FOMC Meeting Preview: The Fed Won’t Cut Rates – But It Should

2024.07.30 03:23

- Falling inflation, rising unemployment, and rising “real” interest rates all augur for an immediate interest rate cut

- Instead, expect the Fed to tee up a September cut through the statement and Powell’s presser.

- The US Dollar Index (DXY) is testing the critical 104.50 level – today’s close will be key.

What the Fed SHOULD Do

About a month ago, I wrote an article titled “Will the Fed Cut Rates in July? Four Contrarian Reasons to Start Reducing Interest Rates” and since then, we’ve seen a run of mixed US economic data, prominently featuring a larger-than-expected decline in June , so I believe there’s still a convincing case to be made for an immediate interest rate cut.

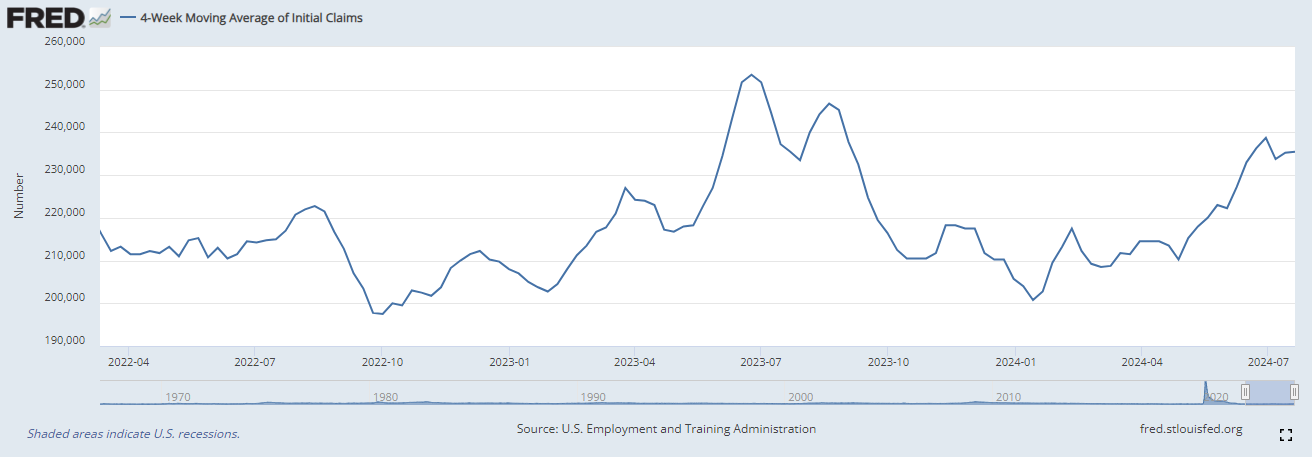

In brief, the recent uptick in and the potential (likelihood?) that the “Sahm Rule” could trigger by the end of the year suggests that the balance of risks has shifted to the downside for the labor market.

Source: FRED

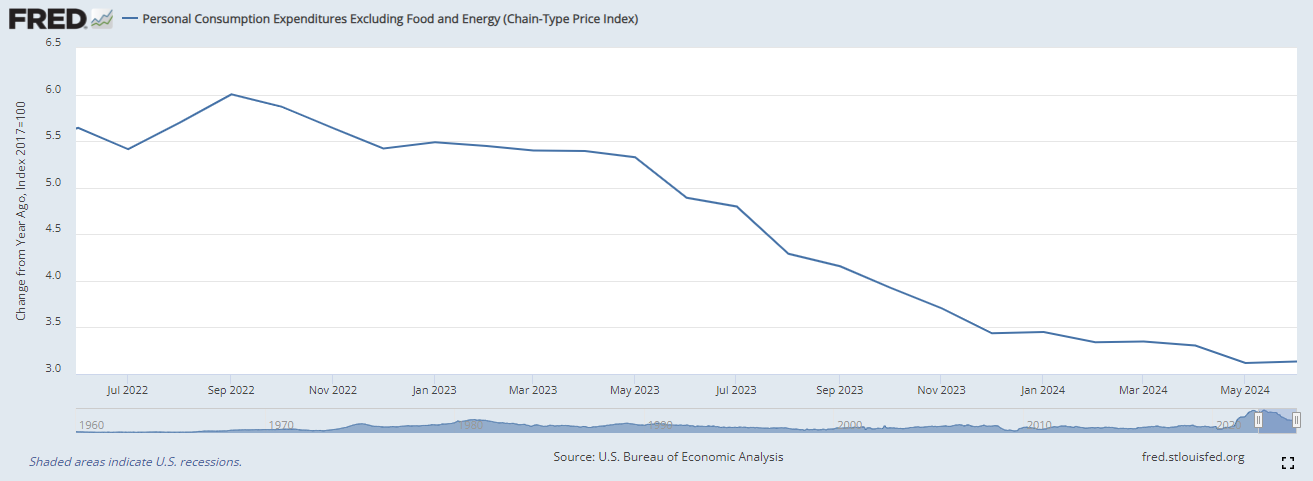

Meanwhile, while has perhaps been incrementally “stickier” than the Fed would prefer in an ideal world, it has now been 11 months since we’ve seen even a +0.1% uptick in the year-over-year rate of Core PCE inflation.

As inflation continues to grind lower, the “real,” after-inflation interest rate is moving higher by the month, making policy incrementally tighter as the US economy shows signs of downshifting in the second half of the year.

