Global Markets Bounce Back, Posting First Weekly Gain in a Month

2023.08.28 08:51

After three straight weekly declines, the Global Market Index (GMI) rebounded for the trading week through Friday, Aug. 25. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs. It represents a competitive measure for multi-asset-class portfolio strategies.

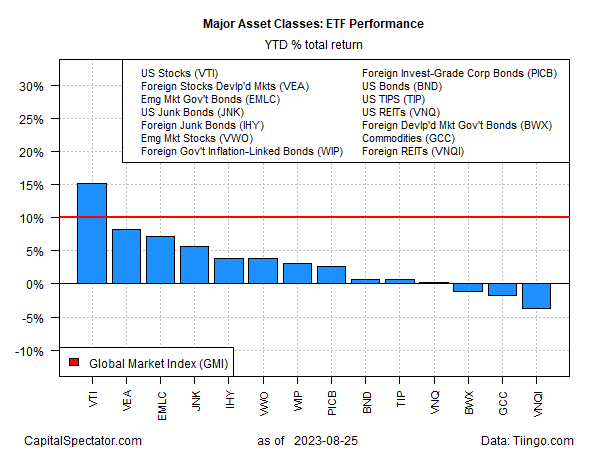

Last week’s gain kept most markets firmly in the winner’s column for year-to-date results. US stocks (NYSE:) remain the clear leader with a 15.2% gain. US bonds (NASDAQ:), on the other hand, are struggling to hold on to a weak 0.7% advance in 2023.

Major Asset Classes YTD Total Return

Despite last week’s gains for most markets, investors will likely tread cautiously in the weeks ahead following Federal Reserve Chairman Jerome Powell’s comments on Friday, when he advised that inflation “remains too high” while the world’s central bankers are debating if more rate hikes are needed to tame inflation.

Economic updates later this week will help shape market sentiment on these questions after the US government releases numbers inflation figures for July (Thurs., Aug. 31) and payroll data for August (Fri., Sep. 1).

“We expect the [payrolls] report to show a moderating trend for job growth, with [recent labor] strikes also working to push the headline jobs figure lower,” writes JPMorgan’s chief US economist in a note sent to clients on Friday.

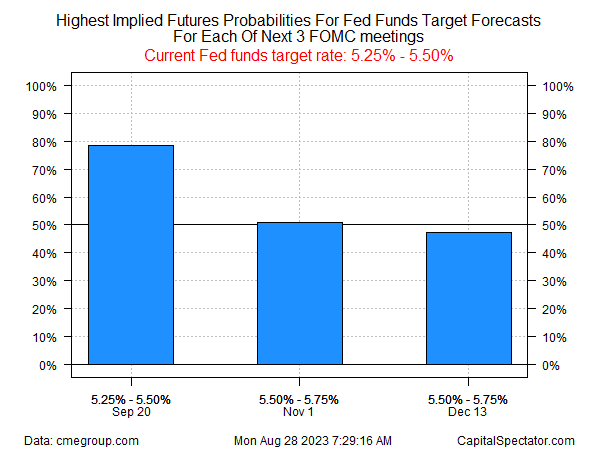

Meanwhile, Fed funds futures this morning are still pricing in moderately high odds that the central bank will leave its current target rate unchanged at 5.25%-5.50% at the next FOMC meeting on Sep. 20. But the current 79% implied probability for no change marks a moderate slide from recent history.

Fed Fund Target Forecasts

The market is also flirting with the possibility of a rate hike in November. For the first time, Fed funds futures are pricing in a slight bias in favor of a 25-basis-points increase for the Nov. 1 policy meeting.

Keep your eye on Thursday’s PCE inflation update as a possible catalyst for changing this outlook.