Gold Above $2400 as DXY Dips Amid Geopolitical Tensions, US Election Uncertainity

2024.07.22 09:12

- Increased geopolitical tensions in the Middle East and US election uncertainty have caused a rise in safe-haven demand, particularly for Gold.

- The US Dollar has weakened due to concerns about a potential Kamala Harris presidency and its implications on the economy.

- Market sentiment is expected to be driven by US election developments and geopolitical issues in the first half of the week.

The week kicked off with heightened market activity due to escalating tensions in the Middle East and a surprising announcement from US President Joe Biden on Sunday evening that he will not seek re-election.

Geopolitical concerns surged as the Israeli military launched retaliatory strikes on the port of Hodeidah in Yemen and other targets, prompting threats of new military action from the Houthis against Israel. This escalation raises the risk of a broader conflict in the Middle East, with comments from Russia and Iran further fueling concerns.

Adding to the uncertainty, President Biden unexpectedly announced that he would complete his current term but not run for re-election. This development introduces a new layer of intrigue and uncertainty, which markets typically find unsettling. Following Biden’s announcement, many Democrats quickly rallied behind Vice President Kamala Harris.

The weakened slightly as markets began to consider the implications of a potential Harris presidency on the economy.

Safe Haven Bids

Markets opened with a strong demand for safe havens, pushing higher in Asian trade, while the and also saw gains.

Throughout most of the year, the US Dollar has benefited from safe-haven flows, but not this time. The current fear stems partly from the prospect of a Kamala Harris and Democratic victory, which could theoretically weaken the US Dollar in the long term due to potential tax increases and lower borrowing costs. This concern likely explains the diminished safe-haven appeal of the US Dollar at the moment.

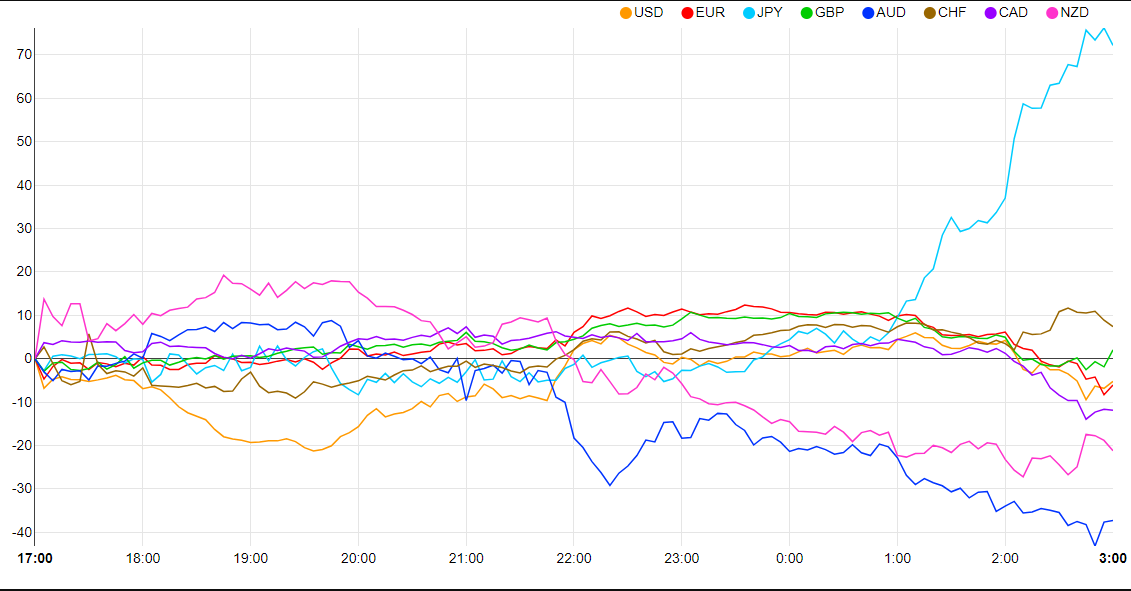

As you can see from the currency strength chart below, JPY and CHF are leading the way this morning.

Currency Strength Chart

Source:FinancialJuice

Looking ahead, there is a slew of important economic data on the horizon. However, for now, I expect that US election developments and geopolitical issues will primarily drive market sentiment in the first half of this week.

Unless there are significant escalations or unexpected changes, we may remain in a risk-off mode until Wednesday when key US economic data starts to come in.

