talk about a great opportunity to aggressively sell gold futures. Gold recently suffered that sharp pullback in May, and has mostly ground sideways a bit above that initial low since. That left gold psychology pretty bearish in the dark heart of the summer doldrums. And the FOMC implied it will keep hiking its FFR and hold it high for the rest of 2023. All that could’ve easily hammered gold 2%+ lower after that hawkish FOMC.

Yet the yellow metal still looks to be bottoming despite the Fed. Late May’s initial $1,941 pullback closing low still hasn’t been breached. Market reactions following FOMC decisions often aren’t apparent until the end of the following trading day. That allows foreign traders to react overnight, and then American ones to fully digest what the Fed is doing. Gold did weaken further in overseas trading leading into Thursday.

It had slumped near $1,927 by the time the US trading session rolled around, which would’ve made for a breakdown. Yet as I pen this essay midday Thursday, gold has caught a strong bid from American gold-futures speculators. It has surged as high as $1,960, fully regaining levels from a few trading days before top Fed officials forecast two more hikes. Why is gold holding its own through these big selling catalysts?

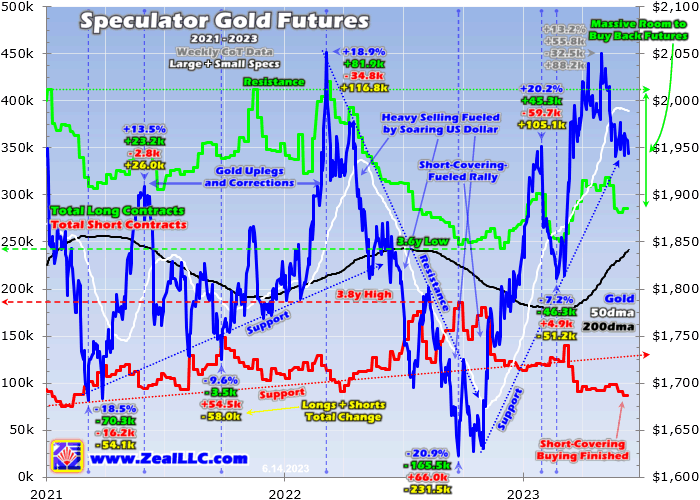

The primary reason is probably speculators’ gold-futures positioning, which remains bullish for gold. This chart superimposes the yellow metal’s technicals over specs’ total long and short contracts reported in the weekly Commitments of Traders reports. These hyper-leveraged traders who often bully around short-term gold prices have much more room to buy than sell. They are poised to flock back in on the right catalyst.

Major gold uplegs are fueled by three sequential stages of buying. Initially off major lows gold-futures speculators buy to cover shorts. That stage-one buying is readily apparent early in gold’s current strong upleg, as spec shorts falling sharply from secular highs catapulted gold higher in November. That short-covering buying eventually pushed gold high enough for long enough to entice bigger long-side specs to return.

That happened in December, January, and April, blasting gold to new upleg highs. More short covering flared in mid-March, but stage-two gold-futures long buying was gold’s main driver to challenge record nominal highs. Eventually, that super-leveraged gold-futures buying fuels enough upside momentum to entice investors back with their vastly-larger pools of capital. Their stage-three buying supercharges gold uplegs.

That has barely started yet, as evident in the best daily high-resolution proxy for global gold investment demand. That’s the combined holdings of the dominant mighty GLD (NYSE:) and iShares Gold Trust (NYSE:) gold exchange-traded funds. At best during gold’s entire upleg over this past half-year or so, GLD+IAU holdings only climbed 4.3% or 58.2 metric tons from mid-March to late May. That’s next to nothing by major-gold-upleg standards.

Gold’s last comparable uplegs to today’s 26.3%-at-best-so-far both crested in 2020, at massive 42.7% and 40.0% gains. Stage-three investment buying fueled much of those, with GLD+IAU holdings shooting up 30.4% or 314.2t and 35.3% or 460.5t during them. Investors love chasing gold upside momentum, which accelerates and amplifies it. Not much of that has happened yet in today’s upleg, arguing it is still young.

