Eurozone PMI Data Offers Short-Lived Support for Euro, But Trend Remains Unchanged

2024.10.24 08:24

On Thursday, S&P Global released flash estimates for the October PMIs across major regions. The significance of this data increases over time, and in Europe, it often influences market trends.

The European data was mixed, but the currency market focused on stronger-than-expected numbers from Germany.

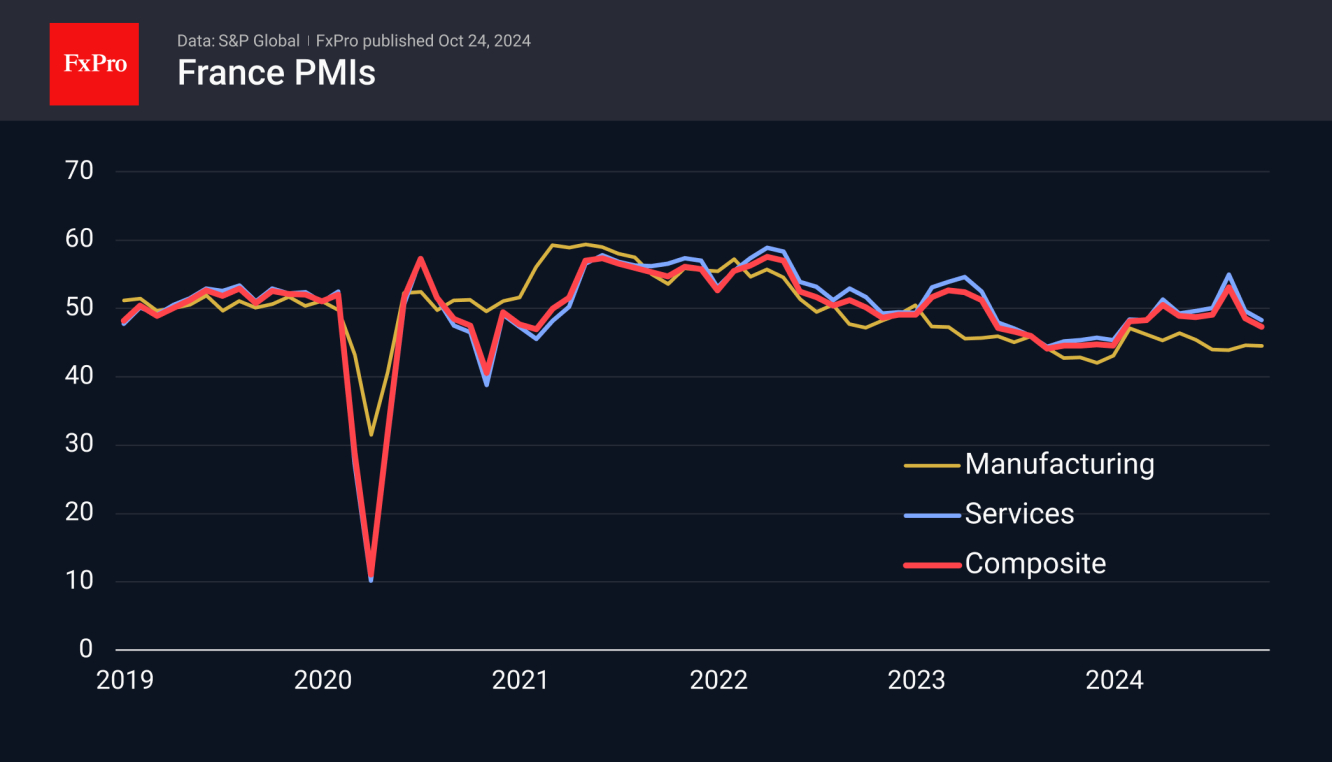

In France, the services sector is experiencing a deeper decline following a boost from the Olympics. The dropped from 49.6 to 48.3, marking its lowest point since the end of last year. Meanwhile, the remains in contraction territory at 44.5, staying below 50 for the second consecutive month. The also fell to a nine-month low of 47.3.