Source: FRED

In other words, inflation is within spitting distance of the Fed’s target, the risks to the labor market are growing, and real interest rates are growing more restrictive even as the Fed holds, a compelling reason to consider cutting interest rates immediately.

What the Fed WILL Do

Fortunately for both you and me, I don’t make decisions at the Federal Reserve, and I expect the to leave interest rates unchanged this week. The central bank has spent the last several months setting up September as the start of the rate-cutting cycle, there’s essentially no chance that Jerome Powell and Company jump the gun this month.

Instead, expect the central bank to leave interest rates unchanged, and use the combination of the monetary policy statement and Fed Chairman Jerome Powell’s press conference to set up a September interest rate cut without necessarily pre-committing to such a move.

In the , the FOMC could opt to remove the word “modest” from its recurring note that “there has been modest further progress toward the Committee’s 2 percent inflation objective.” Similarly, the committee could drop its specific call out of price pressures in the phrase “The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.”

Removing the reference to inflation would signal that the economic risks are balanced and set the stage for an interest rate cut. Fed Chairman Powell could echo this evolving view throughout his ensuing press conference.

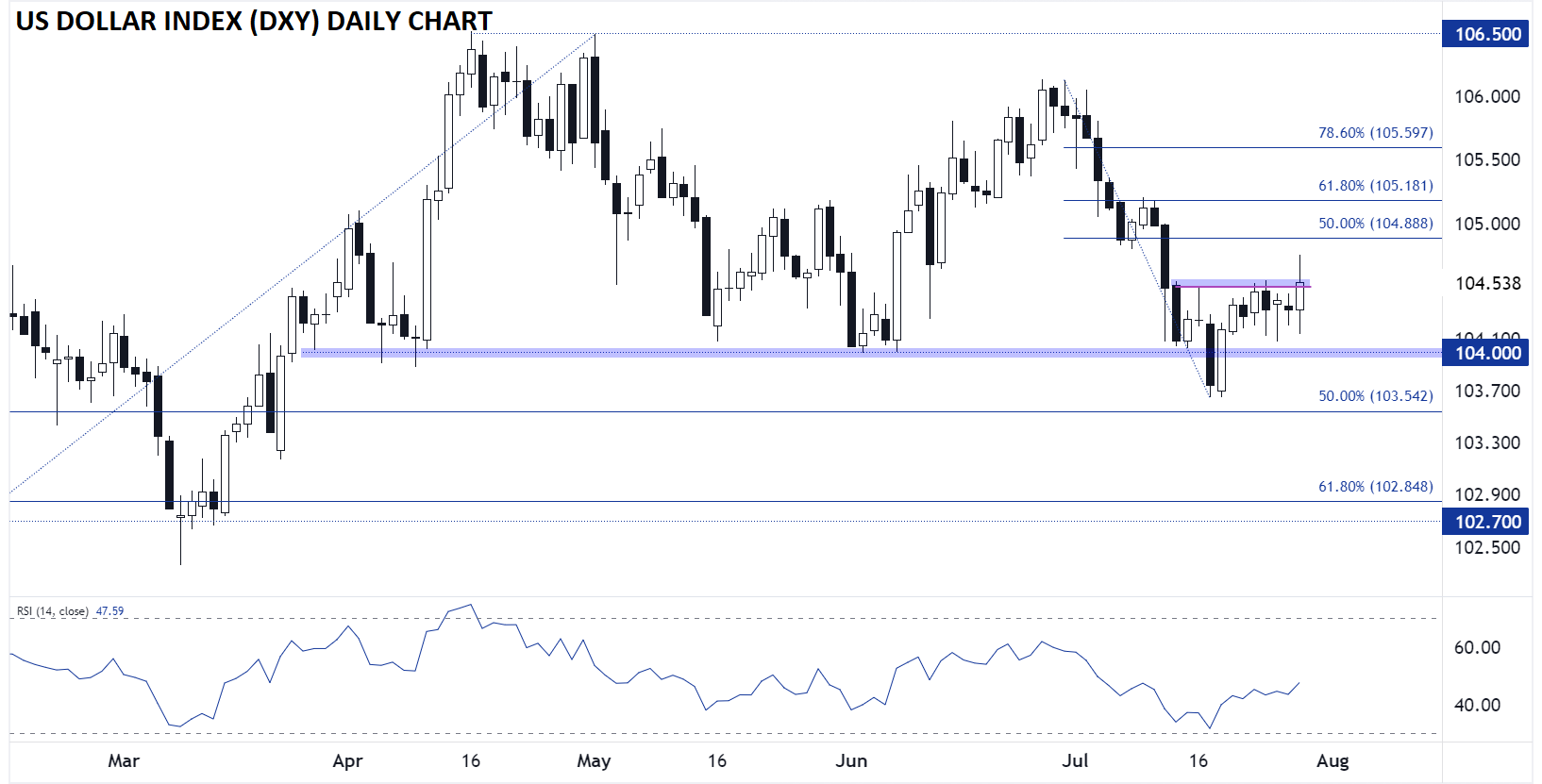

US Dollar Technical Analysis – DXY Daily Chart

Source: TradingView, StoneX

Technically speaking, the (DXY) is showing signs of forming a potential bottom after briefly breaking below previous support at 104.00 earlier this month. As I noted in my morning video today, the world’s reserve currency is forming a potential inverted head-and-shoulders pattern on the 4-hour chart, hinting at a continued rally if it can close the day above the 104.50 level.

A fade later today and move back below 104.50 would keep last week’s 104.00-50 range intact heading into Wednesday’s FOMC meeting.

Original Post