EU Struggles to Agree a Price Cap for Russian Oil

2022.11.28 17:58

[ad_1]

European Union diplomats met Friday evening to see if they could hammer out a final deal on a price level to cap Russian oil exports.

Despite a fight over how strict the price cap with the Group of Seven, Diplomats are optimistic that they can finalize a deal soon as the bloc is feeling deadline pressure, with EU sanctions on Russian oil set to kick in on Dec. 5.

Undoubtedly, the aim of the price cap, first proposed by the US, is to keep Russian oil flowing while also curbing Russia’s revenue.

An attempt by the EU to cap Russian oil could result in a steep surge in the energy price war at utmost as Russia could repeat the strategy.

Russia had already tested this energy price tool during the tariff trade tussle between the US and Russia in 2018, which resulted in a sharp drop in prices in July 2018 as it traded below $70.

Oil prices continued to slide further during the post-tariff-trade war till Dec. 24, 2020, and hit a low at $42.

Finally, this slide in oil could become a nightmare with the confirmation of the first case of Coid-19 in China in December 2019.

Oil prices started to slide further on Mar. 6, 2020, from the $42 and hit a lifetime low at minus $40 on Apr. 20, 2020.

Covid concerns have increased once again, with a sudden surge in fresh lockdowns in China could hamper the global demand for oil during the upcoming week as the fresh lockdowns in China have surged the oil-demand worries which could result in selling sprees to continue during the upcoming week.

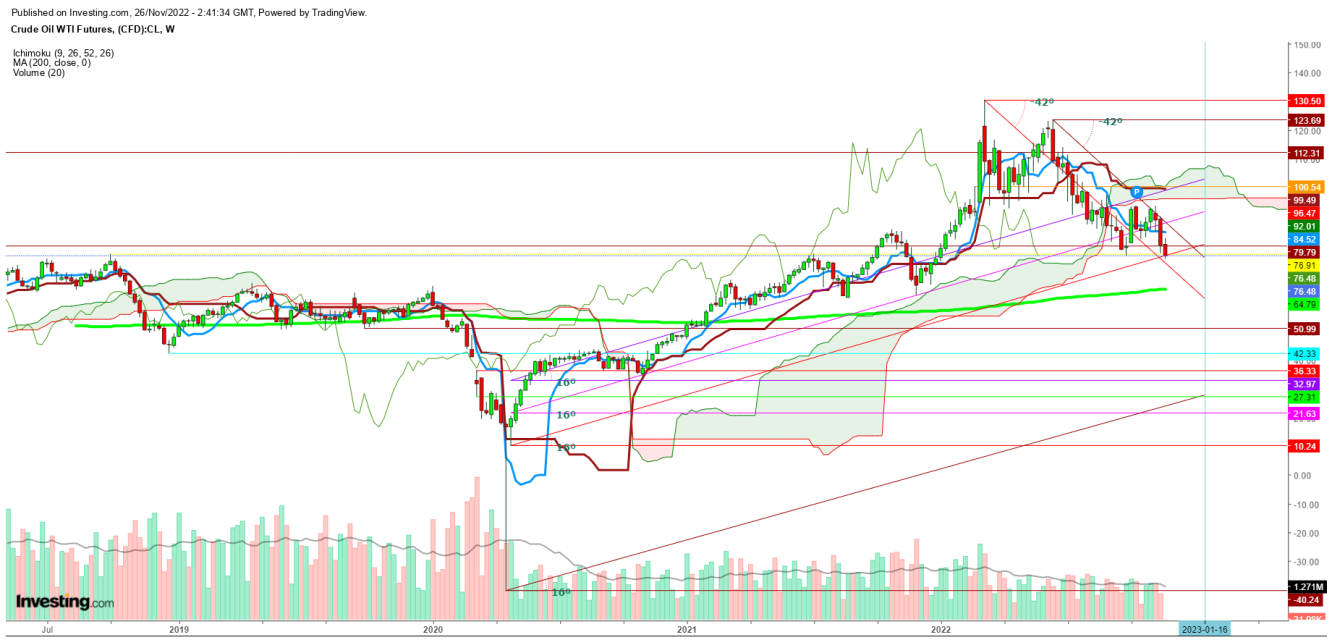

WTI Crude Oil Futures Weekly Chart

WTI Crude Oil Futures Weekly Chart

Technically speaking, in the weekly chart, oil prices found significant exhaustion after testing a peak at $130.50 on Mar. 7, 2022, and hit a low at $93 on Apr. 11, 2022, before starting an upward journey once again as the oil bulls were unaware about the demand worries if the pandemic appears once again.

