Gold and USD Index Under Trump’s Presidency

2024.11.07 12:19

Gold and USD Index Under Trump’s Presidency

And no, I don’t mean Trump’s presidency, but that’s true as well. I mean the rally in the USD Index and the declines in the precious metals and mining stocks.

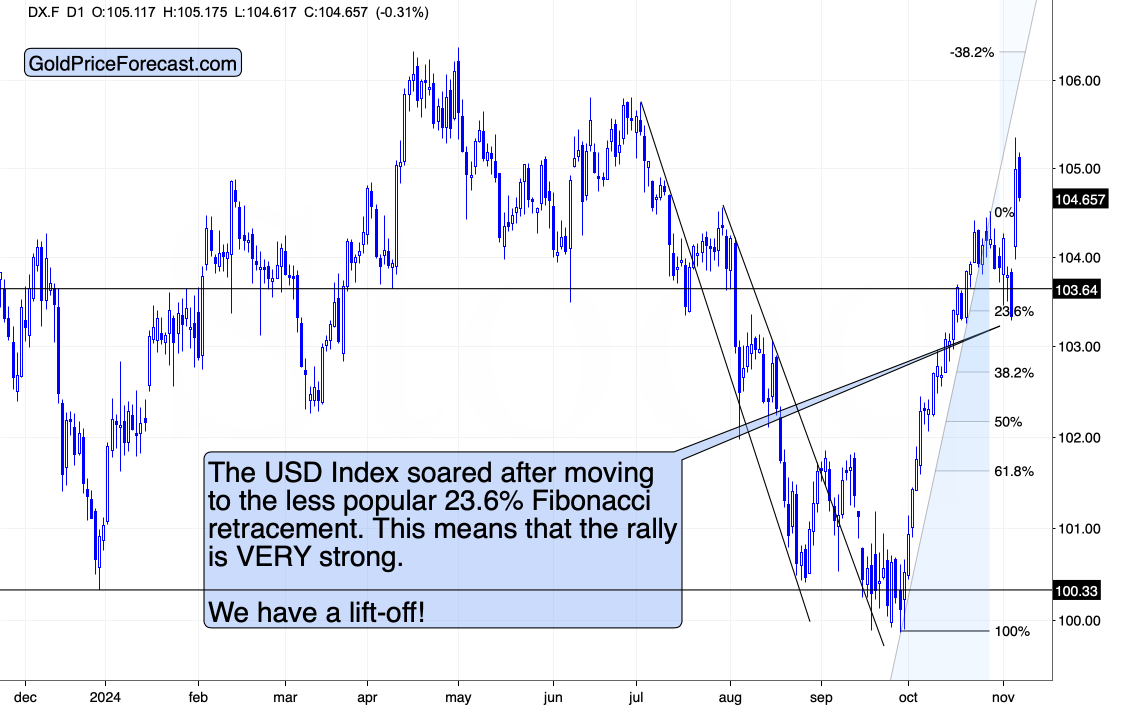

On a short-term basis, it might seem as if the rally was so huge that it’s unsustainable. I agree; it was very sharp and nothing short of spectacular, but whether it’s sustainable is a completely different matter.

To answer the question about this rally’s sustainability, we need to zoom out and see what the situation looks like in general – not just in the case of the most recent price moves.

After all, a higher move might be excessive for a short-term move, but it might not be excessive at all when compared to the previous bigger uptrends.

And that’s exactly what zooming out reveals.