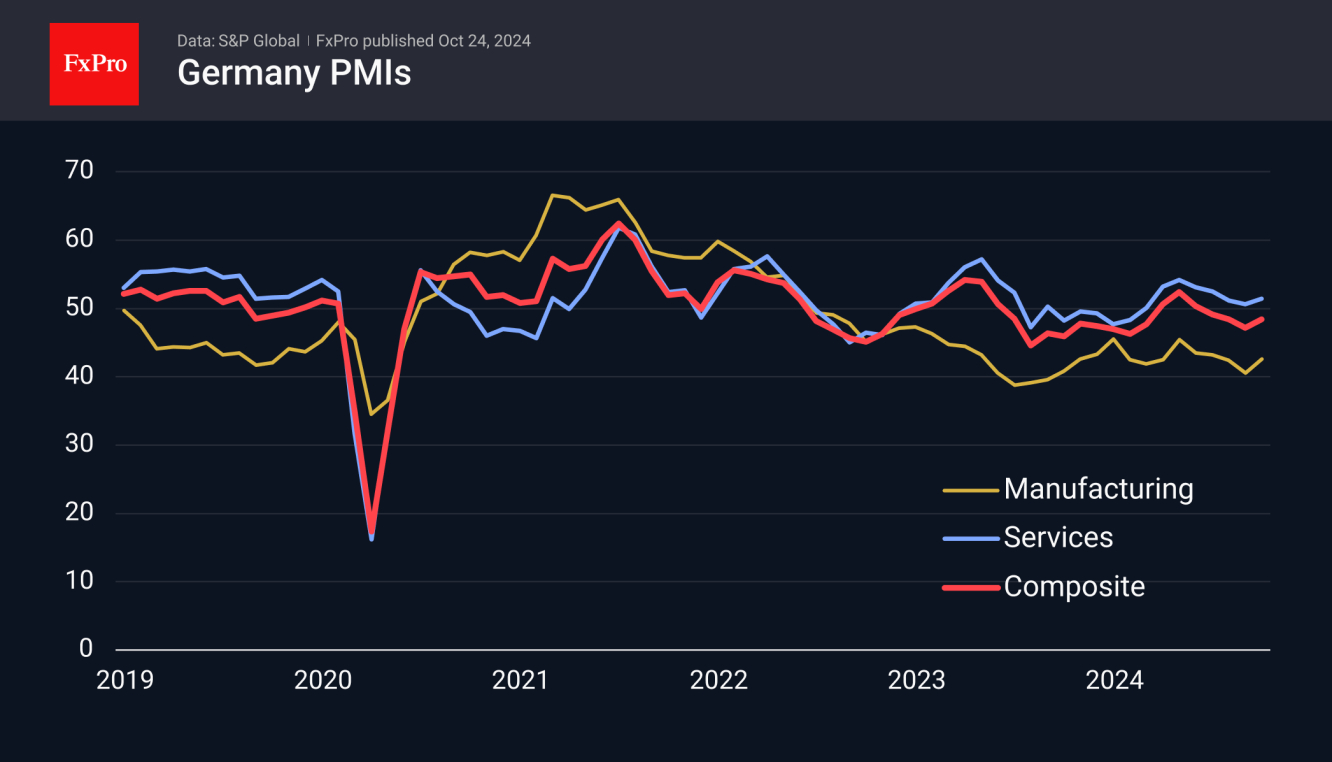

Index estimates for Germany shifted the ’s trajectory, beating forecasts by a wide margin. The rose to 51.4 after four months of decline. The rose from 40.6 to 42.6, although 40.7 was expected. This rebound offers some reassurance, as German manufacturing, as measured by the PMI, has been in contraction territory since July 2022. As a result, the stands at 48.4 in October, remaining below the 50 mark for the past four months.

