Falling Inflation and Record Real Interest Rates Signal Trouble Ahead

2023.05.24 04:30

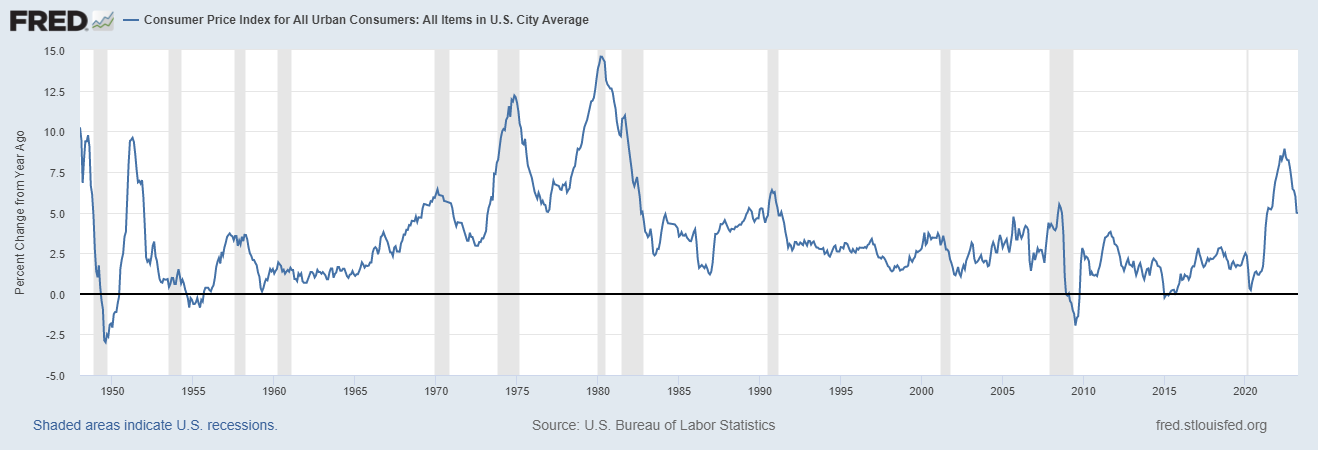

peaked in June 2022. The one-month increase was 1.2 percent, and that followed a 0.9 percent rise in May. Those numbers will roll out of the annual calculation with the June and July number.