Implications for Precious Metals

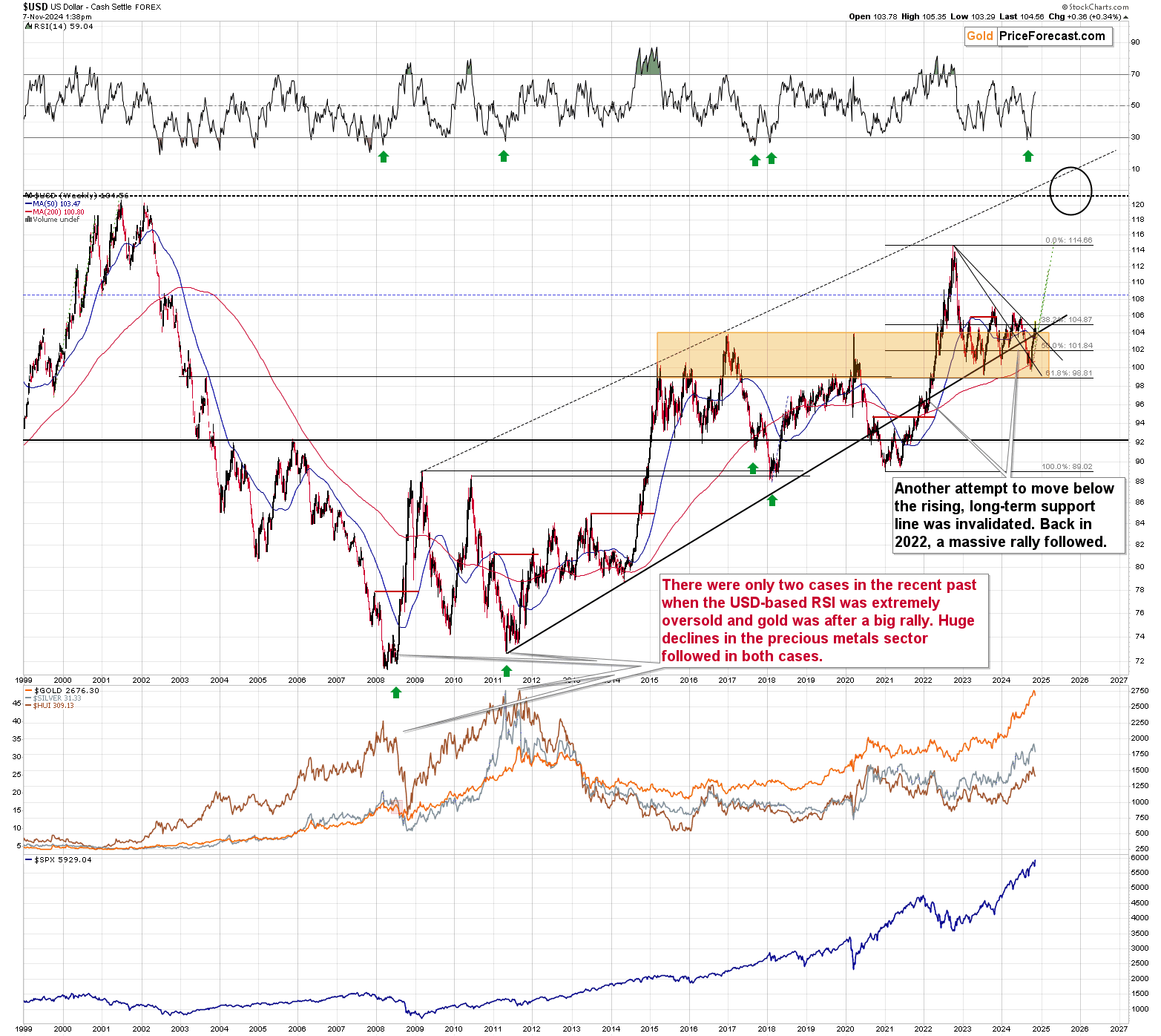

The USD Index just invalidated its breakdown below the powerful, rising support line based on the 2011 and 2014 lows. There were three previous breakdowns below this line, all invalidated. They were all followed by sizable rallies in the USDX, but only one is really similar to what we saw in the previous months because of how long the USDX stayed below the line.

The only similar case is the 2020 breakdown and its invalidation that took place in early 2022. Back then, the USD Index continues to rally for about 15 index points. If the same happens again (note: I’m not writing about something completely new happening – I’m writing about the recent past being repeated), then the USD Index could rally to about 120 – it’s a critical, medium-term high.

