Gold: A Cyclical Low Is Here

2024.12.17 12:51

While the price is in the short-term doldrums (after a massive rally over the past year), the world’s most savvy gold bugs are buying maniacally.

A look at their action. The dip from $2790 to $2550 was bought with record aggression by India’s citizens, aka “The Titans of Ton”.

The Chinese PBOC also moved back into the market, and that will restore confidence amongst Chinese players who had moved to the sidelines when the PBOC went quiet.

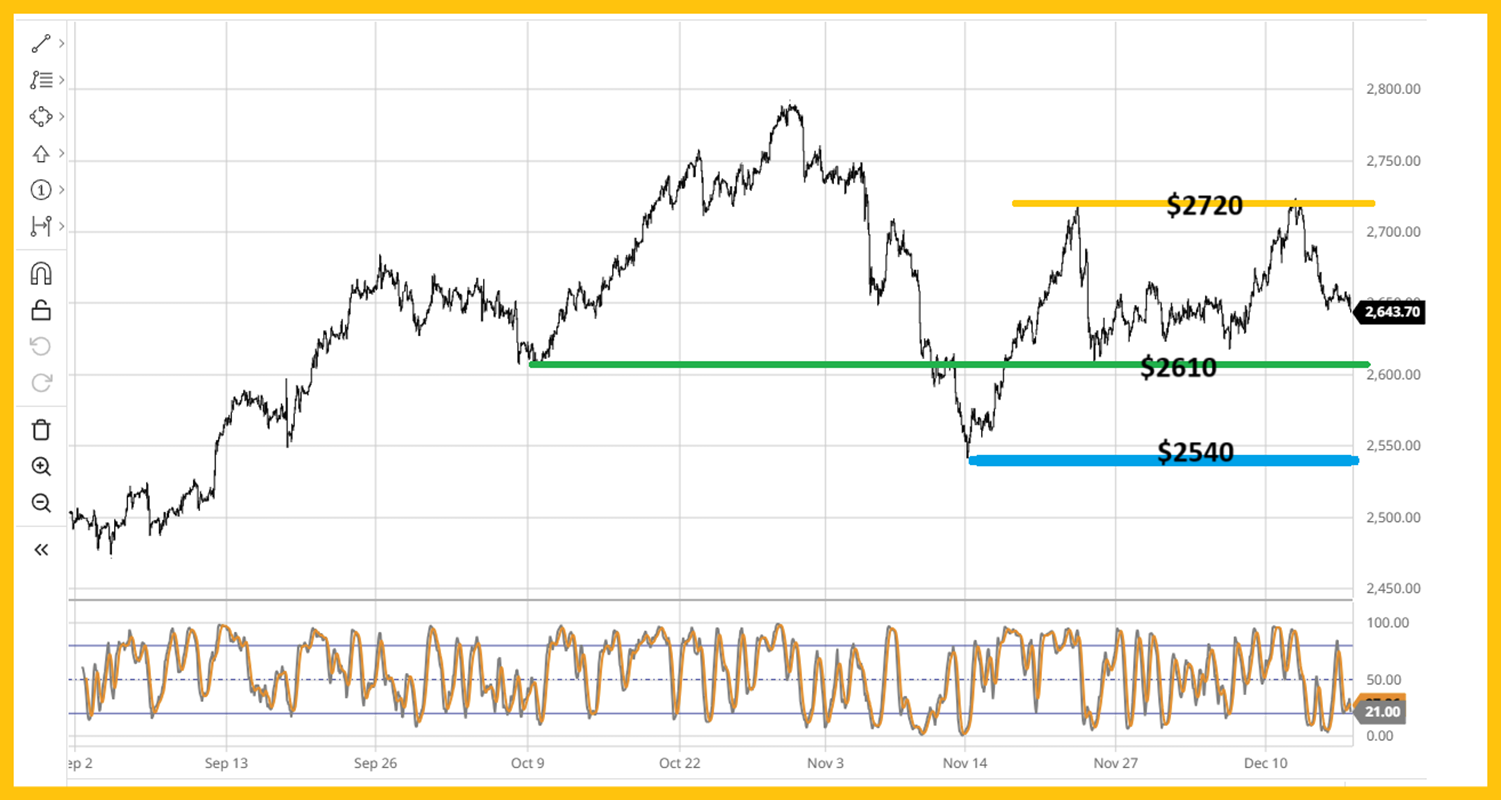

Tactics? Several key support zones are evident on the chart…

But not all support zones are zones for all investors to buy.

