Estimate for U.S. Q1 GDP Skews Slightly Negative

2023.02.22 09:29

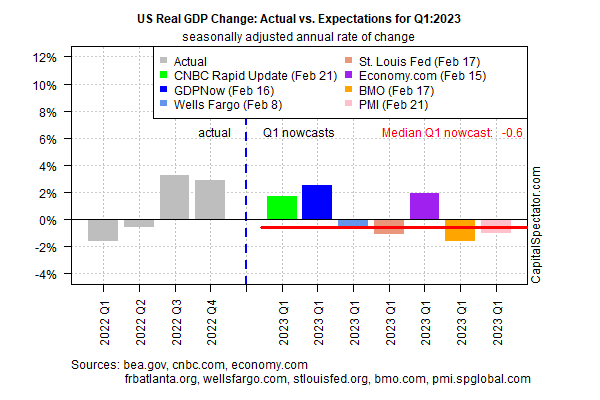

The economic rebound in the second half of 2022 looks challenged in early estimates for first quarter GDP, based on the median for a set of nowcasts compiled by CapitalSpectator.com.

US output is on track to decline slightly in the first three months of this year, slipping -0.6% (seasonally adjusted annual rate). This median estimate, if correct, will mark the first decline in GDP after two straight quarters of growth.

US Real GDP Change Actual Vs. Expectations for Q1-2023

It’s still early in the quarter for economic data and so today’s estimate should be viewed cautiously. But the slide in today’s median nowcast from the suggests that the incoming numbers are weak relative to results in last year’s Q3 and Q4.

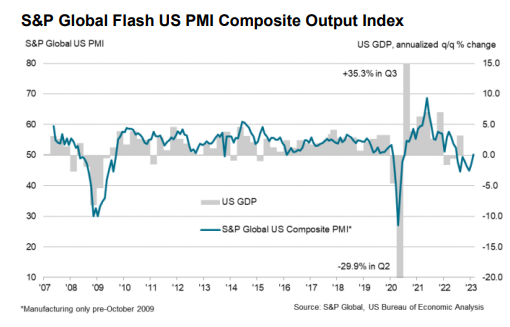

On the bright side, one component in the chart above rebounded in February, which may be a precursor of firmer numbers ahead. The Index, a survey-based GDP proxy, rebounded this month, rising to the highest level in eight months and posting a slight increase after a run of negative prints.

U.S. GDP Vs. S&P Global Flash U.S. PMI Chart

“February is seeing a welcome steadying of business activity after seven months of decline,” says Chris Williamson, a chief business economist at S&P Global Market Intelligence.

“Despite headwinds from higher interest rates and the cost of living squeeze, the business mood has brightened amid signs that inflation has peaked and recession risks have faded.”

Yet, a number of other indicators still highlight elevated recession risk for the US. The Conference Board’s Leading Economic Index in January “continues to signal recession over the next 12 months,” based on the indicator’s 6-month annualized growth rate.

If the upbeat PMI data for February is the more accurate measure of how the business cycle is evolving, the improvement will likely show up in our next GDP nowcast update.

Anatole Kaletsky is among the optimists. Gavekal Research’s chief economist and co-founder point to the strong labor market as a key sign that the economy will stay resilient and avoid a recession. He tells Barron’s:

“This virtuous circle may sound over-optimistic, but it is the normal state of a functioning capitalist economy, which is why recessions are relatively rare events.”