Gold: A Super Surge to $2200 Is Next

2023.11.14 14:51

A week ago, Morgan Stanley analysts called stocks a buy, while I called for a week of pain.

Vaneck Vectors Gold Miners ETF

Vaneck Vectors Gold Miners ETF

The GDX (NYSE:) chart. Clearly, it was pain that prevailed, but could these analysts be correct going forward from here?

The $30 neckline of the inverse H&S bottom is strong resistance. It coincides with gold $2000 and that’s a big number. Significant news is clearly needed to get the price higher.

UBS analysts see much worse economic news in 2024, and a “raft” of rate cuts from the Fed to deal with it.

Would the Fed cut rates with oil at $120? If it did, that could create a tidal wave of institutional money into gold and stocks.

If goes to $120 and the Fed doesn’t cut, or hikes to keep the inflation fight as priority number one, the stock market would incinerate…

And the bond market likely would too.

Clearly, India’s 1.4billion “titans of ton” citizens have lots of gold, and are storming the stores for more!

Some heavyweight jewellers there are predicting that once this tiny pullback ends, there will be a gold bullion “super surge” to $2200 by January or February 2024.

Gold bugs on the fear trade side of the pond are generally focused on miners, and the super surge would obviously be very good news.

Last November saw the Chinese stock market begin a massive rally, along with gold.

Can the action repeat again this year? I’ll dare to suggest that we’re just days away from it happening, and today’s US CPI (inflation) report could be the catalyst that launches the rally.

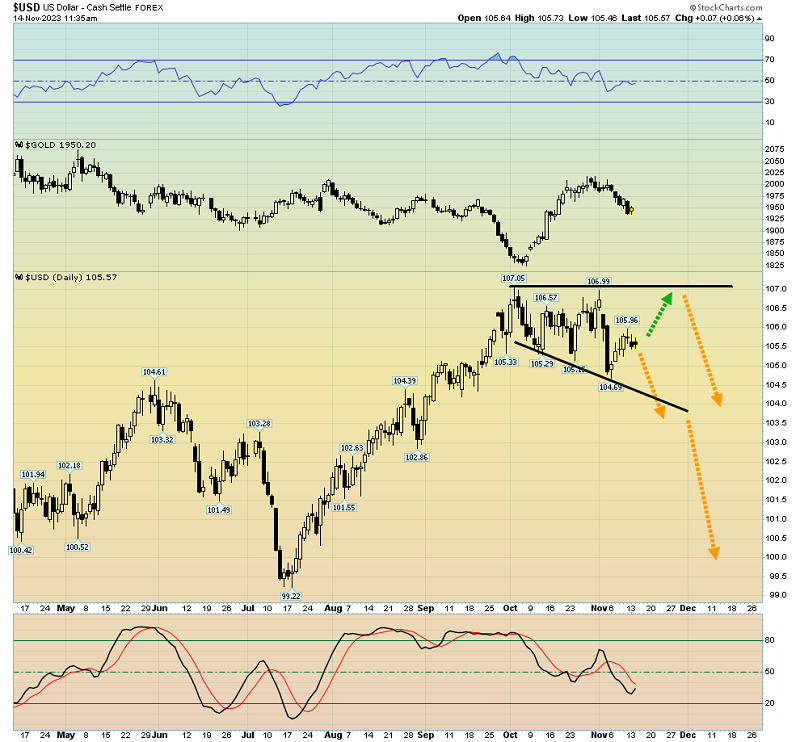

The dollar has a broadening top pattern in bearish play. The death knell likely comes on Dec 13. That’s the final Fed meeting of the year. 10 Year US Treasury Yield Index

10 Year US Treasury Yield Index

The 5% zone is a huge resistance for US interest rates.

Significant H&S top action is also in play. A right shoulder rally for rates and a final dip to my $1900 buy zone for gold would be just what the doctor ordered for gold bugs of the world

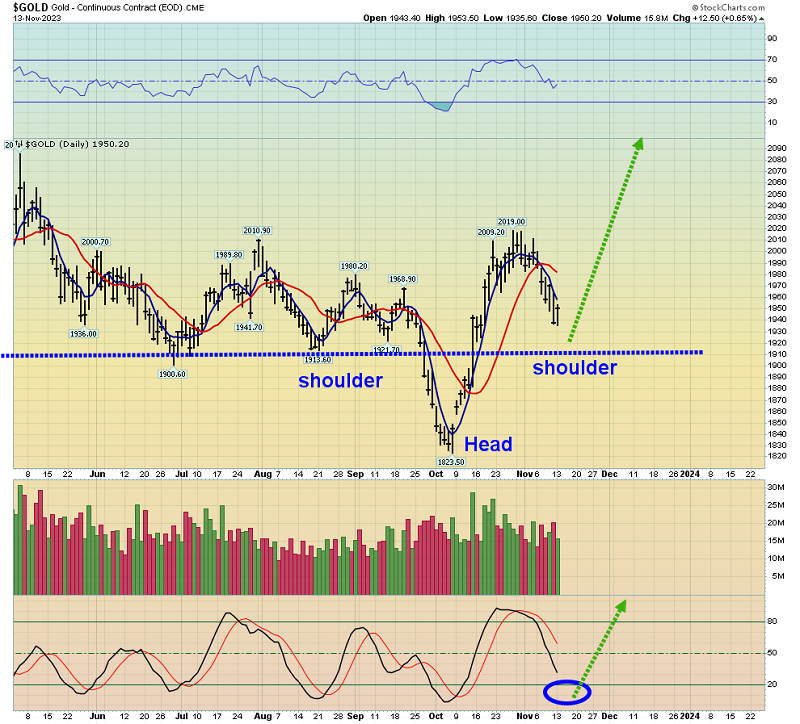

The fabulous daily gold chart. In reference to the huge inverse H&S pattern in play: Whether the final right shoulder low is today or later this week really doesn’t matter.

What matters is that a rally even more shocking than the Gaza war rally is likely the next big move for gold.

Vaneck Vectors Gold Miners ETF

Vaneck Vectors Gold Miners ETF

The key daily GDX chart. While it can be argued that the H&S pattern is failing, it’s still a very bullish technical “blob”. The bottom line for charts:

Not all gold stock rallies begin from textbook chart patterns. Many are launched from zones that feature very rough but bullish technical action.

Investors need to prepare for a surprise. Surprise has been the theme thus far for the 2021-2025 war cycle like it was for the 1919-2021 virus cycle.

There’s been a shocking war involving Ukraine and Russia (and US government debt-funded meddlers), and now there’s an even more shocking one involving Israel and Gaza.

The 2021-2025 war cycle still has 25 months to go. Will the next phase of the cycle be as shocking as the first two? That’s unknown, but the next few days likely represent the final chance to get gold in the $1900 zone and GDX sub $30. There’s a buying mania occurring in India, dare I suggest there needs to be one for the gold bugs of the West too? I think I do.