Gold attempts recovery to only face limitations again

2024.05.07 11:22

-

Gold stays trapped below 2,325 after Monday’s bounce

-

Technical signals reflect persisting caution

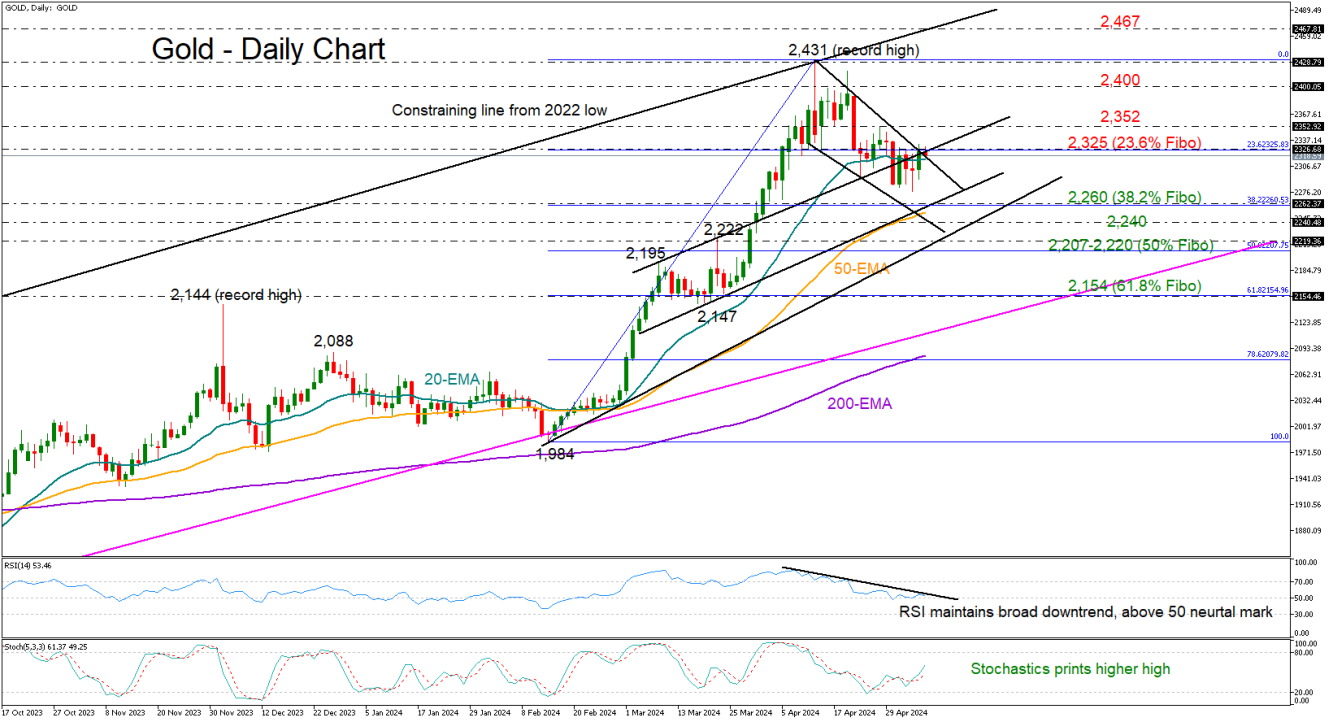

Gold had a positive start to the week, bouncing back above its 20-day exponential moving average (EMA), but the bullish attempt was not strong enough to drive the precious metal successfully above the constraining zone of 2,325. This is where the 23.6% Fibonacci retracement of the February-April uptrend and a former restrictive line are placed.

The price seems to have reached a make-or-break point and the technical picture cannot guarantee a meaningful bullish breakout. While the positive trend in the stochastic oscillator is an encouraging sign, the RSI has yet to violate its almost one-month-old downward path despite showing signs of a recovery above its 50 neutral mark.

If the bears retake control below the 20-day EMA, the price might slide towards the 38.2% Fibonacci of 2,260 and perhaps test the 50-day EMA around the same region. If the falling support line from April proves fragile around 2,240 as well, the next stop could be somewhere between 2,220 and the 50% Fibonacci of 2,207. A step lower could aggressively push the price towards the 61.8% Fibonacci of 2,154.

In the case the bulls win the battle around 2,325, they might initially challenge the 2,350 area, where the price peaked on April 26. A continuation higher could then find resistance around the 2,400 psychological mark, while a steeper increase could head for the all-time high of 2,431. Should the market venture into uncharted territory, it could establish a new higher high around the longer-term ascending line at 2,467.

Summing up, gold needs to knock down the wall at 2,325 and preferably overcome the 2,350 territory to bolster buying appetite again. Otherwise, the short-term downleg could stretch towards the 2,260 area.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Source link