Fed Goes All-In for 2024: How to Rebalance Your Portfolio Accordingly

2023.12.14 02:56

Instead of holding their cards back, the Fed decided to go all in today and show their hand. I don’t play poker anymore, but the only time I would go all in in Texas Hold’em was when I thought I knew something my opponent didn’t. In some cases, my hand was so bad, and I dug myself into such a horrible hole that the one chance I had to survive was to try to bluff my way out of it. That didn’t always work, though.

Either the Fed knows something we don’t about the economy, or has convinced itself it can achieve a soft landing and is going for it. I don’t know which one is correct, but to bet, man, my feeling is that the Fed expects the balance of its monetary policy to kick in. It wants financial conditions to ease to keep the economy from going into recession as those effects of tightening take effect.

There is no other reason why the Fed would have decided to indicate cuts at this point; it now sees rates at 4.6% by the end of next year. This caught me and many people offside.

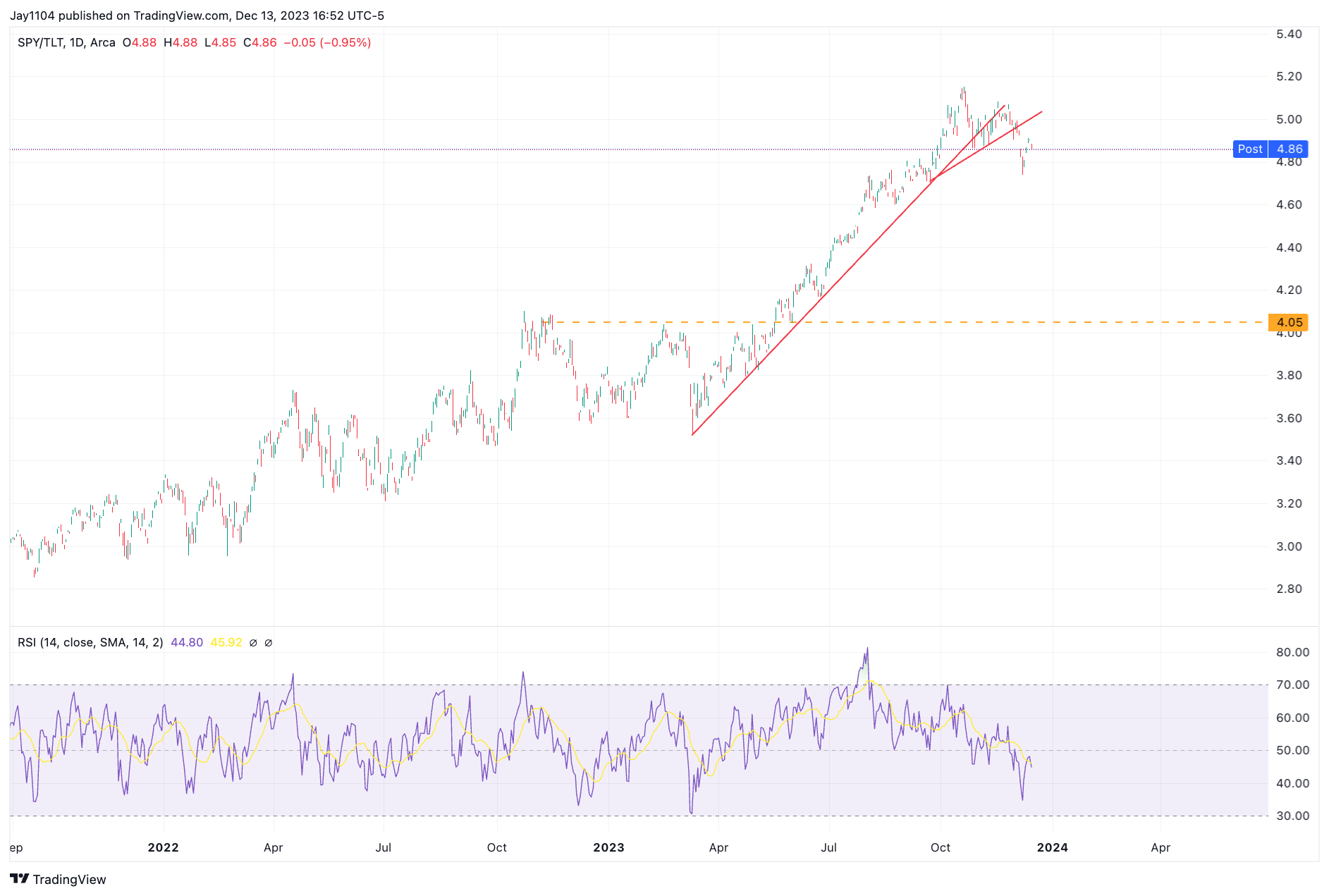

This led to the collapse and the back of the curve dropping, which led to the steepening .

Everyone knows that I have been looking for the yield curve to steepen; I just thought we had more time for the 2-year to hold up and for the 10-year to move up some. The move down in the 2-year came earlier than expected. It would like the next support level for the two to be around 4.35%.

It seems clear that we will have a positive sloping yield curve in the future.

As for the rise, it may still break out and move higher. I don’t know what drives that at this point, and the RSI slipped lower, suggesting that momentum change in trend has failed.

What Happens Now?

We continued to see the rotation from growth rotation into value, which seems to make sense. If people have been hiding out in mega-cap stocks and technology for fear of owning bonds, then today’s message from the Fed would suggest that the time to come out of hiding and move back into bonds may be here.

It also seems clear that if the yield curve is going to steepen, the move out of banks into technology, starting in March, is also likely to unwind.

This also appears to be the case for the (regional banking) ETF, which appears to be breaking out above a neckline.

It also doesn’t seem clear just how much money will move out of the equity indexes and back into bonds. The ratio of the to the is very stretched, and again, if people were hiding out in large-cap names and shunning bonds and small-caps.

More than anything, I think the Fed gave the all-clear that it may be okay to move back into bonds again. If the safety trade in 2023 was the S&P 500 basket, then one needs to be careful with how the market rotates here because the parts of the market that have underperformed in 2023, like bonds, small caps, and other rate-sensitive parts, could outperform in 2024. It will come at the expense of something. Again, what it means for the indexes will be based on how big the rotation is.

Original Post