Can the USD Index really move as high? Yes – it would be just history’s rhyme, nothing particularly new.

The impact on the precious metals market would be negative, and the above chart shows how bad things could get.

Given the recent extremely oversold reading from the RSI and the high gold recently rallied, there are only two similar situations in the recent past: the 2011 high (right before that high) and the final 2008 top. Gold, silver, and mining stocks plunged in both cases, so the implications are very bearish.

On a side note, the medium-term bottoms in the USD Index are often accompanied by some kind of theory based on which the USD is becoming useless and substituted by other currencies. Back in 2008 it was the twin deficit and recently de-dollarization is what is often mentioned as the reason for dollar’s “unavoidable” death. I got quite many requests to comment on it when the USD Index was bottoming earlier this year and I have been repeating that it’s likely a sign of the bottom that this topic emerged (a sign of extremely negative sentiment) and not a valid fundamental reason for decline’s continuation.

Maybe the world will step away from using the USD, but:

-

This is unlikely to happen anytime soon.

-

In my view, it will be a move toward CBDC (gov’t crypto) and not other fiat currencies.

Moving back to the above chart, the analogy to 2011 is particularly interesting – back then gold continued to rally for some time after dollar’s RSI moved below 30. The same happened recently, gold continued to move higher and then made a clear top – just like what we saw in 2011.

Stocks and Broader Market Trends

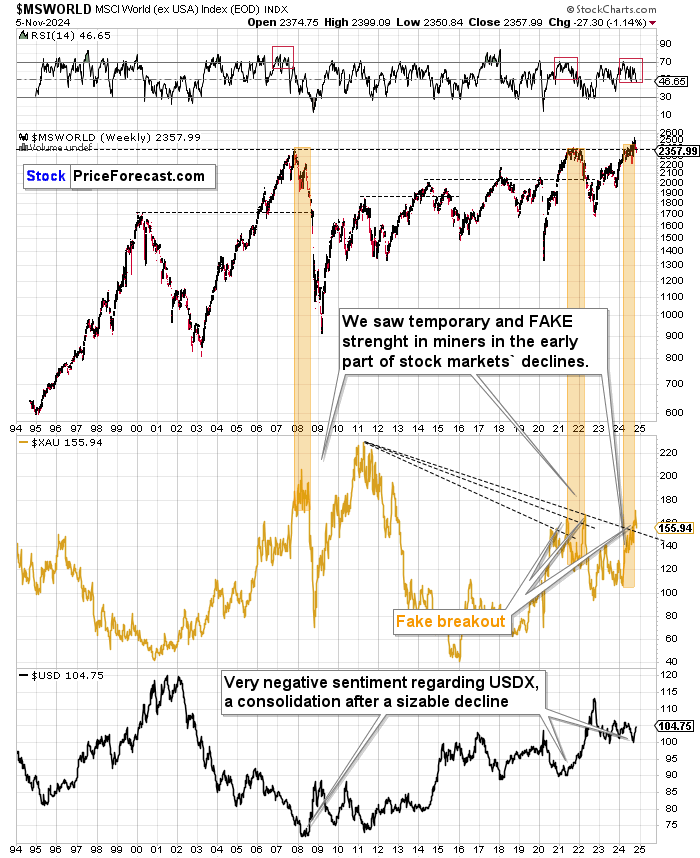

Now, as I wrote yesterday, the situation would become particularly bearish for mining stocks if the stock market also declined. In particular, seeing world stocks (not just U.S. stocks) collapse would be likely to trigger significant declines in the miners.

That’s what happened in 2008 and in 2022 – the declines in world stocks and mining stocks were really significant. The XAU Index (proxy for gold and silver mining stocks) in the middle of the above chart shows just how tiny the recent decline was compared to what we saw in 2022 and – more importantly – 2008. If you can’t see the current decline there, rest assured it’s there; it’s just so tiny that it’s barely visible.

Interestingly, both: 2008 and 2022 declines in world stocks were accompanied by big rallies in the USD Index… So, if one is underway, then world stocks can slide, taking miners with them.