European and Chinese Economies Drag Markets Down

2023.09.05 07:36

Economic data from China and the eurozone sent markets back into sell-off mode.

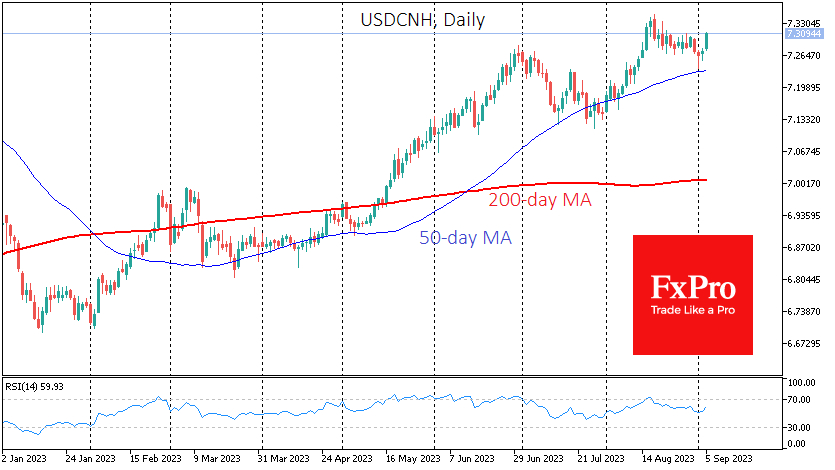

China’s services PMI fell from 54.1 to 51.8, the smallest growth rate since last December. That’s a sharper slowdown than the 53.6 expected. The momentum of the recovery from lifting COVID restrictions is quickly fading, and the stimulus measures announced so far have proved unable to reverse the trend.

The dollar is once again approaching 7.31 yuan

The dollar is once again approaching 7.31 yuan

Sellers have taken control after a two-week rally in Chinese indices. The dollar is once again approaching 7.31 yuan, back in the range of the multi-year highs reached in August. And that’s bad news for global equities, too, given the size of the Chinese economy and its links to others, especially Europe.

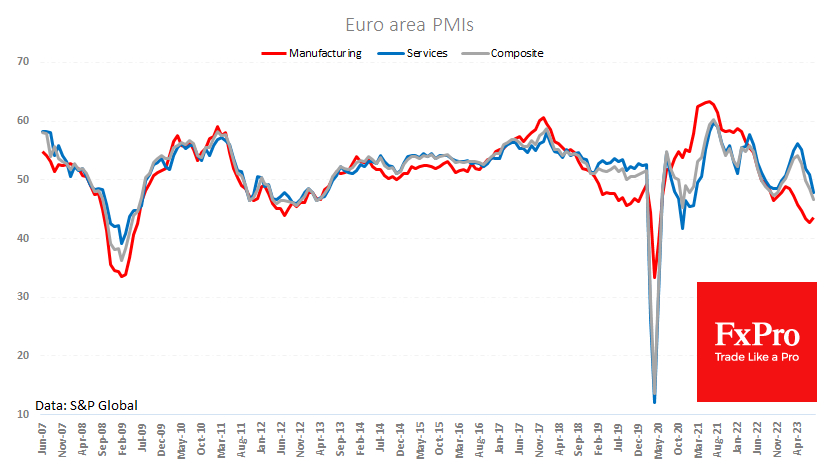

Meanwhile, Europe is, unfortunately, one step ahead of China in this economic cycle. The latest composite PMI estimates for the eurozone marked a contraction in business activity at the fastest pace since November 2020. The index peaked at 54.1 in April and has declined every month since, falling to 46.7 in August.

PMI estimates for the eurozone marked a contraction in business activity

PMI estimates for the eurozone marked a contraction in business activity

Lower gas prices and full storage facilities could not overcome the factor of high interest rates and weaker demand from China.

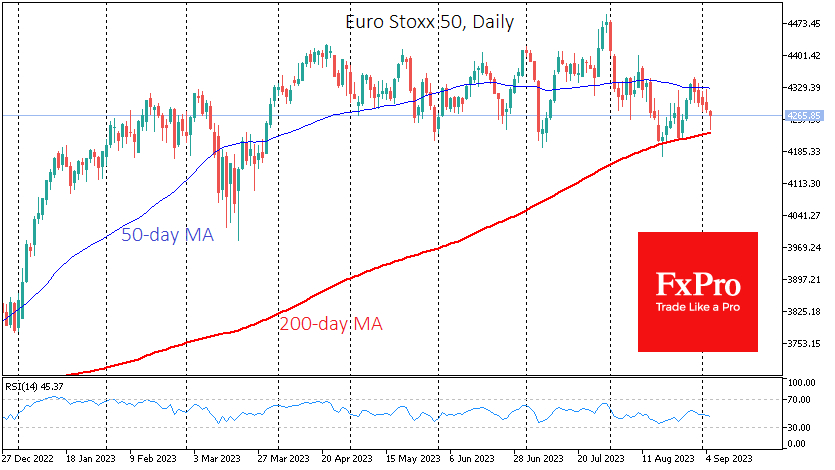

Since the middle of last month, the EuroStoxx50 has regularly tested its 200-day moving average and found support on the way down to 4220. It is fair to say that the European market is now clinging to hopes of ending the ECB’s policy tightening and that the economy is adjusting to higher rates.

EuroStoxx50 has regularly tested its 200-day MA

EuroStoxx50 has regularly tested its 200-day MA

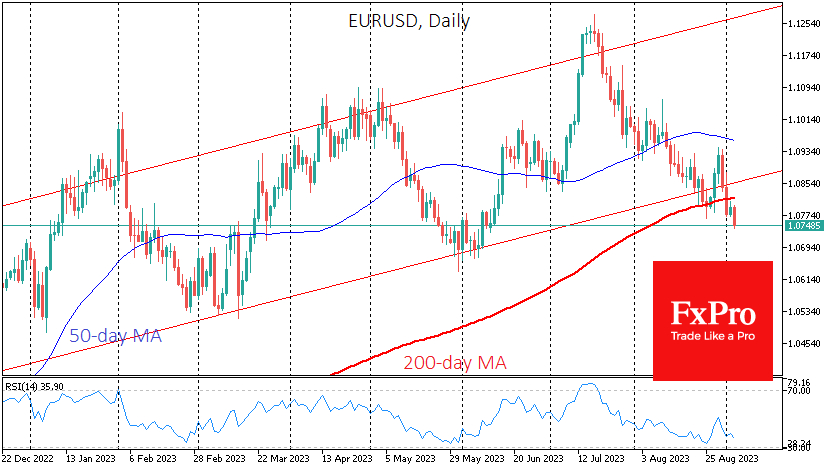

The second major factor is the 4% weakening of the euro over the past seven weeks. The fell to 1.0750, its lowest level since June. Last Friday, it fell below its 200-day moving average, which signals a change in the long-term trend and could drag the pair down to the 1.0500 area.

The currency market is often one step ahead of the stock market, and in periods of strong trends, the correlation between stocks and the euro is often direct rather than inverse, as in the US or Japan. Therefore, if EURUSD continues to fall into a bear market, euro zone blue chips are also at risk of an intensified sell-off towards 4000.

EURUSD fell to 1.0750, its lowest level since June

EURUSD fell to 1.0750, its lowest level since June

The FxPro Analyst Team