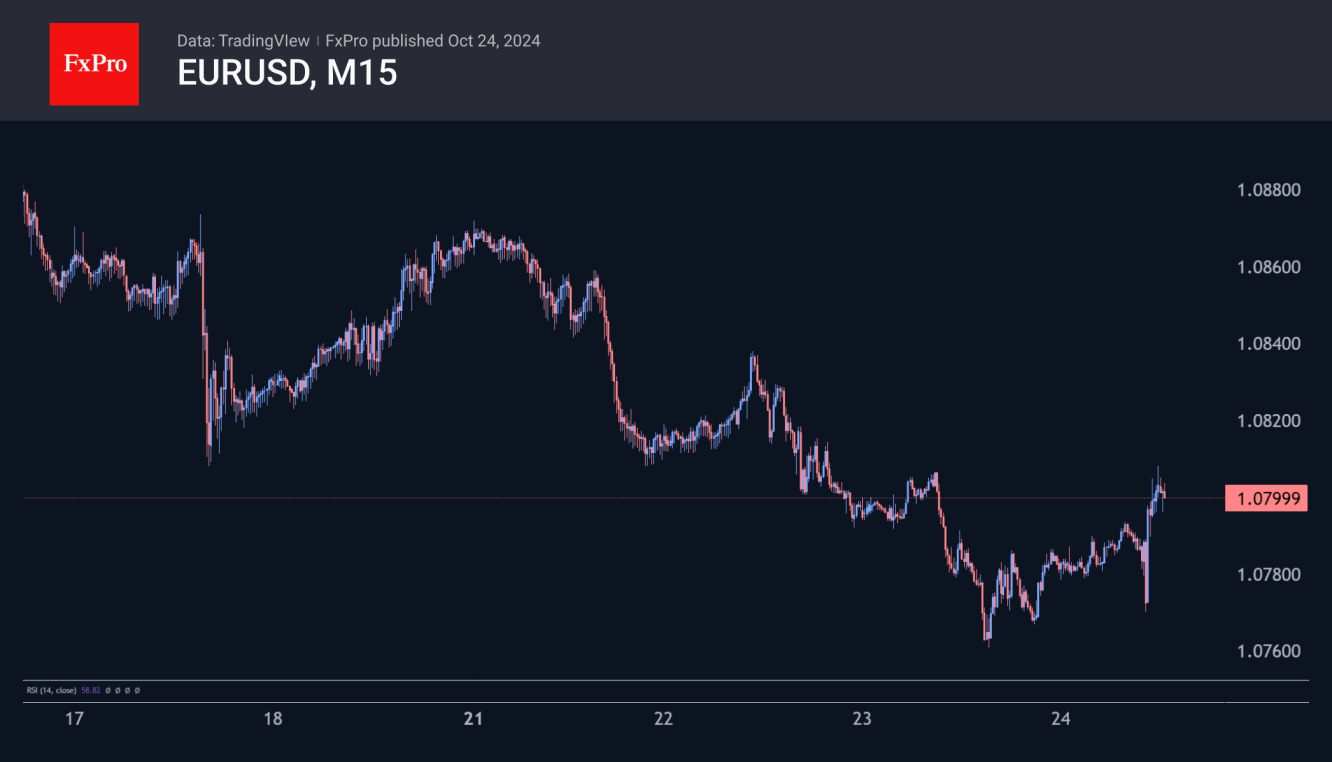

Investors and traders clearly saw the light at the end of the tunnel, as they noted the slight reversal of the German PMIs towards growth, prompting a 0.35% jump in the immediately after the release. However, in the short term, the single currency struggled to break above the 1.08 level, which appears to act as local resistance.

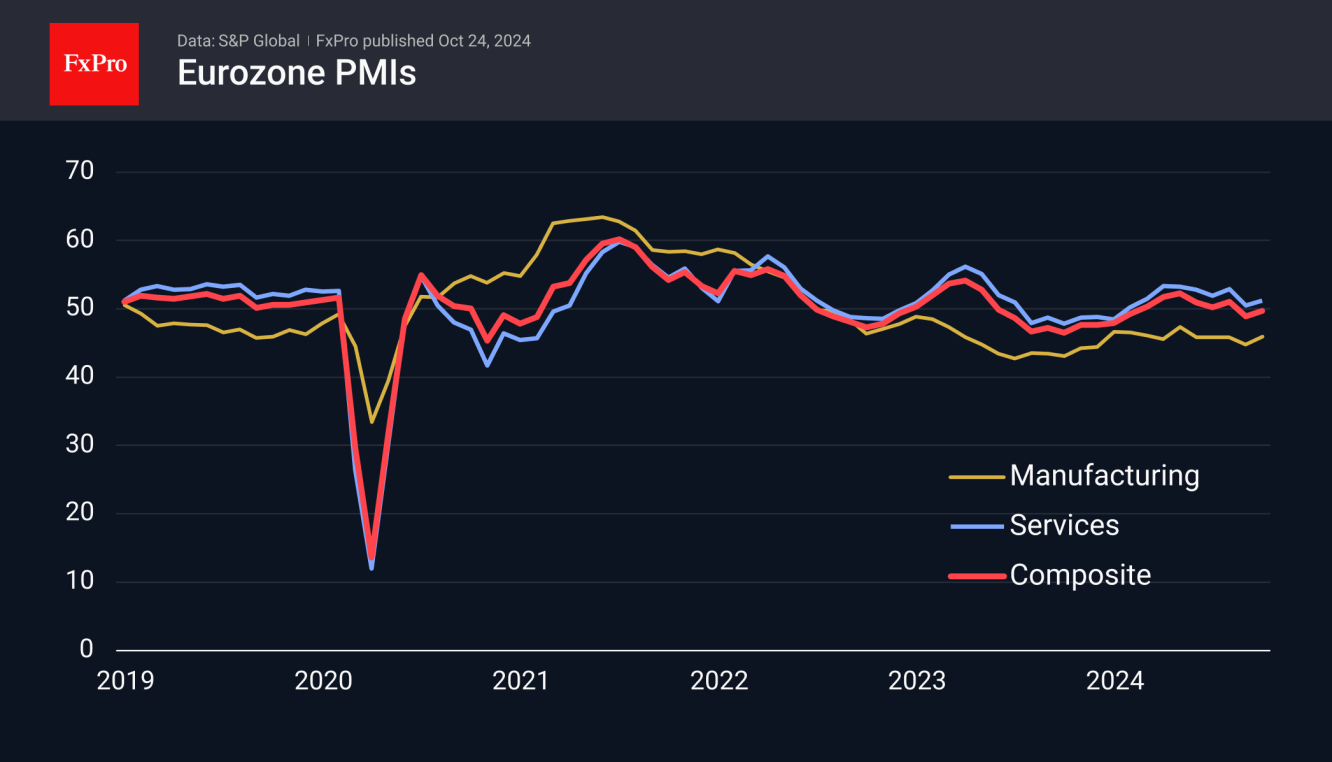

The PMI data for the entire Eurozone exceeded expectations for the manufacturing sector, with the index reaching a five-month high of 45.9. Meanwhile, growth in the picked up slightly, as the increased from 48.9 to 49.7, remaining in contraction territory.

Better-than-expected German data helped the euro pause its decline. Against this backdrop, EURUSD may be able to start a corrective bounce after its almost continuous failure since the end of September. However, the improvement is too modest to affect the ’s dovish tone on interest rates in the coming weeks. The central bank is still expected to cut rates actively.

The FxPro Analyst Team