Europe Gas Jumps as Latest Russian Cut Plans Stokes Supply Fears

2022.08.22 11:14

Europe Gas Jumps as Latest Russian Cut Plans Stokes Supply Fears

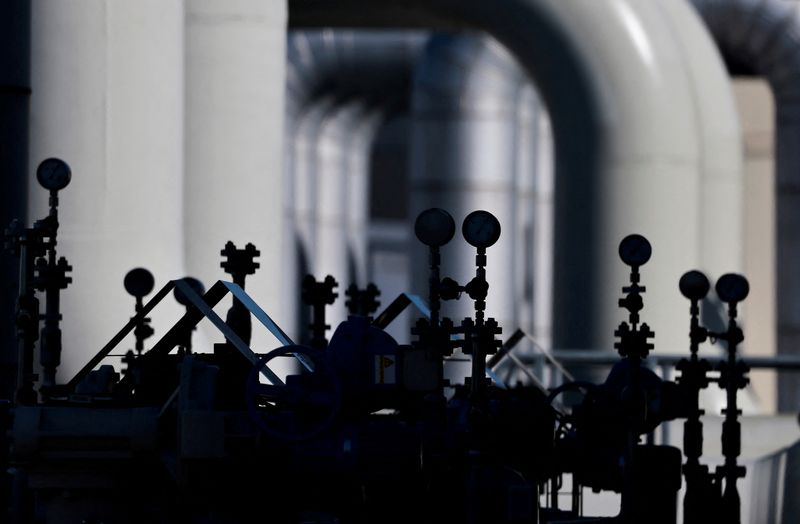

(Bloomberg) — Natural gas prices in Europe extended gains as fears deepened about a prolonged supply halt with Russia planning to shut a major pipeline for works, a move that could jeopardize the region’s already struggling economy.

Benchmark futures rose as much as 13%, after closing at a record high on Friday. The key Nord Stream pipeline will stop for three days of maintenance on Aug. 31, again raising concerns that the link won’t return to service as planned after the works. Europe has been on tenterhooks about shipments through the link for weeks, with flows resuming only at very low levels after it was shut for works last month.

Separately, Germany also warned Moscow could further reduce supplies, and reiterated a call for conserve energy. “We have a very critical winter right in front of us,” German Economy Minister Robert Habeck told public broadcaster ZDF in Montreal, during a visit to Canada with Chancellor Olaf Scholz. “We must expect Putin to further reduce gas.”

European authorities have repeatedly warned of the possibility of a complete shut down of Russian supplies as the Kremlin retaliates for sanctions imposed because of its war in Ukraine. Germany, Europe’s biggest gas consumer, is looking for alternatives but is unlikely to be able to replace all Russian imports. The nation and others in the continent are reversing energy policies by relying more heavily on coal and bringing back nuclear plants as they look to avoid shortages.

On Friday, Gazprom (MCX:GAZP) said works are needed in the only functioning turbine that can pump gas into the link. The pipeline has been operating at only 20% capacity for weeks and European politicians insist the curbs are politically motivated. Russia’s Gazprom PJSC (OTC:OGZPY) said volumes would return to that level following the latest shutdown.

“Whether the reasoning is true or not, the outcome drives a European gas market that tightens further, and one that is left reliant on demand curtailments to find itself in balance,” said Biraj Borkhataria, an analyst at RBC Capital Markets. “The market may disregard Gazprom’s comments and start to consider whether the pipeline may not return to service, or at the very least may be delayed for any given reason.”

Germany May Resort to Nuclear Plants to Plug Russian Gas Gap

The Dutch front-month contract, the European benchmark, was 11% higher at 270.98 euros a megawatt-hour at 9:03 a.m. in Amsterdam. It rose for a fifth straight week on Friday, the longest run this year.

Over the weekend, German leaders said the country may struggle to replace dwindling supplies from Russia. The government is targeting a 20% reduction in gas consumption. While the country is one of the worst hit by Moscow’s cuts with the economy on the bring of a recession, the energy crisis has reverberated through Europe.

©2022 Bloomberg L.P.