Each investor is different. Some are leveraged gamblers. Others are incredibly conservative. Buying gold isn’t just about predicting the next move. It’s also about ensuring each buy fits the investor’s personal style.

For example, the $2610 zone is a support zone, and a dip into it from the recent $2720 high is a rough $100+/oz price sale, but some investors may prefer to focus on a breakout above $2720 for their buys, while others may want a bigger dip down to $2540 before they buy.

What can be said is that $2720, $2610, and $2540 should be the immediate zones for focus… for all gold market investors.

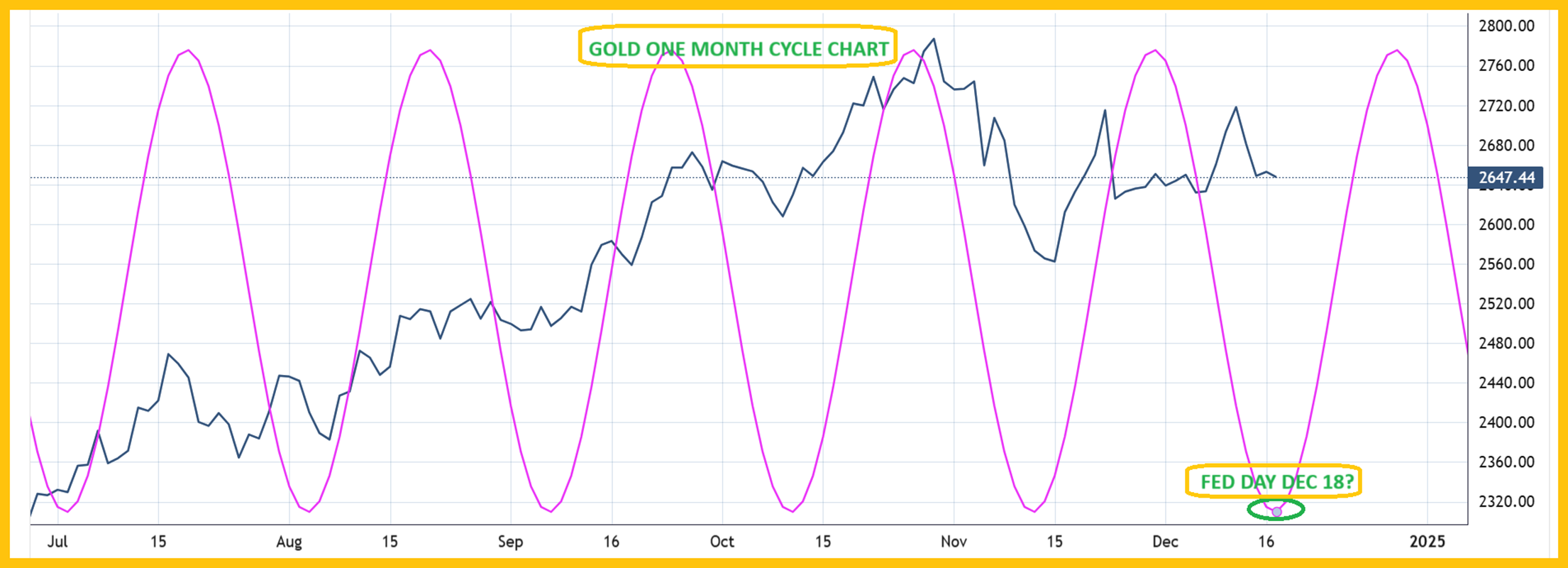

The one-month cycle chart for gold. It suggests a rally is imminent, and it could begin as early as tomorrow… which is also when the Fed makes its next interest rate policy decision.

