Global Markets Stage Broad Rebound In Last Week’s Trading

2022.10.24 09:26

[ad_1]

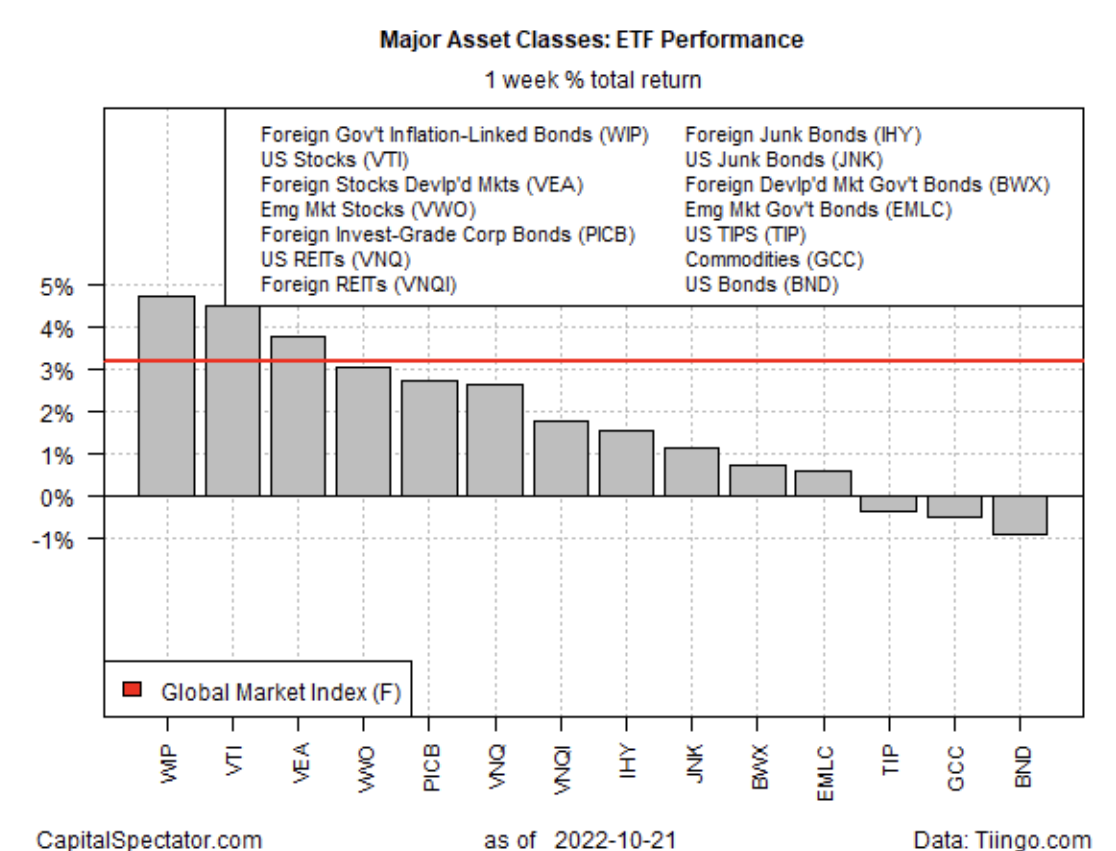

Offering a reprieve from bear-market conditions that have pummeled markets for much of 2022, traders bid up prices for most of the major asset classes for the week through Friday, Oct. 21, based on a set of ETFs.

Inflation-indexed government bonds ex-US led the rally. The SPDR FTSE International Government Inflation-Protected Bond ETF (NYSE:) rose 1.6% in last week’s trading. The gain marks the first weekly increase in the past three, although the fund’s strong downside bias remains intact.

Investors are wondering if higher prices for markets generally last week are a sign that the selling has been exhausted. In research note to clients, David Donabedian, chief investment officer of CIBC Private Wealth US, wrote:

“The equities market is trying to form a bottom to get to the last leg of the bear market. It feels like a two-way market right now. We have a tug of war going on between the skeptics and those who think it is time to own equities.”