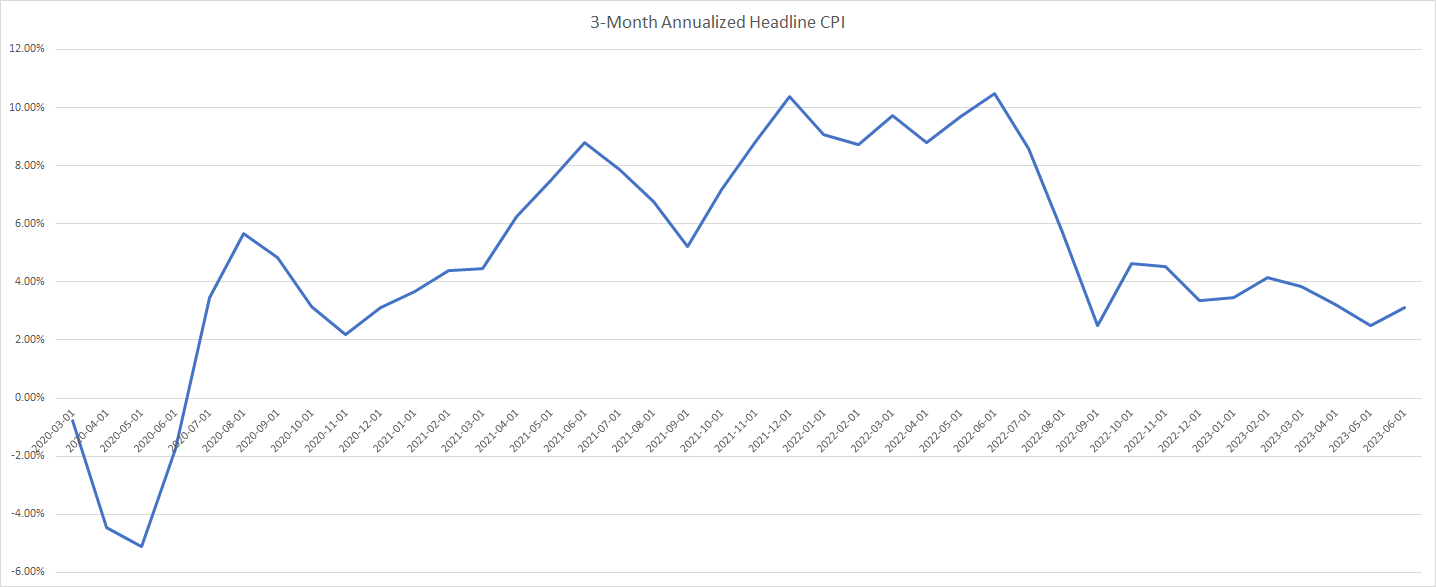

The year-on-year CPI is running at 5.0 percent. Subtract the 2.1 percent falling out and that’s roughly a 3 percent headline CPI. May is currently projecting at 0.2 percent headline CPI. Black Swan aside, there’s no way headline CPI doesn’t come in with a 3-handle by July. The 3-month annualized CPI has been running with a 3-handle since December.

inflation remains stubbornly high, though and it won’t drop as quickly as the headline CPI. The Federal Reserve will likely hold the Fed funds rate up around 5 percent despite falling CPI readings.