The important PCE inflation report is scheduled for Friday. On an ongoing basis, the Fed meets and the PCE are significant events for the Western fear trade for gold.

In time, the entire Western fear trade, including its concerning “Gold pays no interest so sell it if the Fed raises rates!” mantra, will be overwhelmed by the much larger “ultimate trade” in China and India.

There, investors buy gold to celebrate good economic news as well as to protect against anything bad.

Regardless, the complete change of the gold price discovery guard appears to be a decade or two away. For now, investors should be open to a possible gold price rally of significance starting some time between “Fed Day” and “PCE Day”.

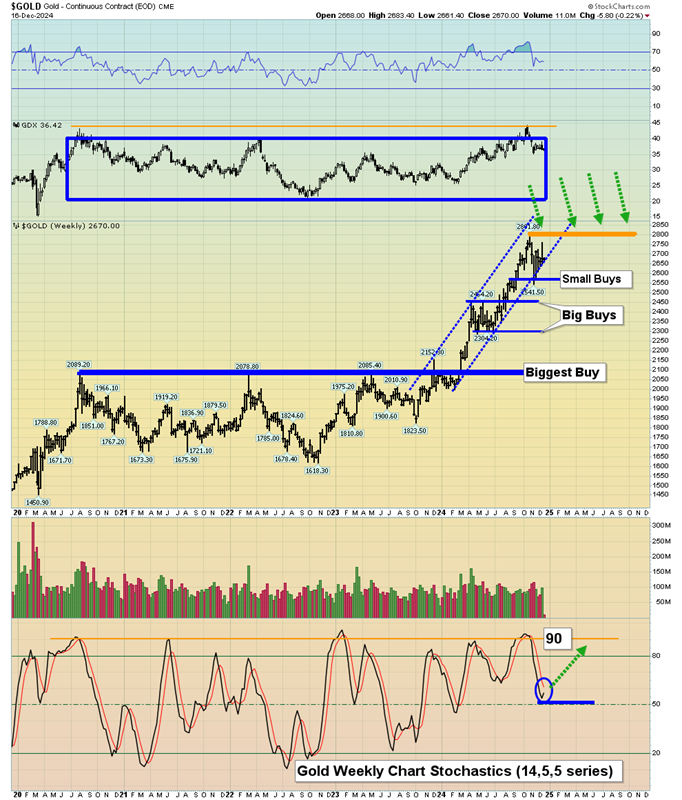

A look at some exciting weekly chart action. Note the action of the Stochastics oscillator at the bottom of the chart. I recently urged gold market investors to be on the alert for a reversal around the momentum zone of 50, and that reversal is coming into play now.

Note the sharpness of the turn. It’s very bullish.

Next (LON:), the weekly GDX (NYSE:) chart. For both gold and the miners, the 14,5,5 series for weekly chart Stochastics is more effective than the standard 14,3,3.

It tends to bottom closer to a turn, and a lot of feeble moves are filtered out. It often bottoms around the 50 zone for gold and the 20 zone for GDX… and that’s where it is right now.

The have broken down. Will the Industrials follow?

That’s unknown, but the US stock market is incredibly overvalued, and it could begin to fall just as the US government unleashes a tidal wave of inflationary tariff taxes.

In recent decades, the Fed has a history of trying to support the stock market at the expense of “boots on the ground” Main Street inflation… which is very good news for gold.

Given the important US events this week (Fed and PCE), a low on the gold cycle chart, powerful Chindian demand, and fantastic weekly chart Stochastics positioning for both gold and GDX…

Aggressive investors should consider doing some buys around the key $2610 support zone for gold.

All investors should be waving cheerleading flags for core positions. The weight of the current technical, fundamental, and cyclical evidence suggests they will be waving these flags for a winning gold, silver, and mining stocks team!