GBPJPY finds support but lacks bullish confidence

2023.02.24 06:39

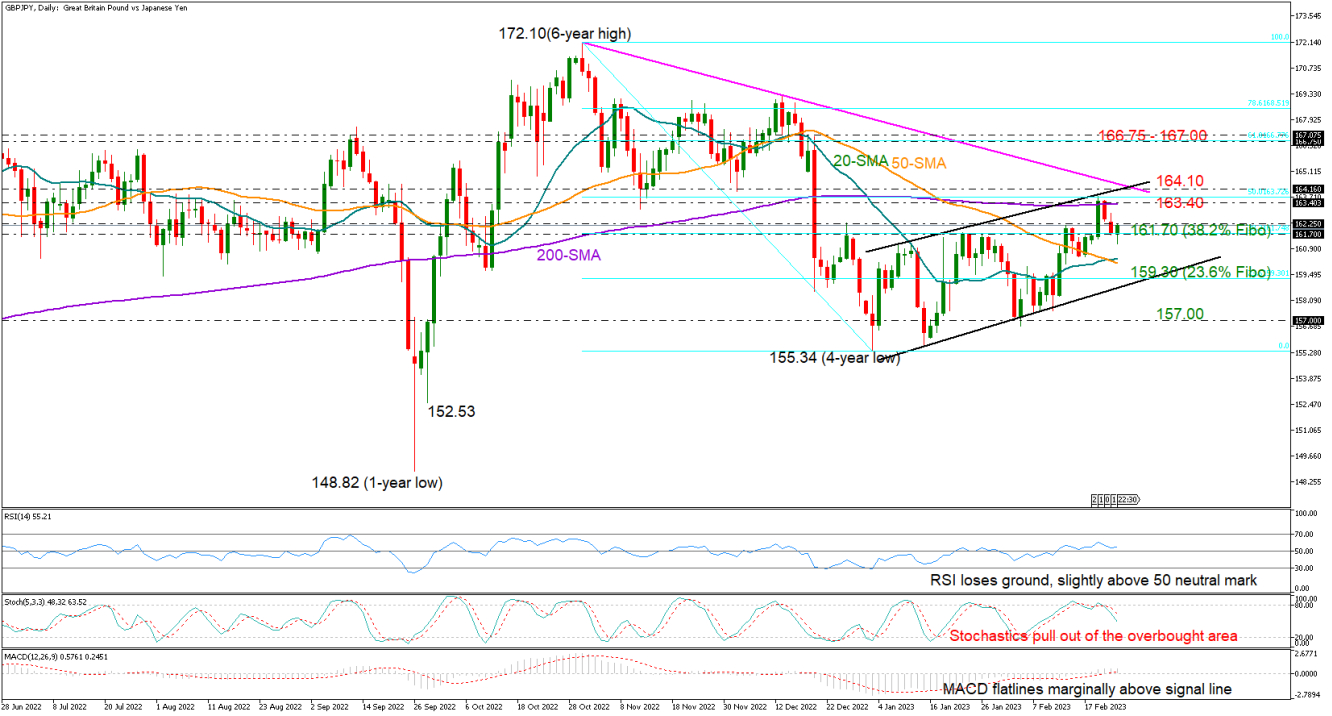

GBP/JPY pinned a new two-month high of 163.74 near the 200-day simple moving average (SMA) earlier this week before easing slightly below the 162.00 level.

The pair is currently trying to set a foothold near the former resistance of 161.70, which overlaps with the 38.2% Fibonacci retracement of the 172.10-155.34 downleg and the 50-period SMA in the four-hour chart.

The technical picture, however, suggests that the market is not ready for a meaningful rally yet. Specifically, the RSI has given up significant ground within the bullish area and the MACD has shifted to the sidelines above its red signal line, while the Stochastic oscillator has pulled below its 80 overbought level, showing falling buying pressures.

Another bearish extension could initially stabilize near the 20- and 50-day SMAs at 160.40 before pushing towards the 23.6% Fibonacci of 159.30 and the bottom of the short-term bullish channel seen around 159.00. A breakdown at this point would dampen sentiment, likely activating a sharper decline towards the 157.20 barrier.

Alternatively, a bounce on the 161.70 base could stage another battle with the 200-day SMA at 163.40. The channel’s upper boundary, the 50% Fibonacci level, and the tentative resistance trendline drawn from October’s 6-year high are in the neighborhood as well, casting doubt on whether the pair will extend its recovery towards the 61.8% Fibonacci of 166.75 and the 167.00 region.

In a nutshell, GBPJPY is looking bullish-to-neutral in the short-term picture. A decisive rally above 164.00 is required to boost buying confidence in the market. Otherwise, a close below 161.70 is expected to extend the latest pullback towards the channel’s lower boundary.