Ever-Increasing Currency Debasement Is Inevitable

2024.10.09 05:15

The Federal Reserve has returned to monetary easing in an environment of elevated inflation.

If one of the steepest rate hike cycles in history couldn’t defeat inflation.

And the Fed can’t raise rates much further without bankrupting the US government because of the soaring interest expense.

How will the Fed EVER escape the trap of ever-increasing currency debasement?

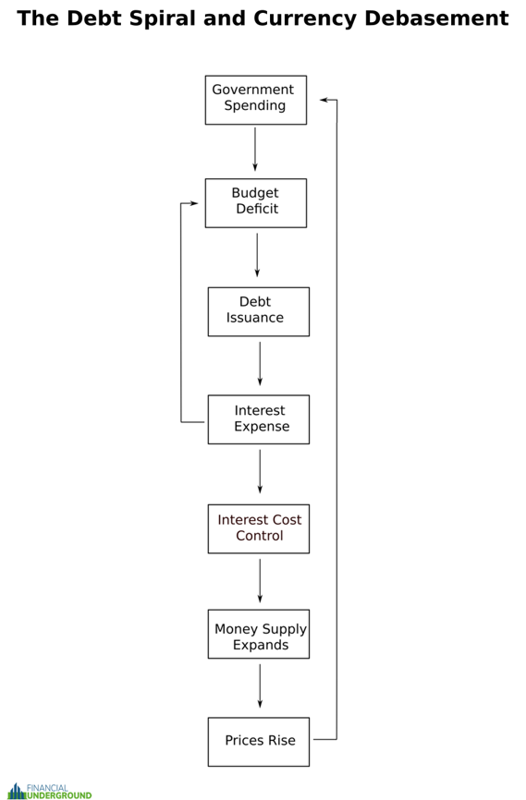

When you put together the pieces to see the Big Picture, it’s clear that ever-increasing currency debasement is the inescapable outcome of the US government’s debt spiral.

Step #1: It’s politically impossible to even slow the federal spending growth rate, let alone cut it.

Step #2: Issuing ever-increasing amounts of debt is the only way to finance continuously expanding budget deficits.

Step #3: An ever-growing interest expense on the ever-growing federal debt compounds the problem because it adds to the deficit, which needs to be financed with even more debt, which causes more interest expense. In other words, the debt spiral is here.

Step #4: The skyrocketing interest expense threatens the solvency of the US government and forces the Fed to cut interest rates, buy Treasuries, and implement other monetary easing measures to try to control it.

Step #5: The money supply expands due to the Fed’s interest cost control measures.

Step #6: As the money supply expands prices rise, which compounds the problem as it increases government spending (go back to step #1).

