Global Markets Extend 2023 Rally for Second Week

2023.01.16 11:52

[ad_1]

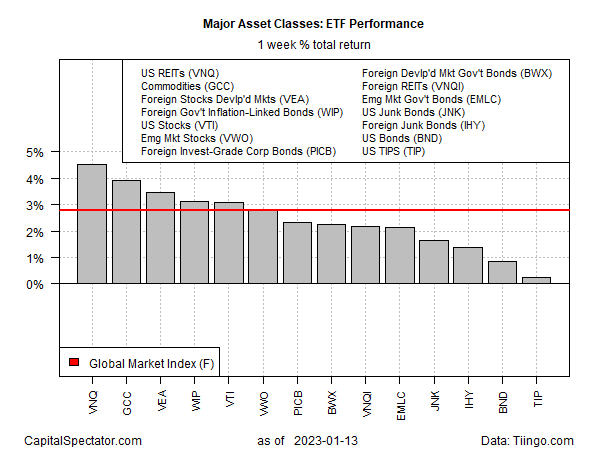

All the major asset classes scored gains last week, delivering more relief from widespread losses in 2022, based on a set of ETF proxies through Friday’s close.

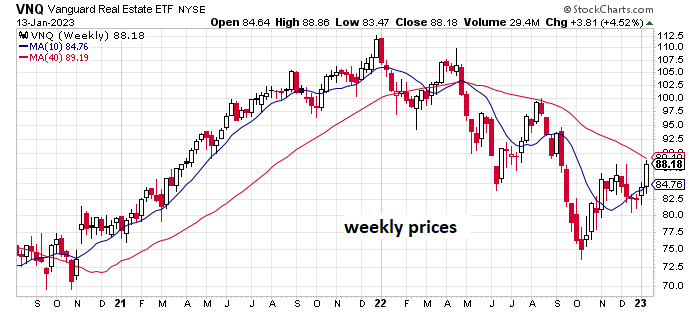

US real estate investment trusts led with a strong 4.5% increase. Last week’s rally in Vanguard Real Estate Index Fund ETF Shares (NYSE:) left the fund near its highest close since September.

The rest of the field also posted gains, leaving no major slice of global markets untouched by the buying wave. But a new potential market headwind came into focus on Friday when Treasury Secretary Janet Yellen advised that the US would reach its debt limit within days.

She said,

“Failure to meet the government’s obligations would cause irreparable harm to the US economy, the livelihoods of all Americans, and global financial stability. I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Partisan politics in Washington raise doubts about how quickly a solution can be crafted. Until there’s a resolution, a new macro risk hangs over markets and the economy. Mark Zandi, the chief economist at Moody’s, warned,

“The Treasury debt limit is suddenly a serious threat to optimism we can avoid recession this year. Unless lawmakers increase, suspend, or eliminate the limit, Treasury won’t have the cash to pay all its bills on time later this year. Financial markets and the economy will crater.”

Meanwhile, the Global Market Index (GMI.F), an unmanaged benchmark maintained by CapitalSpectator.com, continued to recover last week, gaining 2.8%. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

Major Asset Classes: ETF Performance Weekly Returns

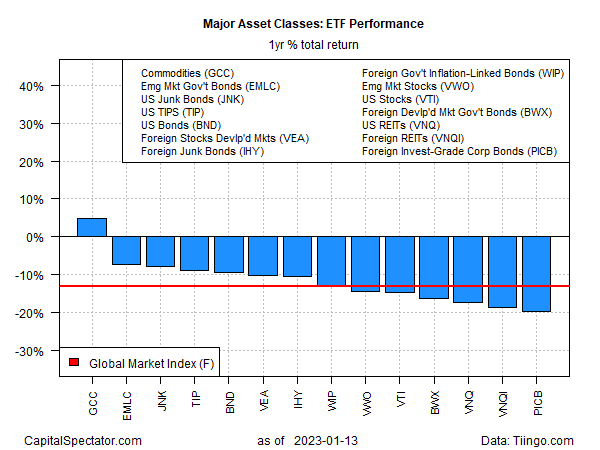

Despite year-to-date rallies, most major asset classes continue to suffer losses for the trailing one-year window. WisdomTree Continuous Commodity Index Fund (NYSE:) is the outlier, posting a modest 4.7% gain at Friday’s close vs. its year-ago price. GMI.F’s one-year performance remains negative at -13. 3%.

Major Asset Classes: ETF Performance 1-Year Returns

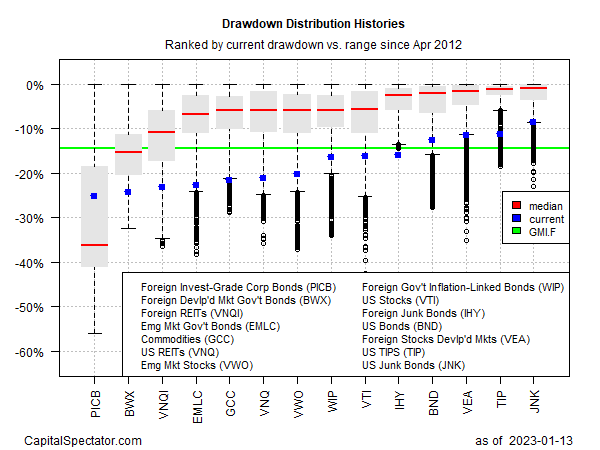

Comparing the major asset classes through a drawdown lens shows relatively steep declines from previous peaks for most markets worldwide. The softest drawdown at the end of last week: High Yield Bond ETF (NYSE:) with an 8.6% slide from its last peak.

GMI.F’s drawdown: -14.4% (green line in the chart below).

Drawdown Distribution Histories

[ad_2]