Equities turn cautious ahead of Powell after Fed speakers dent risk rally

2023.01.10 07:28

[ad_1]

- Tech stocks outperform on Wall Street as S&P 500 rebound flounders on hawkish Fed

- Powell and other central bank heads eyed in first key remarks of 2023

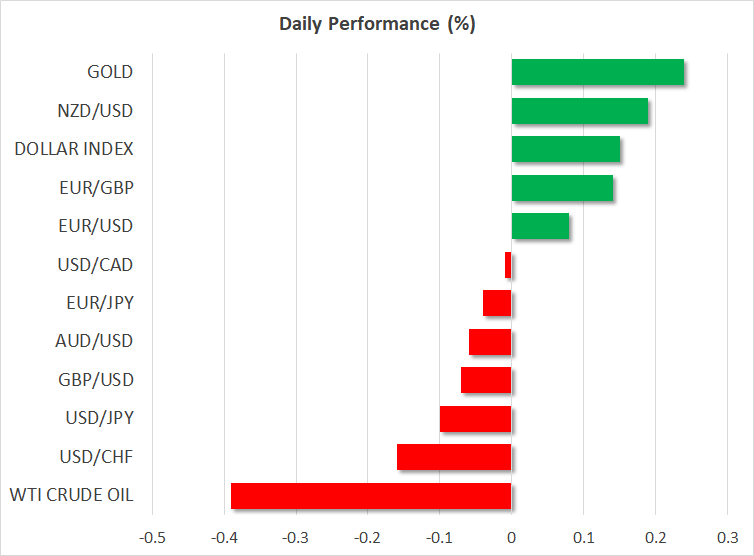

- Dollar steadies but euro and gold maintain bullish bias

Mood sours as Fed unwilling to defuse recession fears

Hopes that a slowing American economy and easing price pressures would assuage the inflation hawks at the Fed were dealt a major blow on Monday, spoiling the post-NFP risk rally. Despite the Fed never having flinched in its hawkish resolve as the evidence pointed to inflation peaking, investors were still holding out for policymakers to be swayed more easily by the incoming data that’s increasingly favourable for the inflation outlook.

San Francisco Fed President Mary Daly was the latest FOMC member after Friday’s ‘softish’ data to maintain her forecast that rates would need to rise above 5%. But it was Atlanta Fed chief Raphael Bostic’s comments that rattled the markets after he suggested that he might not back a rate cut before 2025.

The message from the Fed since the mixed jobs report and poor ISM services PMI is that officials are keeping their options open for downshifting to a 25-basis-point rate hike as early as the February meeting, especially if Thursday’s CPI numbers are also weaker than expected. However, the door to a rate cut or even a pause appears to be firmly shut for now and that’s what’s upset the markets.

Sentiment could yet change, though, as Chair Powell himself will be speaking later today at 14:00 GMT in a panel discussion organized by Sweden’s Riksbank. Other notable speakers include the Bank of England’s Bailey, the Bank of Japan’s Kuroda and the Bank of Canada’s Macklem. They will be participating in an earlier discussion at 10:10 GMT, but it’s unclear if any of them will be commenting on domestic monetary policy.

Stocks slip but Nasdaq bucks the trend

On Wall Street, the Fed’s unwavering stance revived fears about the US economy being unable to avoid a hard landing. However, even with a Fed pivot likely being some time away, only few expect any recession in America to be severe and the real concern is how well valuations will hold up in a weaker demand environment.

The upcoming earnings season, which kicks off this Friday with the major banks, should shed more light on this, but in the meantime, the latest rebound seems to have hit a wall. Both the Dow Jones and S&P 500 came off their highs yesterday to finish the session in the red, and futures point to more slight losses today.

Tech stocks were the exception, however, as the sharp reversal in Treasury yields since the end of December, which gathered pace on Friday, has taken the pressure off the Nasdaq, with Tesla (NASDAQ:) leading yesterday’s rally. The Q4 earnings results may yet spark fresh worries about the hefty valuations in the tech sector but investors are possibly out bargain hunting to adjust their positions ahead of the season in light of the pullback in yields.

European stocks also succumbed to selling pressure after an impressive start to 2023, while shares in Asia were mixed. Optimism around China continues to support equities in the region and even though some of the reopening boost has started to fade, investors have been additionally encouraged by the government’s apparent shift towards more market-friendly policies lately and its easing up on regulatory crackdowns.

Commodities caught between China boost and US doubts

This could keep commodities well supported too, but in the immediate term, the disappointment about the Fed’s intransigence is weighing somewhat on the demand outlook.

Oil futures were mixed on Tuesday, edged lower, but gold held near eight-month highs around $1,875/oz.

Lower bond yields and a sluggish US dollar are keeping gold prices buoyed in what has been a strong bullish run since November for the precious metal.

Dollar soft but off lows, euro reclaims $1.07

The greenback was somewhat steadier on Tuesday after sliding sharply against a basket of currencies on Monday when it hit seven-month lows, as Fed overtightening worries returned to haunt it. In contrast, expectations that a recession in Europe might not be very steep even, as the ECB sticks to its aggressive tightening path, lifted the euro above the $1.07 level.

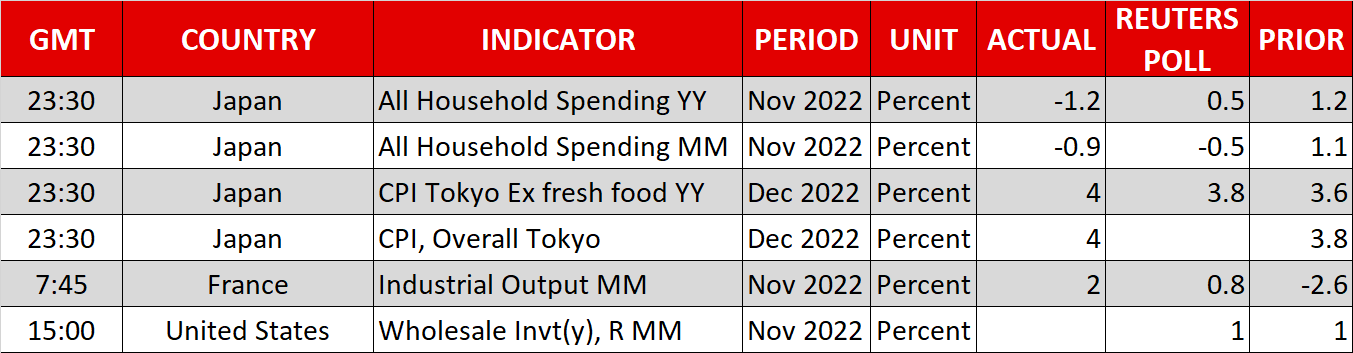

The yen remained on the backfoot, shrugging off stronger-than-expected CPI data for the Tokyo region in December, while the was testing the $0.69 handle after two days of big gains, ahead of domestic inflation figures due early on Wednesday.

[ad_2]