1) It’s Politically Impossible To Cut Spending

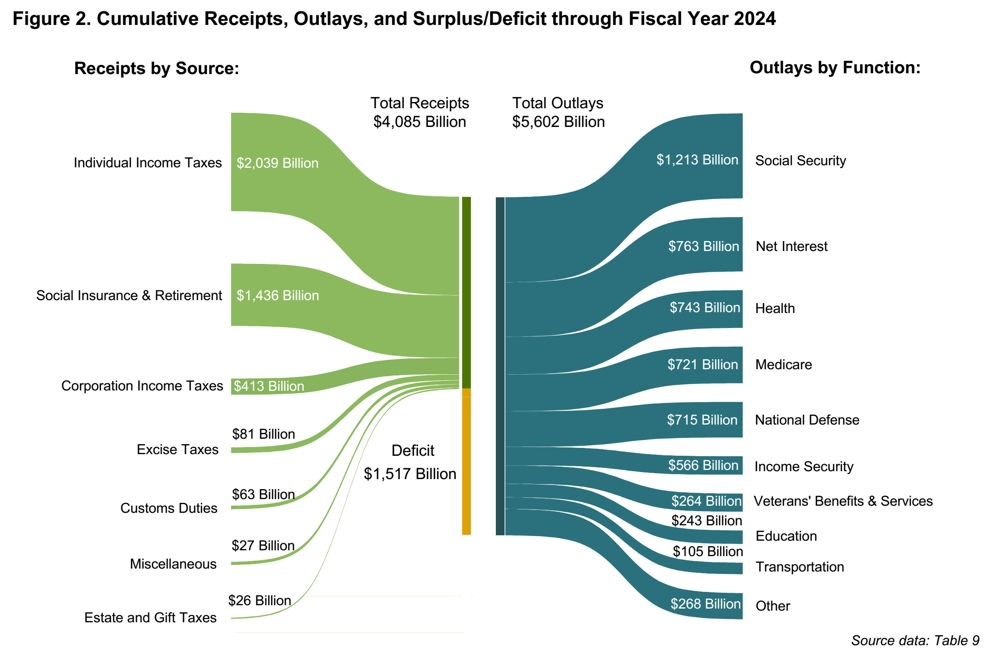

Below is a graphic from the US Treasury Department of the federal budget for Fiscal Year 2024. (Click image to enlarge.)

The interest on the federal debt is already the second-largest federal expenditure. In a matter of months, it’s set to exceed Social Security and become the BIGGEST expenditure.

Among the biggest expenditures for the US government are so-called entitlements like Social Security and Medicare.

It’s unlikely any politician will cut entitlements. On the contrary, I expect them to continue growing.

That’s because tens of millions of Baby Boomers—about 22% of the population—will enter retirement in the coming years. Cutting Social Security and Medicare is a sure way to lose an election.

With the most precarious geopolitical situation since World War 2, National Defense—another large expenditure—is unlikely to be cut. Instead, defense spending is all but certain to increase.

Different types of welfare programs also make up a considerable part of the federal budget and are unlikely to be cut.

In short, efforts to reduce expenditures will be meaningless unless it becomes politically acceptable to make chainsaw-like cuts to entitlements, national defense, and welfare while reducing the national debt to lower the interest cost.

In other words, the US would need a leader who—at a minimum—returns the federal government to a limited Constitutional Republic, closes the 128 military bases abroad, ends entitlements, kills the welfare state, and repays a large portion of the national debt.

However, that’s a completely unrealistic fantasy. It would be foolish to bet on that happening.

Here’s the bottom line.

The government cannot even slow the spending growth rate, let alone cut it.

Expenditures have nowhere to go but up—way up.

2) Ever-Increasing Debt Is the Only Way To Finance Deficits

Don’t count on increased tax revenue to offset these increases in federal expenditures.

Even if tax rates went to 100%, it would not be enough to stop the debt from growing.

According to Forbes, there are around 806 billionaires in the US with a combined net worth of about $5.8 trillion.

Even if the US government confiscated 100% of their assets with a wealth tax, it would barely cover just one year’s worth of federal spending.

It certainly wouldn’t change the trajectory of this unstoppable trend.

The truth is, no matter what happens, the deficits will not stop growing, nor will the debt needed to finance them.

The growth rate is not even going to slow down. It’s going to increase exponentially.

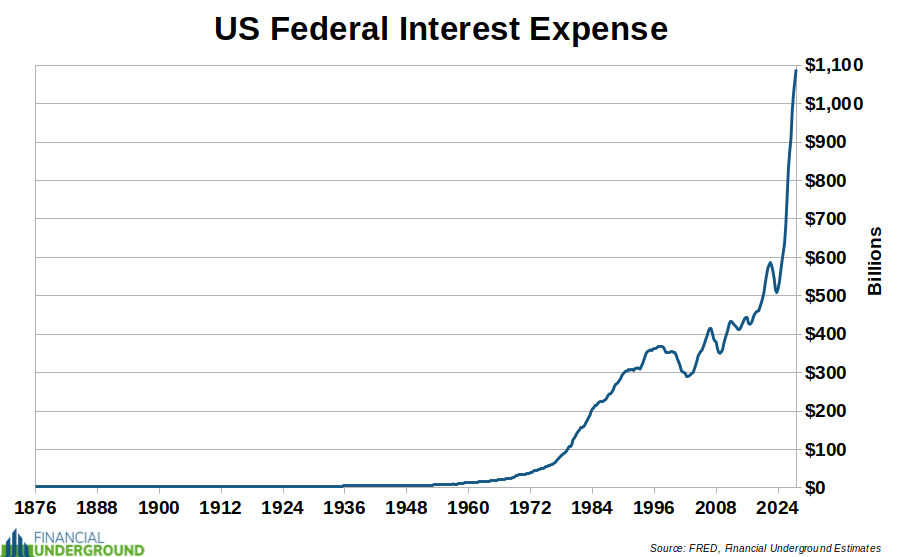

That means interest expense on the federal debt will continue exploding higher.

