Fed’s Rate Cuts May Delay Recession, But Global Risks Remain Elevated

2024.09.12 03:33

- It’s not about “if” but “how much” the Federal Reserve (Fed) will cut rates at the upcoming meeting. The European Central Bank (ECB) is also expected to cut as central banks sync up.

- The most likely scenario is the Fed will cut by 25 basis points in the upcoming meeting and reserve the potential for more aggressive action later this year if the job market deteriorates further.

- As we highlighted in our September 9 Econ Market Minute, investors should expect interest rate volatility as the Fed adjusts policy.

- Immediately following the inflation release, yields on the 10-year Treasury spiked over the inconclusive longer-term outlook on rates, growth, and employment.

- In recent days, the yield curve disinverted as the economy normalizes.

Global Central Banks Begin Synchronized Easing

The European Central Bank () meets this week to discuss markets and monetary policy, and we expect the ECB to lower rates by a quarter of a percent as they coordinate a global easing cycle with the Fed and most other central banks.

Christine Lagarde, President of the ECB, began cutting rates in June as the euro area showed signs of weakening growth earlier this year. The will likely feel downward pressure as the Fed attempts to move in lock step with its European counterpart.

Weaker domestic growth and decelerating inflation metrics have put unique pressure on Treasury yields recently. Recently, the yield on the fell below the as markets expect — perhaps irrationally — that the Fed will cut aggressively despite some stickiness to inflation.

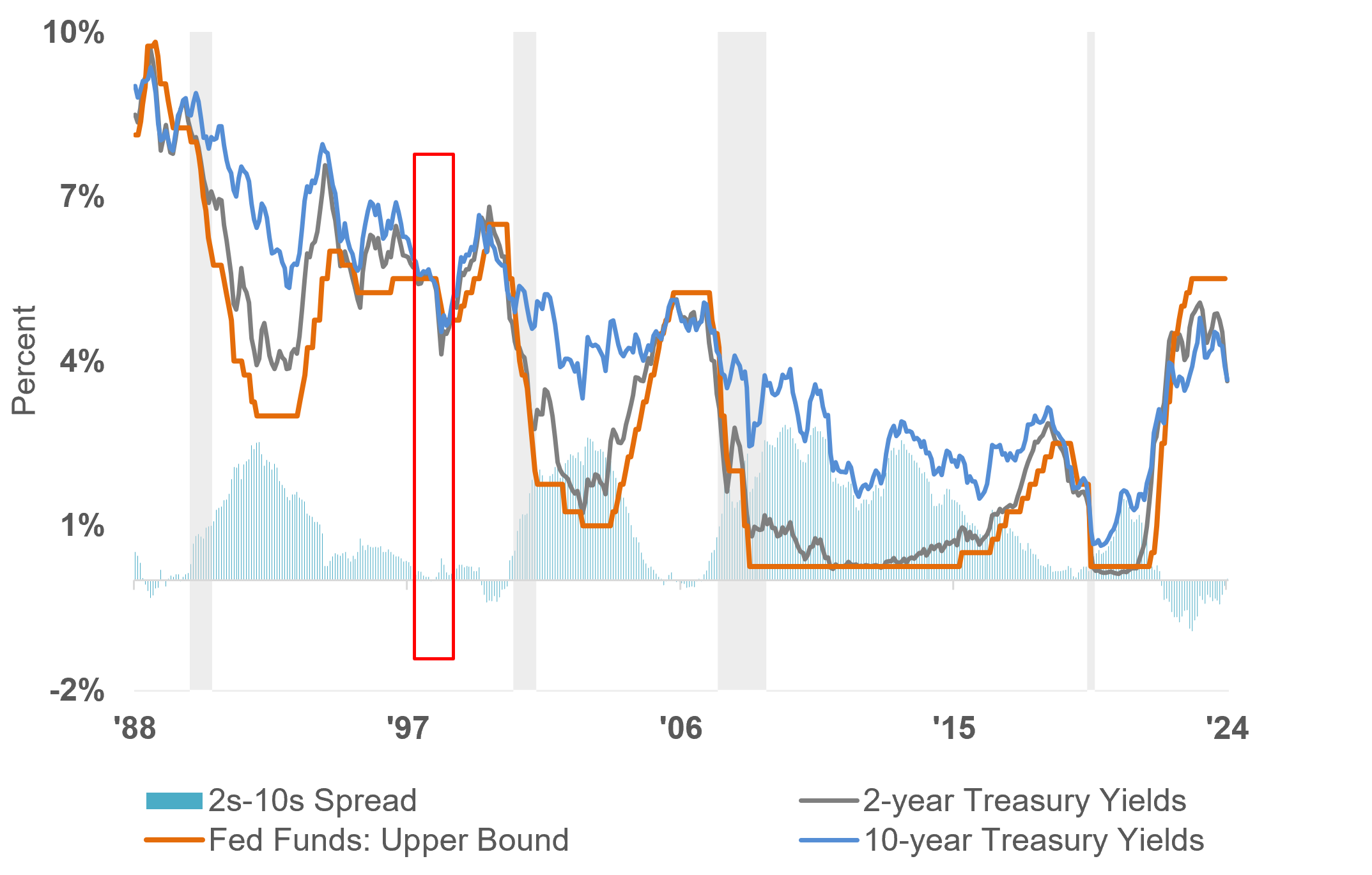

Yield Curve Often Disinverts Before Recessions

Fed Cuts Are the Catalysts

Source: LPL Research, Federal Reserve Board 09/10/24

Investors often talk about the recession signals from an inverted yield curve. Many debate the validity of this signal, especially since the curve has been inverted for quite a while. Perhaps the debate should focus on the drivers behind the inversion and — more importantly — the drivers behind the dis-inversion.

In discussing rules, signals, and theories, Fed Chairman Jerome Powell recently corrected market observers that these recession warnings are statistical regularities, not “an economic rule where it’s telling you something must happen.”

As it relates to the spread between Treasury yields, the dis-inversion is a likely combination of three important factors. First, early signs of slowing economic growth have put downward pressure on yields. Second, markets are anticipating the Fed to aggressively cut rates. And third, the Treasury market continues to be a safe haven for global investors concerned about the greater risks internationally.

So what about the periods of dis-inversion? Note the mid-1990s. The Fed was able to cut rates with softer inflation and higher labor force participation. Still, the economy did not fall into recession because real disposable incomes were growing, giving consumers the ability to spend.

A Word of Warning

The U.S. economy did not fall into recession in the mid-to-late 1990s. The U.S. grew by 4.4% in 1997, 4.5% in 1998, and 4.8% in 1999, and domestic equity markets rallied. Growth was much stronger than expected given the international crises. However, international markets were experiencing something different.

In 1997 and 1998, the Asian financial crisis impacted international economies and spread to Eastern Europe and Latin America. The Fed responded with more rate cuts, easing some of the global pressures on domestic businesses and consumers. Part of the issues of that time were in the banking system and exposure to excessive hedge fund leverage, illustrated most famously by the collapse of the Long-Term Capital Management (LTCM) hedge fund.

Summary

LPL Research anticipates higher volatility among both bonds and equities during this period of global uncertainty and the softer growth outlook. Therefore, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral stance on equities while watching for potential opportunities to add equities on weakness. We expect volatility to remain elevated over the next few months, and believe a better entry point back into the longer-term bull market will likely emerge.

***

Important Disclosures:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.