Fed Meeting Looms: Will Powell Hint at a September Rate Cut Tomorrow?

2024.07.30 09:32

The market is that the Federal Reserve will start cutting interest rates at the Sep. 18 policy meeting.

Tomorrow’s central bank and is still a wild card, but only by the smallest of margins, according to market sentiment. Indeed, it’s fair to say that the crowd’s super confident that the future is clear.

Fed funds futures are pricing in a near-certainty that tomorrow’s announcement will leave the target rate unchanged at a 5.25%-to-5.50% range.

Confidence is even higher that a rate cut will be announced at the next FOMC meeting on Sep. 18. Although there are no certainties in financial markets, traders are nonetheless pricing in expectations that defy such logic.

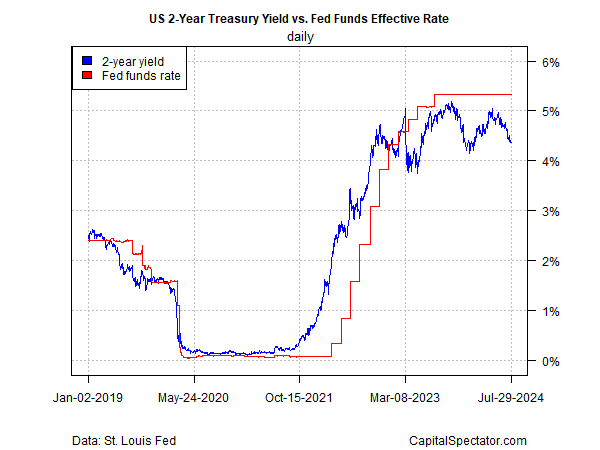

The policy-sensitive certainly aligns with the futures market’s outlook. The 2-year rate, which is widely considered a proxy for market-based expectations on policy decisions, has been trading well below the Fed funds target rate for more than a year.

The embedded forecast has been early, to put it generously, but confidence is high that confirmation is nigh for the dovish pivot forecast.

By some accounts, a rate cut in September will favor follow-through decisions in short order.

“If they have enough confidence to go in September, then that’s got to make November live as well as December,” predicts Richard Clarida, a former vice chair at the Fed who’s now a senior adviser at the bond manager Pimco.

Former New York Fed President Bill Dudley is leading the uber-doves, per his column last week in Bloomberg. “I’ve changed my mind,” he wrote on July 24. “The Fed should cut, preferably at next week’s [July 30-31] policymaking meeting.”

Although a rate cut for tomorrow is considered a long shot, the consensus is now overwhelmingly in favor of the fact that the easing will start in September. Part of the reasoning is the view that the economy is slowing and so it’s timely for the Fed to act pre-emptively to preserve the expansion, or at least minimize the expected fallout.

An animating feature of the view that the Fed needs to cut soon, if not tomorrow, is the Sahm Rule, which signals the start of a recession when it reaches 0.5. The indicator, which summarizes the unemployment trend, has been trending up for much of the past year and rose to 0.4 in June.

The implication, a recession is near. Maybe, although there’s still room for debate, at least for the near term, as by CapitalSpectator.com on Friday.

Recent GDP data also suggests that economy will continue to hum. Following last week’s news that second-quarter growth accelerated, the current Q3 nowcast via the model anticipates more of the same with a 2.8% increase (as of July 26).

Meanwhile, Goldman Sachs advises that even if the jobless rate is ticking higher, it’s rising off a low base. The low rate of layoffs suggests the labor market will remain a net positive for the economy in the near term.

“This is important because it means the economy is not experiencing the usual vicious circle in which job and income loss lead laid-off workers to reduce their spending, leading to further job loss,” analysts at Goldman Sachs explain.

The debate may be resolved, one way or the other, by the end of week, following tomorrow’s Fed announcement and press conference and Friday’s report for July.

Mr. Powell, the floor is yours!