With total spec shorts depleting to just 0% up into their past-year trading range, this gold upleg’s probable stage-one short-covering buying has been fully expended. But the larger and more-important stage-two gold-futures long buying has a long ways to run yet. Note in this chart that spec longs’ upper resistance zone in recent years has been way up near 413k contracts, around where their buying firepower exhausts.

As of the latest-reported CoT when this essay was published current to June 6th, total spec longs were still way down at just 285.1k contracts. And they were probably even lower on FOMC eve a week later, as gold had fallen from $1,963 to $1,944 during this latest CoT week. That CoT data current to Tuesdays isn’t released until late Friday afternoons, well after this essay was published. But spec longs are darned low.

Today’s strong gold upleg was born at deep stock-panic-grade secular lows in late September, when total spec longs only ran 247.5k contracts. That left massive room for these leveraged traders to buy 165.5k contracts before their total longs challenged that 413k gold-upleg-slaying upper resistance. But as of this latest-reported gold-summer-doldrums CoT data, total spec longs were merely up 37.6k since late September.

That is less than 23% up into that gold-upleg spec-long range, suggesting a staggering 77% of specs’ likely stage-two gold-futures long buying remains. Stated another way, specs still have room to more than quadruple the long buying they’ve already done. That will start returning on some gold-bullish news catalysts, and feed on itself growing this gold upleg much larger. Stage-two buying could resume any day now.

Odds are waning Fed hawkishness will prove the triggers. The FOMC has already hiked 500bp, and Fed officials think 50bp more is coming. If two more 25bp hikes indeed come to pass, fully 91% of this monster rate-hiking cycle is behind us. If the FOMC keeps hiking, this cycle will be even closer to ending killing hawkish jawboning. Traders will increasingly expect rate cuts too, which usually start soon after hiking cycles.

Major economic data is likely to become more Fed-dovish too. With mainstream Wall Street economists increasingly questioning those extraordinary upside surprises in monthly US jobs, their manipulations will likely shrink. Facing mounting scrutiny, those dubious hot headline numbers will probably start converging with other weaker jobs data. That will lead Fed officials to really throttle back their hawkish Fedspeak.

And the most-watched US Consumer Price Index inflation gauge should keep moderating too, adding to the Fed-dovish bent. For eleven consecutive months now, the monthly year-over-year CPI increases have shrunk on base effects. The latest May 2023 CPI reported this week only climbed 4.0% YoY, less than half the red-hot peak soaring 9.1% YoY in June 2022. And that will soon roll off year-over-year comparisons.

With price levels surging much higher last summer, coming months’ CPI increases will shrink off those higher bases. Traders will consider lower headline CPI prints Fed-dovish, and trade accordingly, selling the US dollar and buying gold futures. Though far-higher consumer prices aren’t going away, their rates of ascent are really moderating. Lower inflation reads will also shift Fed officials’ comments more dovish.

So there’s a good chance gold is bottoming here despite the hawkish Fed. This healthy gold upleg that is merely seeing another normal mid-upleg pullback should come roaring back as gold’s seasonal autumn rally gathers steam. Gold’s summer-doldrums seasonals buttress this bullish outlook, as their average low came in mid-June. That was actually June’s 10th trading day, coinciding with this week’s FOMC meeting.

The biggest beneficiaries of higher gold prices ahead as this strong upleg resumes will be gold stocks. The larger gold miners of the leading GDX (NYSE:) gold-stock ETF tend to amplify gold’s gains by 2x to 3x. The fundamentally-superior smaller mid-tiers and juniors usually fare even better. GDX has already blasted up 63.9% at best in this gold upleg, for 2.4x upside leverage. And that tends to mount as gold uplegs mature.

The bottom line is gold looks to be bottoming despite the hawkish Fed. The yellow metal has mostly been consolidating high in recent weeks after a normal mid-upleg pullback. Big gold-futures selling catalysts failed to break down gold to new lows, including another massive upside surprise in monthly US jobs and Fed officials forecasting more rate hikes than expected. Those even hit in the bearish summer doldrums.

Gold’s impressive resilience through all that likely stems from speculators’ gold-futures positioning. They still have huge stage-two long buying left to do, with less than a quarter of that expended so far. They will increasingly pour into gold futures on Fed-dovish news, driving gold’s upleg to major new highs in coming months. As usual gold miners’ stocks will amplify gold’s gains, building wealth for smart contrarian traders.