Once again, oil prices hit one more peak at $123.69 on Jun. 14, 2022, before starting to move down since the formation of a ‘bearish crossover’ during the second week of July and finally hit a low at $76.48 on Sept. 26 before resuming an uptrend amid growing hopes for global economic recovery.

Since Sept. 26, oil prices, currently trading in a range from $76.48 to $93.78, ensures a breakdown shortly as oil prices are currently at the lowest point of this range at the last weekly close.

A breakdown from the current level could push oil prices to find support only at the 200 DMA, currently at $63.78 in the upcoming week.

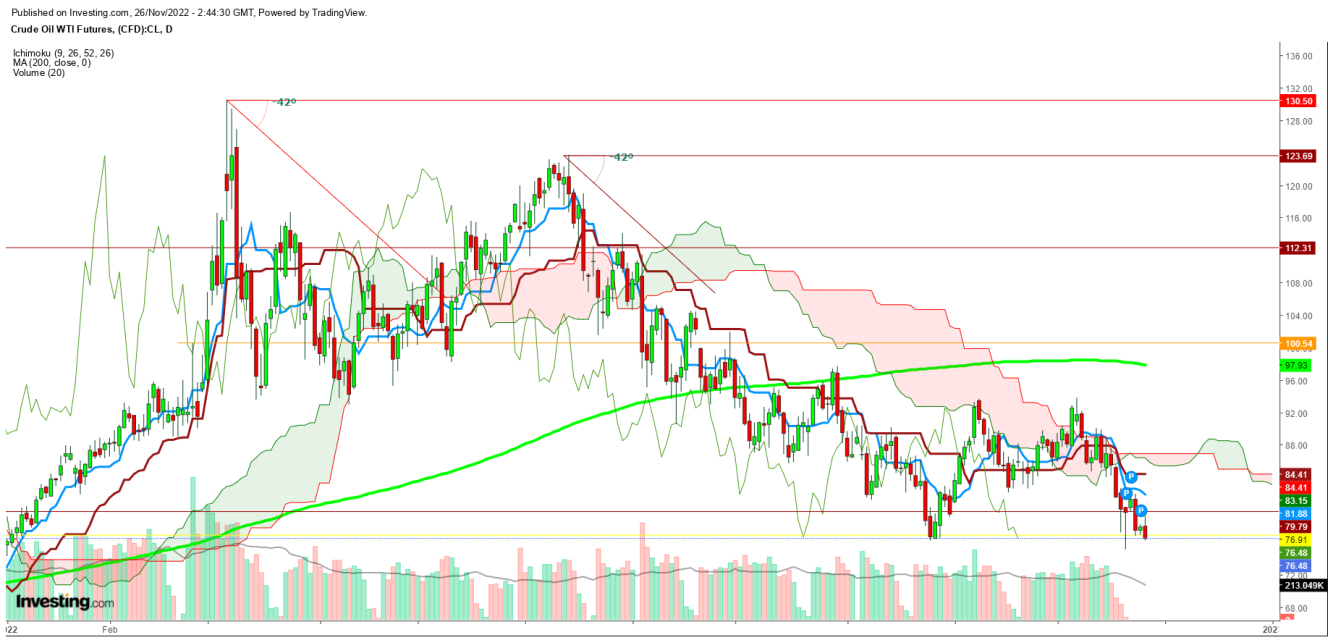

WTI Crude Oil Futures Daily Chart

WTI Crude Oil Futures Daily Chart

In the daily chart, the current situation looks more worrisome as oil prices are trading much below the 9 DMA, currently at $81.88, since the formation of a ‘bearish crossover’ on Nov. 17, 2022.

If oil prices start the upcoming week with a gap-down opening, exhaustion could surge more.

Disclaimer: The author of this analysis may or may not have any position in oil prices. Readers can take any long or short trading position at their own risk. Involved risk in trading needs to be taken care of before creating any trading call.

[ad_2]

Source link