3) An Ever-Growing Interest Expense Fuels the Debt Spiral

Interest on the federal debt exceeded $1 trillion for the first time this year and is shooting higher.

Ray Dalio is one of the world’s most successful hedge fund managers.

His success is due to his consistent ability to get the Big Picture right.

He recently said this:

“We are at a point in which we are borrowing money to pay debt service.

When you keep having debt growth faster than income growth, that means you have debt service encroaching on your spending, and you want to keep spending at the same time.

As that happens, there is a need to get more and more into debt. It accelerates.

We are at the point of that acceleration. We are near that inflection point.”

The federal debt’s interest cost is already higher than the defense budget. It’s on track to exceed Social Security in the coming months and become the BIGGEST in the federal budget.

In short, the skyrocketing interest has become an urgent threat to the US government’s solvency.

4) Surging Interest Expense Forces Fed To Ease Monetary Policy

The skyrocketing interest expense threatens the solvency of the US government and forces the Fed to cut interest rates, buy Treasuries, and implement other monetary easing measures to try to control interest costs.

In the bond market, when demand for a bond falls, the interest rate rises to entice buyers and holders.

However, the federal debt is so extreme that allowing interest rates to rise high enough to entice natural buyers would bankrupt the US government because of the higher interest costs.

Historically, there has been a vast foreign appetite for US debt (Treasuries), but not anymore.

In the wake of Russia’s invasion of Ukraine, the US government has launched its most aggressive sanctions campaign ever.

As part of this, the US government seized the Russian central bank’s reserves—the nation’s accumulated savings.

It was a stunning illustration of the political risk associated with the US dollar and Treasuries. It showed that the US government could seize another sovereign country’s reserves at the flip of a switch.

In short, the US dollar—and Treasuries—have become weaponized in a way they had not been before. They are now clearly tools for Washington to coerce others.

Here’s the bottom line.

US Treasuries can be either a neutral reserve asset or a political weapon Washington wields. They cannot be both.

China is one of the largest holders of US Treasuries, and it indeed took note of what is happening. There’s little doubt that this is the reason China continues to dump Treasuries.

Beijing has sold over 26% of its Treasuries since 2021, an enormous change in such a short period.

Even US allies, like Japan, have cut their Treasury holdings.

There are numerous other examples. The bottom line is that it’s clear the world isn’t hungry for US debt right now. It’s an inopportune moment for lackluster demand because supply is exploding higher.

If higher interest rates are off the table and cannot entice more natural buyers, and foreigners aren’t going to step up to the plate, who will finance these growing multi-trillion dollar budget deficits?

The only entity capable is the Federal Reserve, which buys Treasuries with dollars it creates out of thin air.

In other words, currency debasement is their only option.

5) Ever-Increasing Currency Debasement Is Inevitable

The skyrocketing interest expense forces the Fed to implement interest cost control policies, which inflate the money supply and debase the currency.

As that happens, prices rise.

That causes the US government to spend even more on Social Security and welfare to keep up with the cost of living increases. The same is true of defense and other government spending, which adjusts upward for rising prices.

This compounds the problem because as government spending rises to account for rising prices, that increased spending can only be financed with more currency debasement.

That’s why ever-increasing currency debasement is the inevitable outcome of the US government’s debt spiral.

It’s a self-perpetuating doom loop from which they cannot escape.

In short, the only way the US government can continue to finance itself is for the Fed to create ever-increasing amounts of fake money.

Ludwig von Mises, the godfather of free-market Austrian economics, summed up the Fed’s dilemma:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion.

The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.“

The US government will not voluntarily “abandon credit expansion,” as Mises puts it, because Washington is dependent on issuing increasing amounts of debt to pay for the ever-growing costs of Social Security, national defense, welfare, and interest on the federal debt.

That means their only choice is to debase the US dollar by ever-increasing amounts until, as Mises puts it, the “final and total catastrophe of the currency system involved.”

I believe rampant currency debasement will be the most important investment trend of this decade, and it will devastate most people.

The worst of it could go down soon… and it won’t be pretty.

It will result in an enormous wealth transfer from savers and regular people to the parasitic class—politicians, central bankers, and those connected to them.

Countless millions throughout history were wiped out financially—or worse—because they failed to see the correct Big Picture as their governments went bankrupt.

Don’t be one of them.