Generative AI Steals the Spotlight in H1 2023

2023.07.03 05:31

Global markets have remained relatively calm over the past week even as Fed Chair Jerome Powell reiterated a hawkish stance, signaling a possibility of additional rate hikes.

However, as we conclude the end of the first half of 2023, it is interesting to note that the has risen over 30% year-to-date, surpassing the gains of the and , which have surged by 14% and 2% respectively.

This outstanding performance by the Nasdaq can potentially be partly attributed to the hype surrounding generative AI, which has led to significant market value growth for companies involved in this sector, including names such as Nvidia (NASDAQ:), Microsoft (NASDAQ:), and Alphabet (NASDAQ:).

Everyone Got Into AI

Evidently, AI has become the new hot topic of Wall Street and Silicon Valley. Whether or not the current hype is 100% justified, it seems obvious that the new era of AI applications is here to stay and likely.

In light of these developments, Blackrock (NYSE:) is also betting big on this nascent niche and recently lauded AI-related stocks as potential drivers of returns, particularly amidst the challenging macro conditions.

Bitcoin’s Correlation with Tech Stocks Hits 3-Year Low

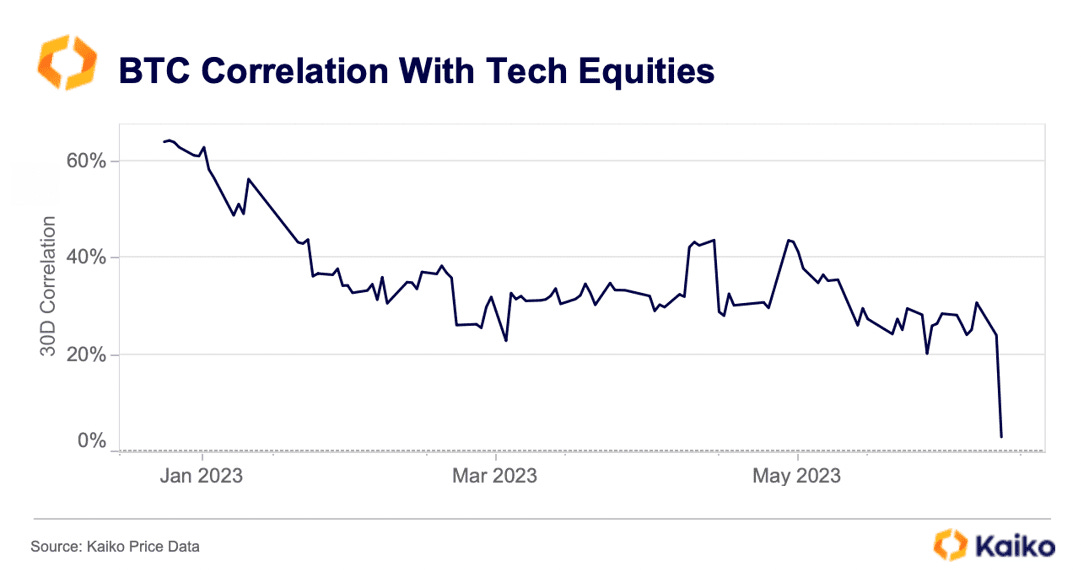

‘s correlation with tech stocks in the has reached a three-year low following BTC’s impressive performance this month. At the beginning of the year, the correlation stood above 60%, but it plummeted to as low as 3% last week.

BTC Correlation with Tech Equities

BTC Correlation with Tech Equities

Image source: Kaiko

Although BTC’s recent rally, fueled by BlackRock, appears to have encountered strong resistance at $31K, the decoupling signifies a potential shift into new territory. However, at the same time, this decoupling does not necessarily imply an imminent rally for BTC.

Staked ETH Surpasses Balance on Centralized Exchanges

According to data from Nansen, the number of staked ETH surpassed the balance held on centralized exchanges on June 26, reaching 23.36 million ETH compared to 23.35 million ETH held on exchanges, including industry leaders Coinbase (NASDAQ:) and Binance.

The staked figure represents 19.4% of the total ETH in circulation, marking a significant increase from the 15.6% during the time of the Shanghai upgrade.

While this increase can be attributed to the improved ease of staking and withdrawal following the upgrade, the recent regulatory crackdown on centralized exchanges has also played a role.

More and more crypto enthusiasts are opting for self-custody solutions.