German CPI and UK’s Wage Growth Data Fail to Impress; Gold Prices Face a Tug War

2024.09.10 11:33

European and US stock futures are trading mixed, while investors are paying close attention to economic numbers from China and Europe. Over in Europe, we saw the number matching the forecast of -0.1%, which is positive news for the biggest economy in the Eurozone because it confirms the fact that there is less resistance for the ECB to cut interest rates further if it wants to. In the UK, the recent release has presented a mixed picture. For example, the failed to impress investors because the actual reading came in at 4.0%, whereas the expectations were for 4.1%.

From the perspective of the markets, this data can be interpreted in two ways: firstly, it indicates that the average earnings index is not trending upward, indicating that inflation is likely to remain stable. This implies that the Bank of England will face fewer concerns. Secondly, the lack of improvement in wage growth indicates that consumers’ disposable income will continue to be constrained, which is not a positive sign as it may hinder their ability to spend.

Overall, the UK’s economic data has sent a mixed message to the markets, suggesting that we may witness challenging price action. However, traders’ interpretation of this news is crucial, as negative news can potentially turn into positive news. Conversely, negative news can remain negative, potentially leading to a sell-off in the .

In the US, traders have now fully digested the message from the , and their attention is now focused on the Fed and their perspective on the recent US jobs data. In this context, the upcoming speeches from FOMC members Barr and Bowman are highly important. Traders will be influenced by their comments regarding the monetary policy of the Fed. It is highly likely that the will only raise interest rates by 25 basis points on September 18.

In terms of the US economic data, there is not much that is going to excite investors and traders today, but this doesn’t mean that the week is going to be dull. This is because the most important economic number for the Fed and markets will be delivered tomorrow, and it’s the number. Many investors do think that it is the US NFP data, which was the last important economic event, that would have impacted the Fed’s monetary policy decision.

However, smart money holds the belief that there is more to the story. This is due to the fact that the US CPI served as the primary catalyst for the Fed’s increase in interest rates, and it will continue to serve as the primary driver for any future interest rate reductions. Furthermore, the rate at which the interest rate is lowered will also depend on the extent to which the inflation reading declines. High-frequency traders, who very much live on volatility and utilise, trading VPS, will be closely watching this event to unfold to tomorrow. The forecast for the inflation reading is to fall to 2.6% from its previous reading of 2.9%. If the data matches the expectations, it would be a good sign for the markets.

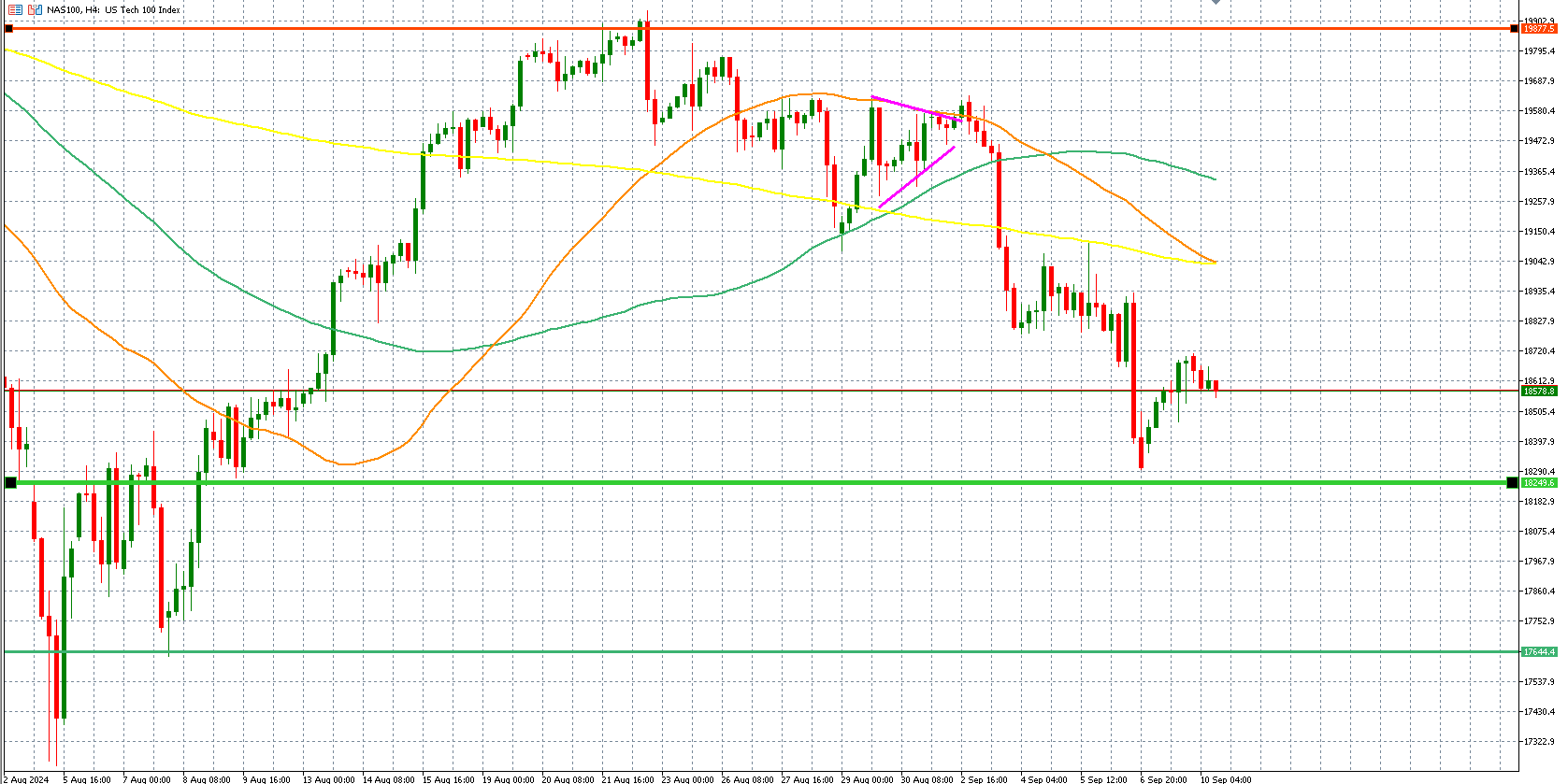

The below chart shows the price action for the and the important price level that traders will be very much watching today. The green horizontal line represents support and red horizontal line represents the resistance line.

Gold

The shining metal continues to trade higher if we look at the weekly time frame, although the price action for today looks a bit weak as traders are waiting for a new catalyst that can support the upward price action. The tug war between the bulls and the bears remains tough, with a clear boundary of 2,500 defined between them. The strength for either side will come from the comments made by the FOMC members, particularly if they adopt a more dovish tone. The likelihood of this happening is relatively low, and the price has already factored in the possibility of a mere 25 basis point drop in the interest rate. If this becomes a reality on September 18, there is a chance that we may actually see a retracement in the price action.

Apple’s Product Line

Apple (NASDAQ:), as always, announced its major product line yesterday, and the reaction among traders has been very lackluster. The reason for this is the same as it has been before, namely that there was nothing new or immensely fascinating in their product, which made owners of iPhone 12 think that they should choose the new iPhone 16. Therefore, if the owners of the iPhone 12 are not persuaded to switch to the new iPhone 16, one can only imagine the feelings of the owners of the other models. We think the time has come for Apple to start thinking seriously about its product line.