Gold and tech stocks receive boost from weak PMI data

2023.08.24 05:57

- Global bond yields plummet after disappointing business surveys

- Gold and stocks capitalize, Nvidia (NASDAQ:) earnings add fuel to Nasdaq rally

- Major FX pairs swing violently, Japanese yen comes out on top

Soft PMIs highlight global slowdown

It was an electrifying trading session in financial markets, after a round of disappointing business surveys from the major economies cemented the notion that the days of central bank tightening are numbered. In a nutshell, global economic momentum is evaporating and Europe is at the forefront of this slowdown.

New business orders declined on both sides of the Atlantic, but fell particularly hard in Europe, foreshadowing a similarly poor performance for economic growth moving forward as this is considered a top-tier leading indicator. The surveys are consistent with the Eurozone and UK economies both shrinking 0.2% this quarter.

Adding credence to these concerns was a weaker profile for labor markets, with the PMIs warning that business hiring almost stagnated in August. Meanwhile, inflationary pressures remained elevated mostly thanks to rising energy prices, complicating matters further for central banks.

With the risk of a European recession back on the radar and signs the US is also losing steam, investors concluded that the era of high interest rates won’t last very long, sending bond yields sharply lower across the globe.

Gold and equities shine

When yields on bonds slide, other assets automatically become more attractive as the opportunity cost of holding them declines. If the risk-free return an investor can earn on bonds decreases, they are more likely to take on more risk in other assets. This dynamic is essentially a gravitational force – the lower yields fall, the easier it becomes for everything else to rally, and vice versa.

That’s why stock markets rallied so hard yesterday despite the worrisome data. Bad economic news is often good news for equities, as it feeds expectations of lower interest rates in the future. Of course, this is a short-sighted approach because slower economic growth also impacts corporate profits over time.

Gold was one of the main beneficiaries of the breakdown in real yields and the ensuing retreat in the dollar. The precious metal, which does not pay any yield and is denominated in US dollars, pierced above a short-term downward sloping channel and its 200-day moving average, helping to turn the outlook more neutral. Chairman Powell’s flagship speech tomorrow at the Jackson Hole symposium will likely be the deciding factor for whether gold can extend this recovery.

FX market in limbo, Nvidia smashes estimates

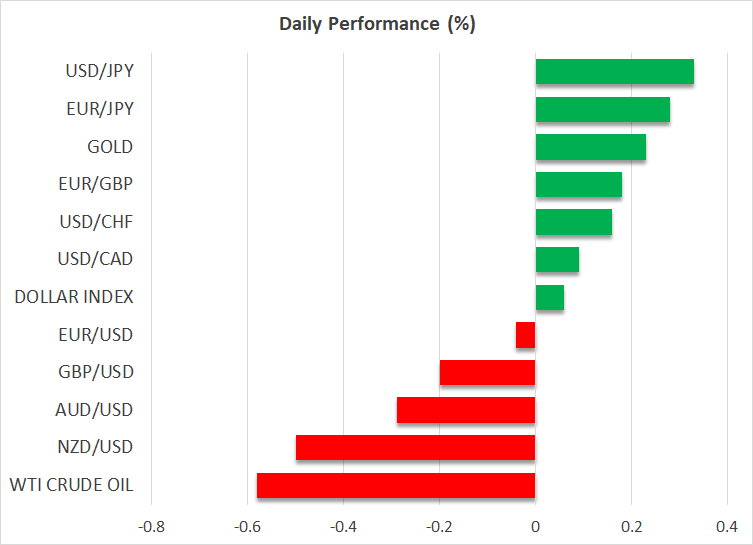

In the currency market, the signs of deteriorating global growth generated volatility but left most major pairs searching for direction. Euro/dollar traded like a pinball machine, falling sharply with the European PMIs before recovering to close higher overall after the disappointing US data and the improvement in the risk tone. Cable followed a similar trajectory.

The main winners were the Japanese yen, which mechanically becomes more attractive as foreign yields fall, and risk-linked currencies such as the Australian and New Zealand dollars. Even so, these moves were not very dramatic and have already started to reverse early on Thursday.

Finally, the supreme emperor of AI stocks, Nvidia, gained another 8% in after-hours trading to hit a new record high after it reported earnings that smashed analyst expectations. It was a massive beat on all fronts – revenue, earnings, margins, and guidance – with the cherry on the cake being an announcement of share buybacks. This has propelled the entire stock market higher today, with the tech-heavy Nasdaq set to lead the charge according to futures.