Geopolitics and Trump’s Cabinet Selections Guide Market Sentiment

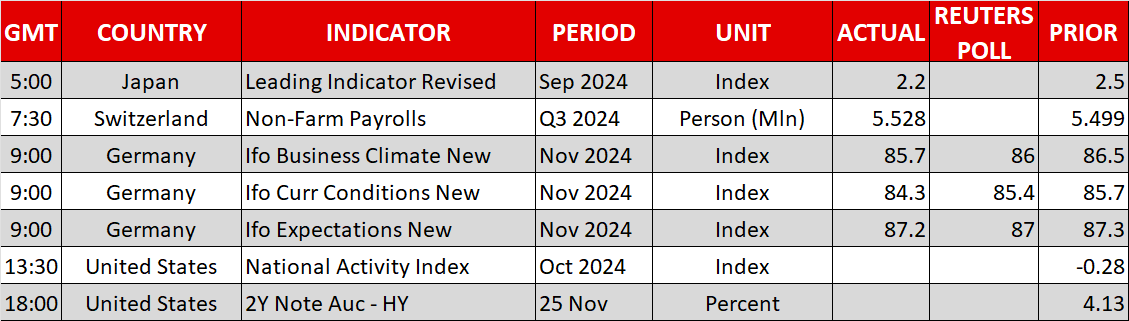

2024.11.25 08:42

- Possible ceasefire in Lebanon, gold dives.

- A shortened week in the US due to Thanksgiving celebrations.

- Trump’s Treasury Secretary nomination pleases equity markets.

Possible Ceasefire in Lebanon, Gold Takes Notice

Contrary to the continued escalation in the Ukraine-Russia conflict, the outgoing US administration under President Biden is reportedly making a last-minute effort to achieve a ceasefire in the Middle East. The latest information points to a preliminary agreement between Israel and Lebanon, but the deal is not yet sealed.

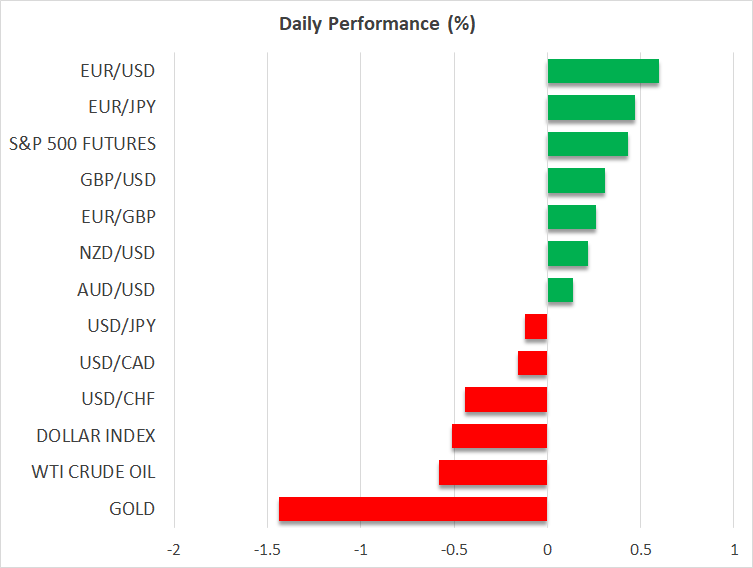

The markets have taken notice of the latest developments, with suffering the most and giving back a decent chunk of last week’s strong rally.

Sentiment remains fragile though, as another long-range missile launch from either Ukraine or Russia could quickly frighten investors and trigger a risk-off reaction.

A US Shortened Week Starts

Meanwhile, a holiday-shortened trading week in the US commences as Thanksgiving celebrations are taking place on Thursday. Equities’ futures are pointing to a positive start and the is on the back foot today. The main reason for these movements is probably President-elect Trump’s pick for the Treasury Secretary position.

Market-Positive Pick for the Treasury Secretary Role

Scott Bessent, a billionaire hedge fund manager, has been selected to run the US Treasury. While there is an arduous process to get the nomination approved by the Senate, equity indices are probably feeling a bit more confident about the economic outlook. Bessent’s nomination means that the proposed tax rate cuts may materialize with one eye on the markets, while his stance on tariffs appears to be less aggressive than the one Trump proposed in the pre-election campaigning. It is still early days, but Bessent’s candidacy is probably more market-friendly than originally anticipated.

Interestingly, while economic data tends to guide the actions, Trump’s reelection and the possibility of another trade war with China have alarmed Fed members. However, Bessent’s selection could translate into a less aggressive US stance against China, potentially unlocking further rate cuts by the Fed, especially if US data show a marked deterioration over the next two weeks.

Euro and Yen in the Green, Drops a Bit

The dollar’s underperformance has allowed certain currencies to take a breather. edged higher, but the outlook remains mostly bearish for the euro. Last Friday’s abysmal PMI surveys put the 50bps ECB rate cut on December 12 firmly on the table, with the market now focusing on Friday’s preliminary eurozone CPI report.

Similarly, the is posting small gains against the dollar, supported by the numerous verbal interventions from Japanese officials. More importantly, the market is becoming more confident that the BoJ may announce a rate cut in December. The market is currently pricing in 15bps of hikes on December 19, with Friday’s Tokyo CPI being the key variable in the BoJ’s decision-making process.

Finally, is trading lower on Monday after almost reaching the $100,000 threshold level. The king of cryptocurrencies is up 40% in November, and hence profit taking could linger in the short term, with the market looking for the next pro-crypto headline to retest the $100,000 level.