Gold and Silver Holding Up Well Despite Tightening Financial Conditions

2023.10.24 03:17

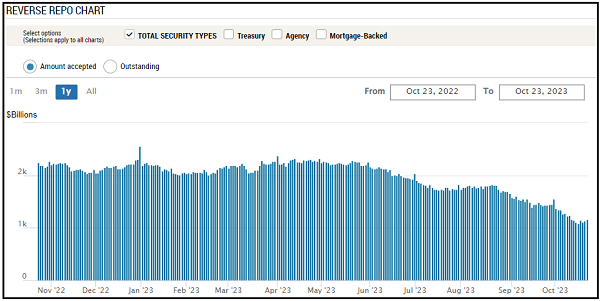

The Fed’s reverse repo facility has declined 51% since March 31st, which is when the RRP facility started drawing down quickly. Without having access to the Fed’s inside books, my bet is that the drawdown in the facility is a result of money market funds redirecting cash from the RRP facility into Treasury Bills. In early April the rate on the three-month T-Bill began to quickly rise above the RRP rate, which would have incentivized MMFs, which are a large percentage of the RRP facility, to reallocate cash from the Fed’s overnight facility to slightly longer duration, higher-yielding Treasuries. For MMFs, gaining 20 basis points of yield is like winning the lottery.

Reverse Repo Chart

This is how the Treasury was able to fund the massive issuance of T-Bills used to finance the rapidly growing spending deficit after the debt ceiling was removed. But what happens when the RRP facility is largely drained? What entities will emerge to fund the coming flood of new Treasury issuance given that the U.S.’ largest financiers – the Central Banks of China, Japan, and OPEC – have been selling down their Treasuries as a means of reducing their reserves? I believe the precious metals sector is holding up well in the face of rising interest rates and tightening financial conditions because it is starting to “smell” that the Fed will likely have to reverse QT and restart QE. While this will be highly inflationary, if the Fed refrains from intervening in the interest rate market, rates will continue climbing relentlessly higher.

In my latest Arcadia Economics podcast, I lay out my thesis and explain why I think the precious metals sector is on the cusp of a big move higher: