Euro Falls on Weakened PMI

2023.10.24 10:46

Economic activity in Europe is cooling, raising the specter of an emerging recession in Germany and the whole eurozone.

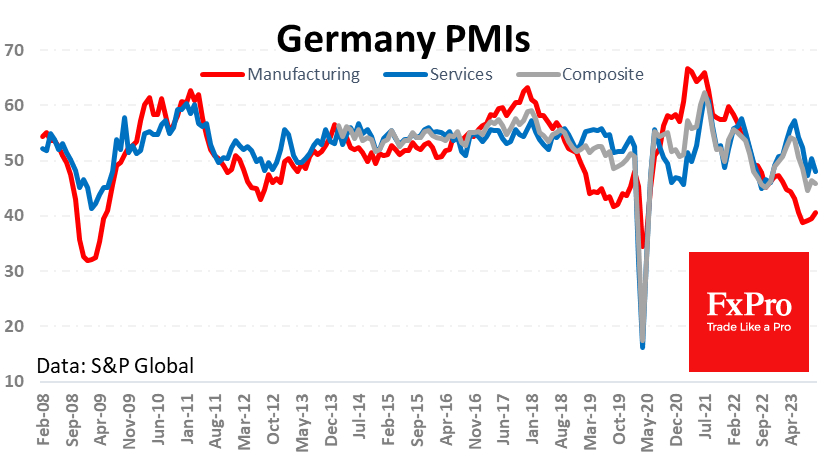

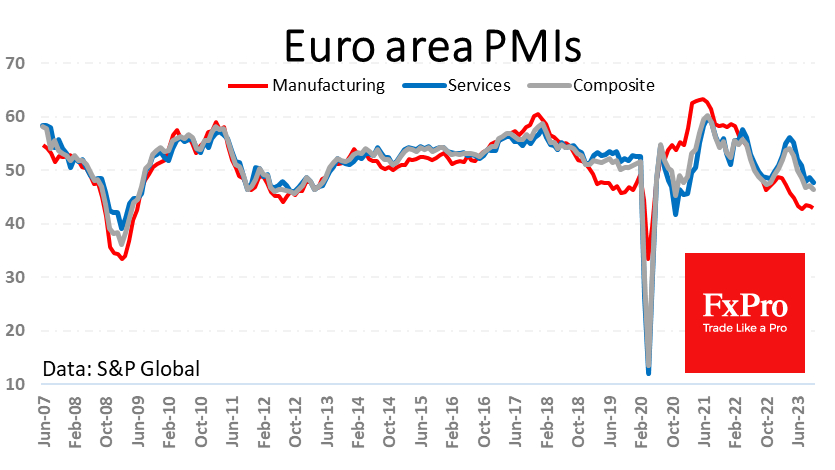

The PMI indices have proven to be a reliable indicator of the economic cycle for currency and equity market investors. The latest preliminary estimates for October disappointed, showing a deepening of the recession rather than the expected improvement.

The main disappointment was the German services sector, where the index fell from 50.3 to 48.0, back into contraction territory, unable to stay in growth territory and much weaker than the expected 50.1.

In France, the services index came in at 46.1, better than the expected 44.9 but still very low.

As a result, the PMI for the entire euro area fell to 47.8, the lowest level since February 2021.

The euro area manufacturing sector accelerated its contraction, falling from 43.4 to 43.0 instead of the expected rebound to 43.6.

The composite index fell from 47.2 to 46.5, the sharpest decline since October 2020. The fact that markets had braced themselves for a rise to 47.4 fuelled the sell-off in the single currency.

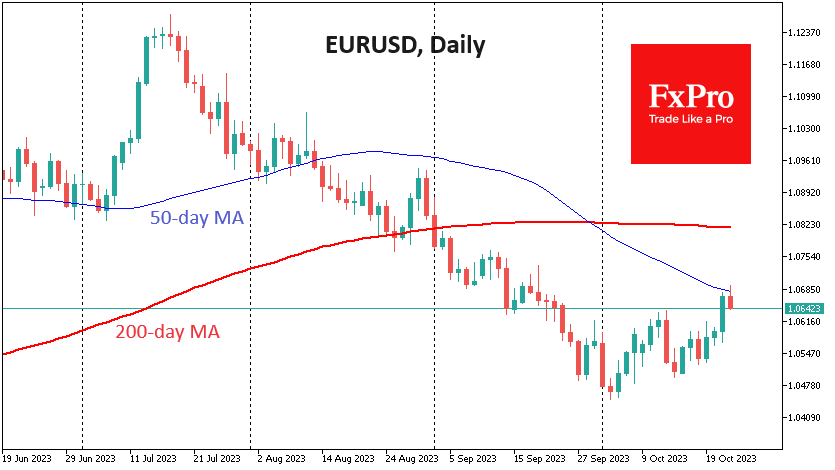

The lost nearly 0.5% shortly after the data was released, turning sharply lower on a move away from 1.07. Technically, sellers piled on the pressure after the pair touched its 50-day moving average, a medium-term trend indicator.

A close below 1.07 would be a reminder that the pair’s slow recovery from 1.05 levels this month was a correction of oversold and not a trend change.

Fundamentally, Europe again shows it is struggling to grow with rising interest rates and volatile energy prices. These conditions have led the ECB to stop raising rates earlier than the Fed.

Perhaps, as in the previous cycle of rate hikes following the global financial crisis, the ECB will turn to easing earlier than the Fed. This is an important factor weighing on the euro against the at a time when the carry trade has re-emerged as a market driver.

The FxPro Analyst Team