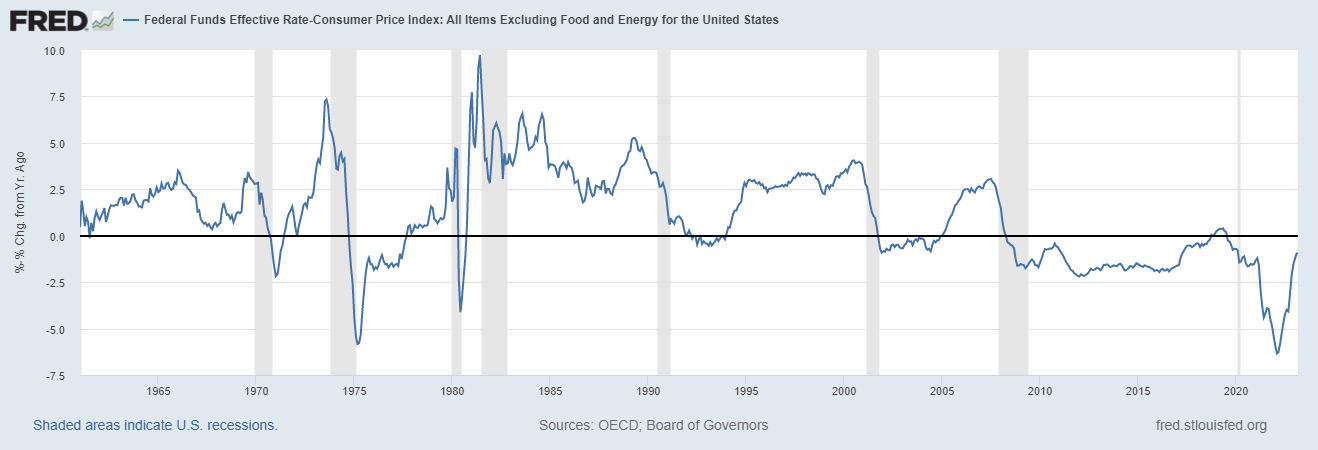

Core CPI-Real Interest Chart

Core CPI-Real Interest Chart

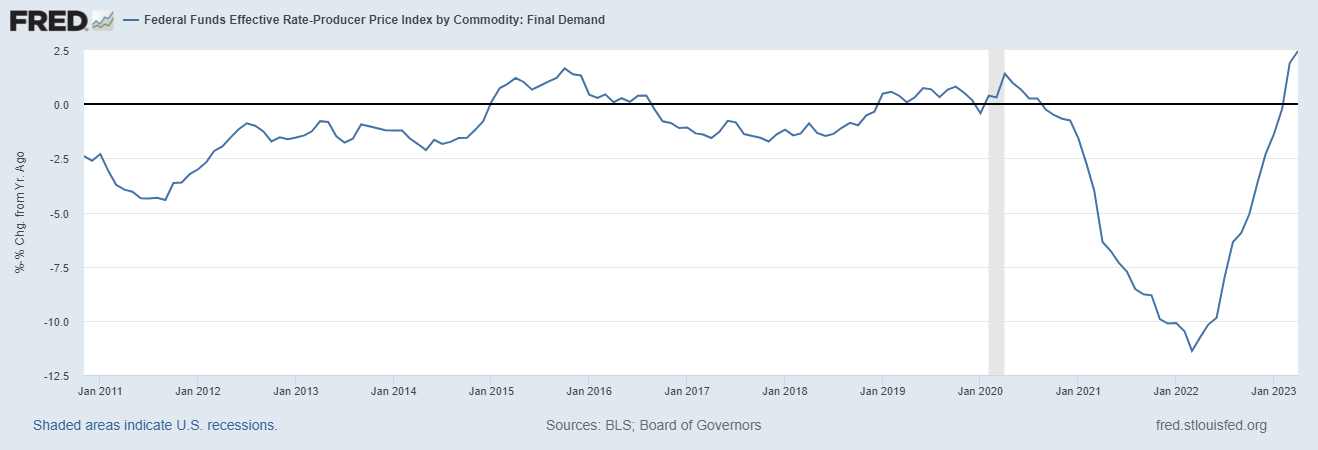

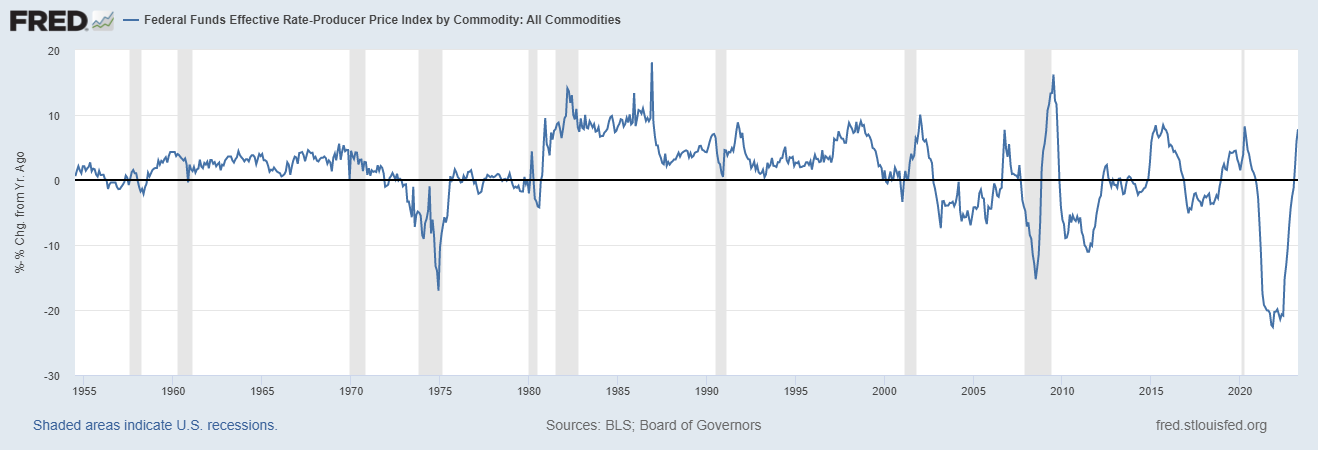

Looking ahead, the real interest rate, as measured against the PPI, is already hitting a post-2008 high. The rate measured by commodities is also near a non-recession high. Going back to 2000, all but that 2000 spike came because commodities prices fell, not because interest rates were high. If I’m right about where commodities are headed and the Fed’s delayed shift, the delta between the Fed funds rate and the PPI commodity subcomponent (PPIACO) will again clear 10 percent.

Tech has done well in the Goldilocks zone of falling inflation and positive growth. The market also thinks rate hikes have been fully priced in. Tech bulls have front-run falling interest rates that should follow falling inflation.

Except, inflation is falling faster than the Fed adjusts, and we’re already approaching record-high real interest rates. The economy is not strong enough for high real interest rates. Rate-sensitive areas such as steel, , and manufacturing have already peaked. The stock market and the economy will follow eventually.