Fed in a Flutter as U.S. Inflation Softens

2022.12.01 12:31

[ad_1]

Federal Reserve Chair, Jerome Powell, tried his best to talk up the prospect of a higher-for-longer interest rate policy story, but the market didn’t believe him yesterday and will be even less inclined to do so after today’s personal income and spending report.

The 0.2% month-on-month deflator outcome (consensus 0.3%) is another inflation surprise with the year-on-year rate slowing to 5% from 5.2%. This is significant as it is the Fed’s favored measure of inflation and with pipeline price pressures, such as import prices and , also continuing to soften after we got the soft core print, it poses real challenges to the Fed’s narrative on inflation.

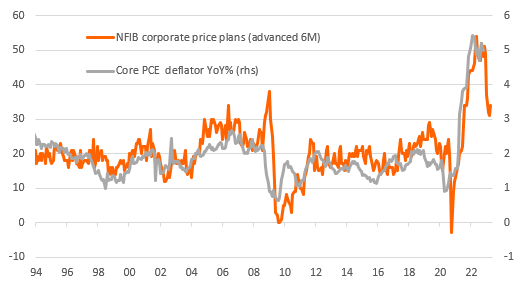

In fact, the situation could get even trickier for the Fed with the chart below plotting the core PCE deflator against the National Federation of Independent Businesses price plans survey. It shows that the proportion of companies looking to raise their prices over the next three months has dropped sharply very recently, presumably reflecting some evidence of softening demand and rising inventory levels. This relationship suggests the core PCE deflator could head down to 3% by the end of 1Q, which would argue that we are getting close to the top for the Fed funds target rate.

Moreover, if the economy does fall into recession as many fear, that corporate pricing power story will weaken much further and could contribute to inflation getting close to the 2% target by the end of 2023.

NFIB Corporate Price Plans, Core PCE Deflator

Activity Still Holding Up for Now

For now though, the activity side is holding up well with real consumer spending rising 0.5% MoM in October, the strongest gain since January. The news on the Black Friday/Cyber Monday retail sales has also been good and means that real consumer spending is on track to rise at a 4% annualized rate in the current quarter. We also expect to see a strong jobs number tomorrow given that job vacancies exceed the total number of unemployed Americans by a factor of almost two. The Fed will likely point to these factors as justifying an ongoing hawkish position insofar as demand exceeding supply will keep the inflation threat alive.

A 50bp interest rate hike for December still looks a certainty and we continue to expect a final 50bp hike in February. For any more hikes we are going to need to see strong demand continue, but with US CEO confidence at the lowest level since the Global Financial Crisis and the housing market deteriorating rapidly, it is not our base case.

[ad_2]

Source link