Fed Pivot Watch

2022.11.03 11:44

[ad_1]

In the search for clues on the outlook for monetary policy, investors and analysts are focused on three questions. When will the Fed slow its rate hikes? When will the Fed pause rate hikes? And when will the central bank pivot and start cutting rates? Powell gave somewhat encouraging remarks in one out of three in yesterday’s press conference.

The possibility of slowing the pace of rate hikes may be near, he hinted. By contrast, Powell downplayed the outlook for a pause or pivot. he said:

“It is very premature to be thinking about pausing. People when they hear ‘lags’ think about a pause. It is very premature, in my view, to think about or be talking about pausing our rate hikes. We have a ways to go.”

A pause and pivot, in short, are nowhere on the immediate horizon. A slowdown in the pace of hiking, however, may be approaching, perhaps as early as the next FOMC meeting on Dec. 14. He also explained:

“As we come closer to that level and move further into restrictive territory, the question of speed becomes less important. And that’s why I’ve said at the last two press conferences that at some point it will be important to slow the pace of increases. So that time is coming, and it may come as soon as the next meeting or the one after that. No decision has been made.”

Fed funds futures are on board with that possibility this morning by pricing in roughly 50-50 odds for a 50- or 75-basis-points hike, according to CME data.

By some accounts the Fed is at risk of overtightening and throwing the economy into recession. But Powell pushed back on that point by arguing that the risk of a policy error lies elsewhere. He said:

“If we were to over-tighten, we could then use our tools strongly to support the economy. Whereas if we don’t get inflation under control because we don’t tighten enough, now we’re in a situation where inflation will become entrenched. And the costs — the employment costs, in particular — will be much higher.”

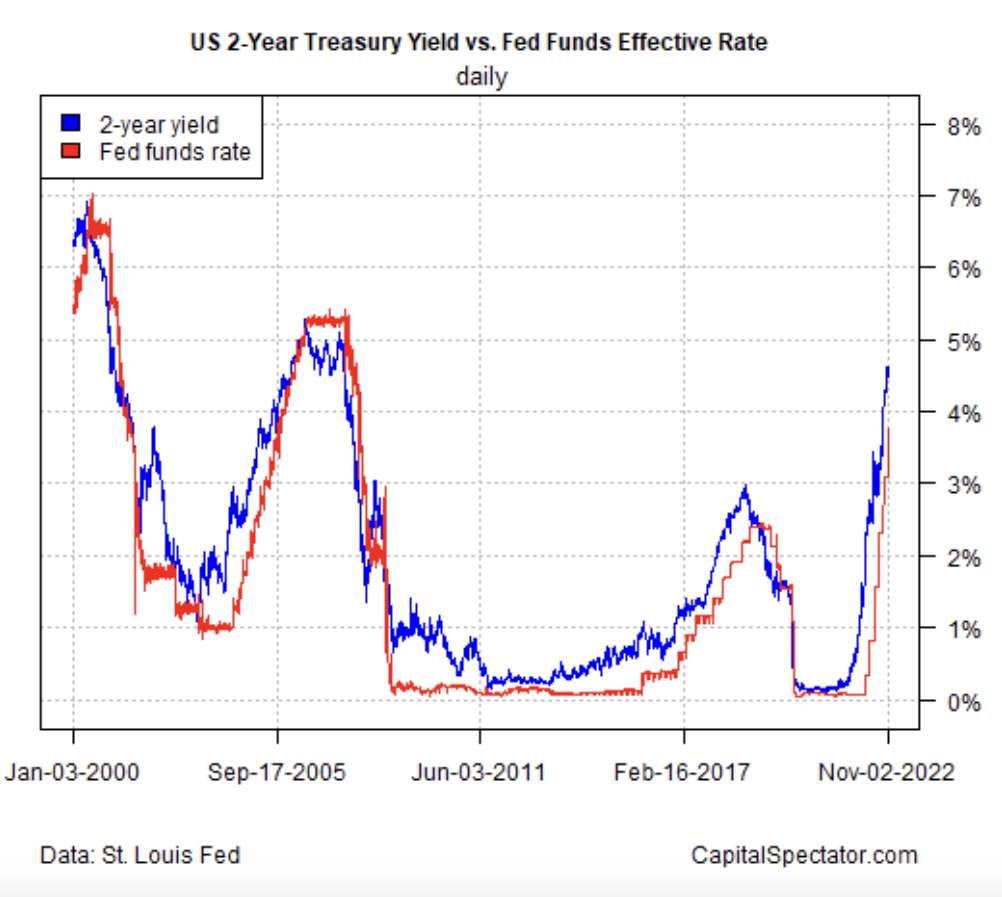

Meanwhile, the Treasury market continues to signal that rate hikes will persist. The policy-sensitive 2-year yield has an encouraging history of predicting the Fed funds target rate and on that score a hawkish bias rolls on. The rate edged up to 4.61% yesterday (Nov. 2), well above the new 3.75%-to-4.0% Fed funds target range. In other words, the Treasury market continues to forecast that the central bank is still playing catch-up and so more rate hikes are on the horizon.

U.S. 2-Year Yield Vs. Fed Funds Effective Rate

U.S. 2-Year Yield Vs. Fed Funds Effective Rate

Michael Schumacher, head of macro strategy at (Wells Fargo), ponders:

“It’s pretty steadfastly hawkish so far. It’s not really what I expected. He’s hanging in there. Powell thinks the bias is they should tighten more than they would otherwise think, just so they should take out some insurance. His quote was that it’s very premature to think about pausing. They’re not going to pause anytime soon.”

[ad_2]

Source link