The only losers for the major asset classes last week: a broad measure of commodities, WisdomTree Continuous Commodity Index Fund (NYSE:), and US bonds. Vanguard Total Bond Market Index Fund, Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:), lost 0.8%, the tenth straight weekly loss for the ETF.

Some analysts are asking if the dramatic rout in the bond market this year has gone too far too fast, providing the basis for seeing fixed income as a buy at this point. But BoFA strategists are skeptical: “With inflation so high and still rising, it would be a mistake to assume that central banks will pivot to easing if something indeed breaks,” they write. “Depending on where they are in their tightening cycle, they may not even pause.”

The broad rally in markets lifted the Global Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies overall. GMI.F posted a strong 3.2% increase last week (red line in chart below).

Major Asset Classes 1-Week ETF Performance

Major Asset Classes 1-Week ETF Performance

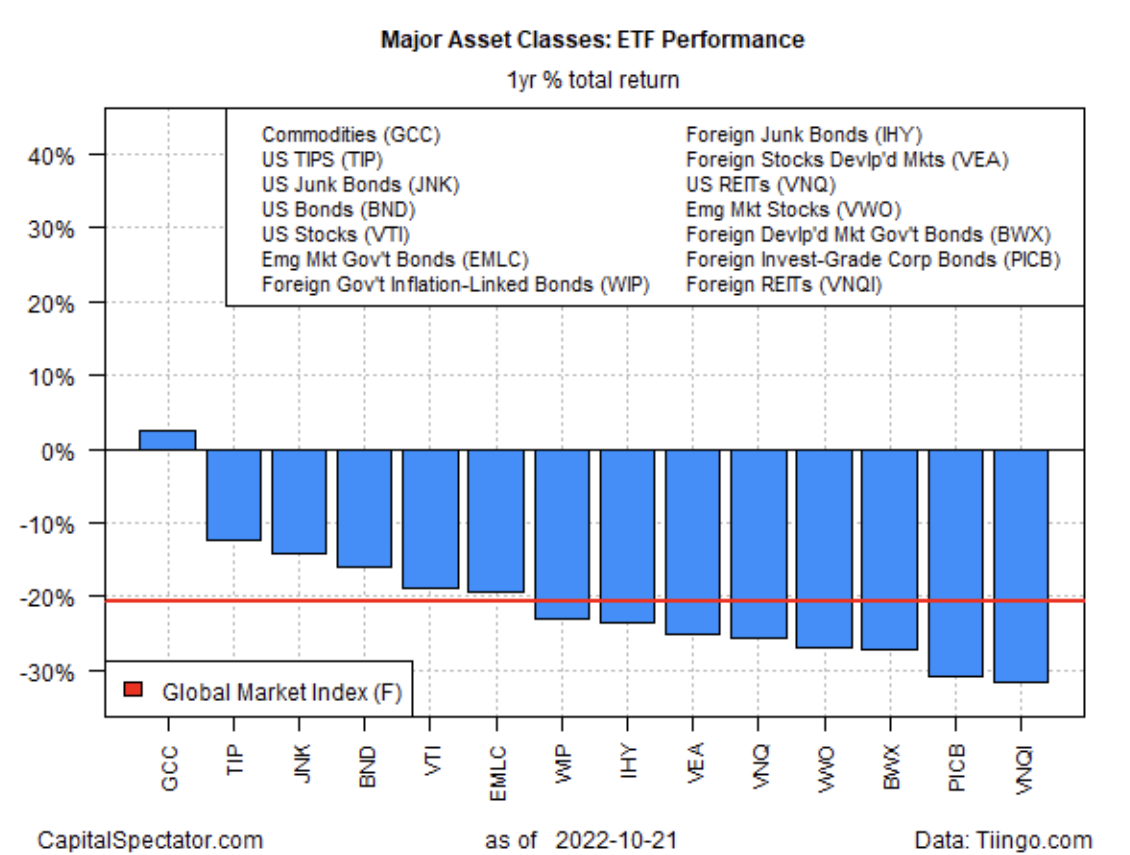

For the one-year window, commodities (GCC) are holding on to the only gain for the major asset classes. GCC is up a modest 2.5% over the past year, in sharp contrast with losses for the rest of the field.

