Fed Preview: Is a Big Rate Cut on the Table This Week?

2024.09.17 02:54

The trillion-dollar question investors have is whether the Federal Reserve will reduce the federal funds rate (a benchmark U.S. interest rate that influences other interest rates) by just 25 basis points (or 0.25%) or by a full 50 basis points (0.5%) during this week’s upcoming Federal Open Market Committee (FOMC) .

The FOMC meeting will run from Tuesday, September 17, to Wednesday, September 18. However, the most likely outcome is that investors won’t get an interest rate cut announcement until around 2:00 p.m. Eastern time on Wednesday, followed by a from Federal Reserve Chairman Jerome Powell.

From business loans and mortgage interest rates to credit card rates and auto loans, changes to the federal funds rate have deep and wide ripple effects throughout the economy. Consequently, investors should monitor shifts in central bank monetary policy — and as you might expect, traders and oddsmakers are positioning themselves for whatever they think will happen on Wednesday and afterward.

How Deep Will the Rate Cut Be?

Over the past few years, oddsmakers have consistently predicted what the Federal Reserve will do at upcoming FOMC meetings. This time around, however, the market can’t seem to agree on whether a “jumbo” 50-basis-point interest rate cut or just a typical 25-basis-point cut is coming this week.

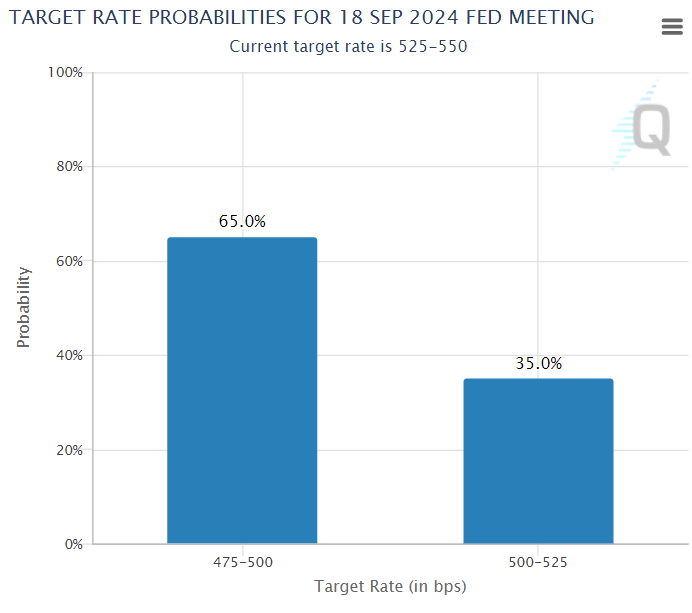

The Chicago Mercantile Exchange has a CME FedWatch tool that tracks the expected probabilities of various possible FOMC meeting outcomes.

Source: CME FedWatch

This past weekend, the tool implied a 50% probability of a 50-basis-point interest rate cut (which would land the federal funds rate at 4.75% to 5%) and a 50% probability of a 25-basis-point interest rate cut (which would put the federal funds rate at 5% to 5.25%).

At the time of this writing, the odds currently favor a deeper rate cut (4.75% – 5.00%).

Either way, hardly anyone expects no interest rate reduction at all, especially since Powell recently declared at an annual economic symposium in Jackson Hole, Wyoming, “The time has come for policy to adjust,” and “The direction of travel is clear.”

Searching for Insights

The Federal Reserve is undoubtedly monitoring inflation and employment data carefully.

First and foremost, they’re looking at the Consumer Price Index (CPI) print for August, which increased 2.5% year over year. This represents a slowdown compared to July’s 2.9% annualized CPI increase. It is also the lowest year-on-year CPI growth rate since early 2021.

They’re also monitoring the Producer Price Index (PPI), which measures what sellers are getting for the goods and services they offer. For August, the PPI only increased 1.7% year over year. That’s down from 2.1% in July, and it’s the smallest year-on-year PPI increase since February.

Also, Powell stated at the aforementioned Jackson Hole symposium that the Federal Reserve doesn’t “seek or welcome further cooling in labor market conditions.” Consequently, oddsmakers are closely watching trends in U.S. employment.

As it turns out, the unemployment rate dropped to 4.2% in August from 4.3% in July. It’s not a huge decrease, but at least the data doesn’t seem to indicate a “cooling in labor market conditions,” according to Powell’s phrasing.

In other words, the stars may have aligned for the Federal Reserve to enact a “jumbo” 50-basis-point interest rate cut.

If so, the might breathe a sigh of relief and surge to new highs in the coming weeks. But then, nothing is guaranteed, and investors should always prepare for all possible outcomes.

Attention will also be paid to the Federal Open Market Committee’s (FOMC) economic projections. When a rate cut is expected, the market wants to understand the pace of future rate cuts.

The projections may signal the Fed is prepared for deeper cuts in November and December. Such easing measures may amplify the market’s reaction and not be restricted to a knee-jerk reaction.

Original Post