Fed Leaves Investors in the Dark as Signals and Monetary Actions Diverge

2023.07.27 08:48

- The Fed raised interest rates by 0.25%, as expected

- Fed Chair Powell expressed uncertainty about achieving the 2% inflation target by 2025

- Meanwhile, markets fluctuated and closed with uncertainty yesterday

The meeting held yesterday came to the highly-anticipated conclusion of a 0.25% hike, surprising a total of zero investors. Moreover, Chairman Powell’s remarks during the meeting echoed what we’ve heard in previous rate-raising meetings:

- remains below the 2% target, but the Fed will closely monitor the situation.

- They will assess each meeting before making further decisions on rate adjustments.

- The impact of previous rate hikes on the economy is still being observed.

- The robust labor market allows them to consider implementing more restrictive measures.

The only notable difference was Powell expressing uncertainty about achieving the 2% inflation target by 2025, and he reiterated that there wouldn’t be any rate cuts this year.

The meeting had a positive outcome in the form of the Fed being confident that there will be no recession-related issues in 2023. However, they purposefully maintain a vague stance to avoid sending misleading signals to the market, which could potentially drive prices even higher.

Inflation remains the central concern for the Fed, particularly after their earlier claim of it being transitory in 2020-2021, which proved to be a significant mistake they are determined not to repeat. They prefer a more cautious approach for the next six months rather than a lenient one.

Following the meeting, the markets experienced fluctuations and closed with uncertainty, with the up by 0.23%, the down by 0.02%, and the down by 0.12%.

The big picture, though, is that the market doesn’t appear to believe that the Fed will keep raising for much longer, despite of Powell tries to signal. It seems that actions speak louder than words in the monetary policy world, too.

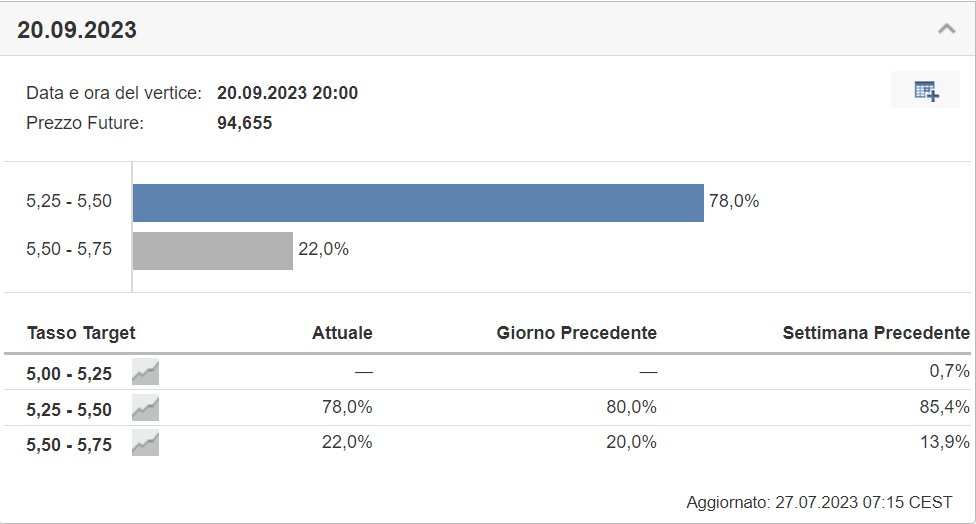

The next meeting is scheduled for September 20, after the summer break, and as of today, there’s a 78% probability (subject to change) for a pause in rate hikes, according to our .

This morning, it was the ECB’s turn, which, once again, came to a very similar 25 basis points in interest rates, along with plenty of vague and abstract indications for future meetings.

For those who make decisions based on short-term market movements, these times can be challenging. However, for medium- to long-term investors, this summer is just like any other, with a sense of normalcy prevailing.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author owns the stocks mentioned in the analysis.