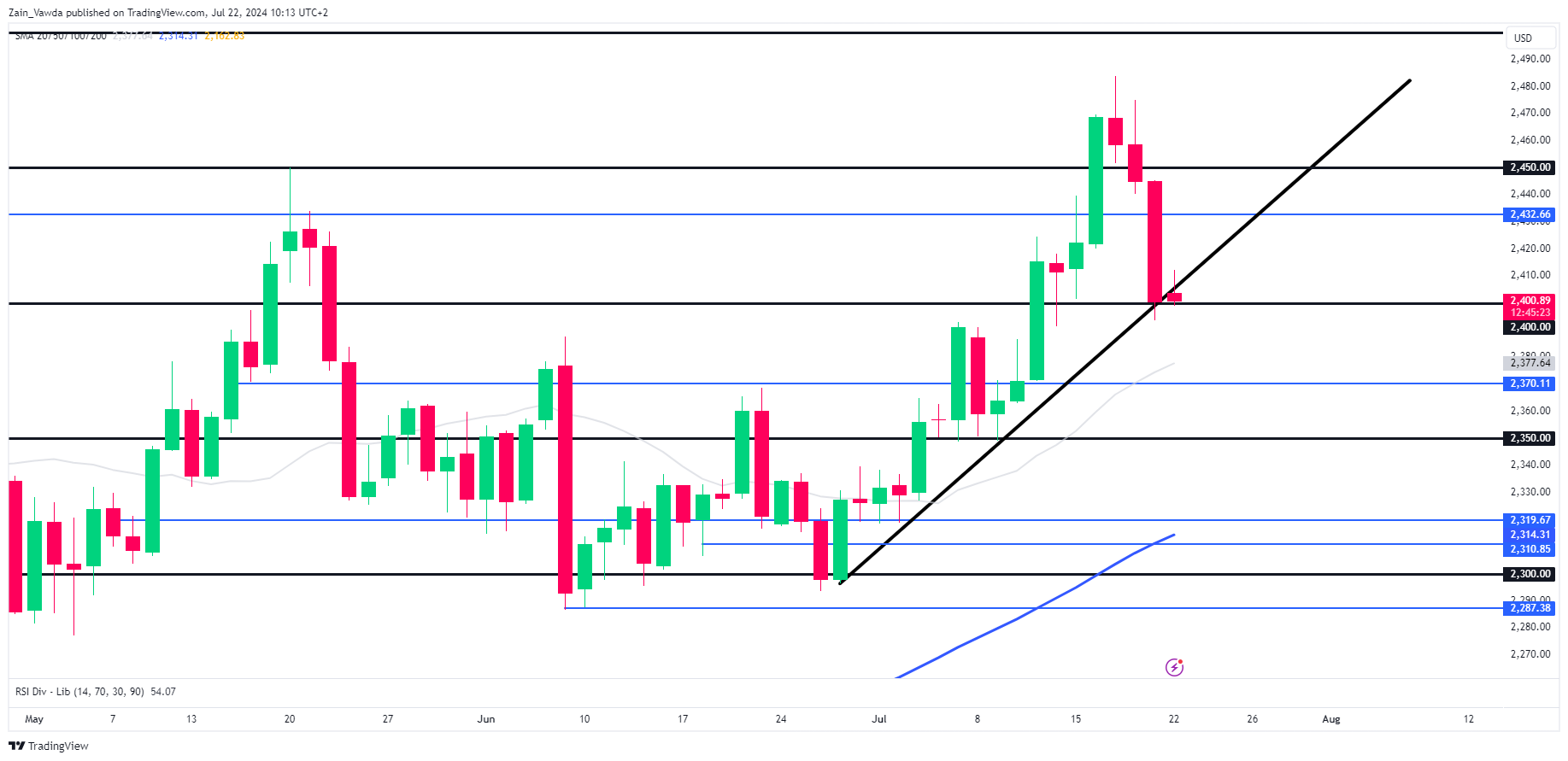

Technical Analysis on XAU/USD

Spot Gold (XAU/USD) experienced significant selling pressure on Thursday and Friday but managed to cling to the crucial $2400/oz psychological level. With risk-off sentiment on the rise, further gains could be in store for the precious metal, especially if it continues to hold above the $2400/oz mark.

A weaker US Dollar at the start of the week may also help Gold stage an early recovery. Any signs of escalating tensions or increased uncertainty around the US elections are worth monitoring, as they could further impact Gold prices.

On the weekly timeframe, Gold printed a massive shooting star rejection candle, suggesting potential downside ahead. Moving to the daily chart, Gold prices are eyeing a break of the ascending trendline, which could lead to a retest of the 20-day moving average, currently at 2377.

Overall, the technical and fundamental outlooks are at odds as the week begins. The key question for many this week is which side will dominate and drive price action moving forward.

Support

- 2400 (psychological level)

- 2392

- 2377 (20-day MA)

Resistance

XAU/USD Daily Chart, July 22, 2024

Original Post