GMI.F is down 20.7% for the past year.

Major Asset Classes 1-Year ETF Performance

Major Asset Classes 1-Year ETF Performance

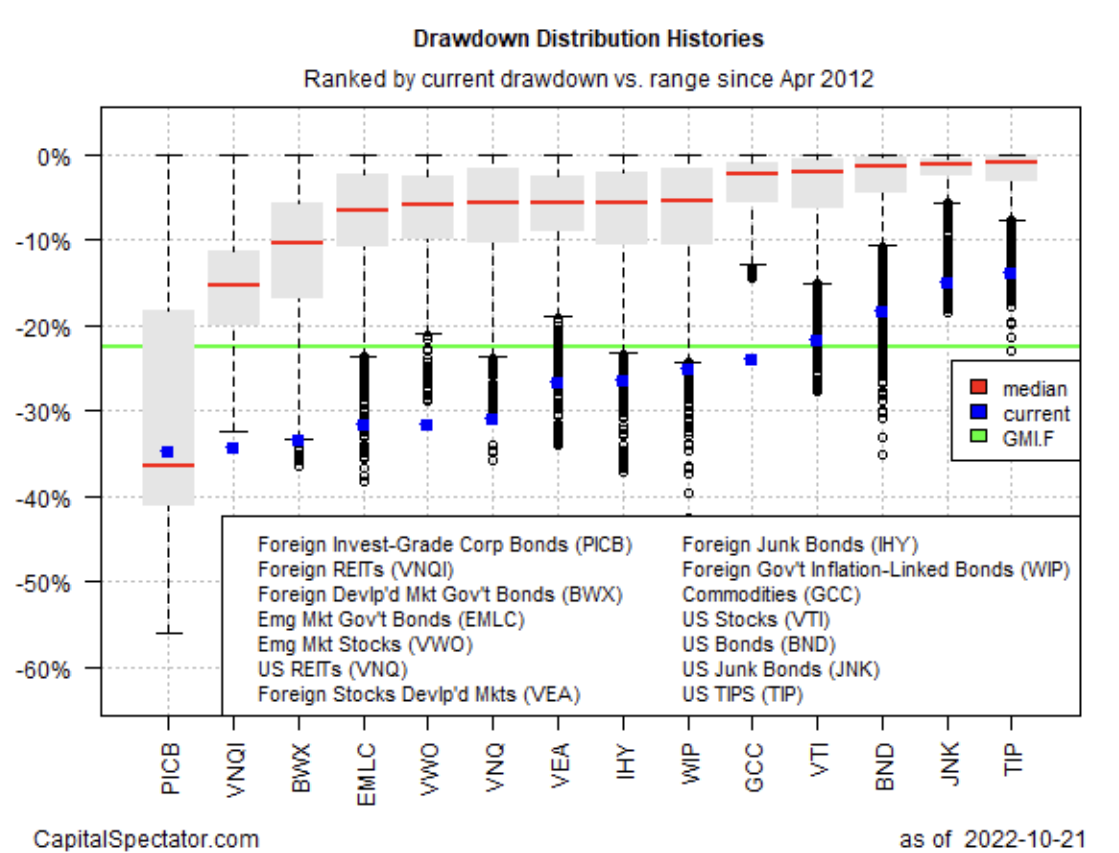

Reviewing the major asset classes through a drawdown lens continues to show steep declines from previous peaks. The softest drawdown at the moment: inflation-indexed Treasuries, iShares TIPS Bond ETF (NYSE:), with a 14% slide. At the other extreme: foreign corporate bonds, Invesco International Corporate Bond ETF (NYSE:), are nursing a roughly 35% decline from the previous peak.

GMI.F’s drawdown: -22.6% (green line in chart below).

Drawdown Distribution Histories

Drawdown Distribution Histories

[ad_2]

Source link